“Simon Schama writes eloquently again about Brexit, representative democracy and the threat to institutional order posed by unbridled populism (“Who speaks for the people?”, Life & Arts, October 5), but with little humility. Important points are made, but he infers the lazy trope that (Leave) voters did not have the “correct” facts, thus failing to accord with the managing classes’ prescription. Remain will win a second referendum, it will all have been a bad dream.

“An academic is a restless seeker of truth, which can mean uncomfortable journeys, but this is wishful thinking writ large, picking over whatever arguments can be made to delegitimise Leave voters.

“Professor Schama’s erudition would carry more weight if he showed that he had spent any of the past three years understanding the parts of the electorate his elevated status prevents him from connecting with. It might in fact ease his distress. Polls are rarely about facts, they concern principles and sentiment — on all sides. If the answer to historical questions is simply suggesting that “people were wrong”, then history books would be short indeed.”

- Letter to the Financial Times from David Cole, Dunmow, Essex (12 October 2019).

“One of the dominant facts in English life during the past three quarters of a century has been the decay of ability in the ruling class… In intention, at any rate, the English intelligentsia are Europeanized. They take their cookery from Paris and their opinions from Moscow. In the general patriotism of the country they form a sort of island of dissident thought. England is perhaps the only great country whose intellectuals are ashamed of their own nationality. In left-wing circles it is always felt that there is something slightly disgraceful in being an Englishman and that it is a duty to snigger at every English institution, from horse racing to suet puddings. It is a strange fact, but it is unquestionably true that almost any English intellectual would feel more ashamed of standing to attention during ‘God save the King’ than of stealing from a poor box. All through the critical years many left-wingers were chipping away at English morale, trying to spread an outlook that was sometimes squashily pacifist, sometimes violently pro-Russian, but always anti-British.”

- George Orwell, ‘England Your England’.

Get your Free

financial review

We recently spent a few days in Luxembourg, on business. Luxembourg City in the late summer is beautiful, offering delightful views from the old town and from the Chemin de la Corniche across the Alzette and Pétrusse river valleys.

The old city is a fortress. Nevertheless, Luxembourg has been invaded by just about everybody, including the Burgundians, the Spanish (twice), the French (twice), the Austrians, the Prussians, and most recently the Germans. It has a good claim to being the birthplace of the EU, a point we’ll get back to in due course.

Unsurprisingly, when we asked our hosts on the Avenue Monterey what they thought about Brexit, they reacted with a mixture of acute embarrassment and polite sympathy, as they might have done if we had just alluded to a mad relative locked in an attic. It would seem as if the recent years of tortuous progress towards some kind of departure from the EU have been entirely wasted because each side of the debate has been answering different questions, like two deaf men shouting at each other in a wind tunnel.

Contented Europhiles can’t understand why we could possibly want to leave an institution that has kept the peace in Europe for decades. Frustrated Brexiteers can’t understand why anyone would want to stay in an institution that immiserates most of its people and point out that europhiles have confused the EU with NATO.

As our erstwhile writing colleague Nick Hubble has observed, (ex UK) European defence spending has lately been somewhat underwhelming – a supposition confirmed by the fact that German soldiers on exercises after the Russian invasion of Ukraine were forced to use painted broomstick handles in lieu of real guns.

But as Nick has also pointed out, the British economy has done rather well out of Brexit Chaos. We particularly like his suggested poster:

Unemployment? Down!

GDP? Up! FDI? Record!

Inflation? Sweetspot!

Stockmarket? All-time highs!

We demand:

3 More Years

Of Brexit Chaos

The real casualty of Brexit has clearly not been the UK economy, but rather trust in UK institutions, most notably Parliament and our media.

Orwell was right. Putting aside the (non-trivial) issue of naked self-interest, the only reason we can find for so many British politicians having favoured Remain both in the run-up to the 2016 referendum and afterwards is a combination of national self-loathing and a complete lack of confidence in our country’s economic vitality. Remainer MPs (and one notes ominously our new Prime Minister’s fondness for locales like Davos over his native Westminster) are following Hilaire Belloc’s advice to Jim in the eponymous poem, clinging desperately to nanny’s skirts, so that they can

“..always keep ahold of nurse

For fear of finding something worse.”

The astonishing thing about our ongoing parliamentary preference for the Big (European) State is the complete blindness to its obvious economic flaws. For us, the political debate has never been between capitalism and socialism – that debate, after all, has been conclusively won, or at least you could be forgiven for thinking so, unless you are an academic – but between Big Government and small government, between authoritarianism and libertarianism, if you prefer.

If you are entirely dependent on Big Government for your paycheque, chances are you’ll be in favour of it. But for those of us engaged in what we hope will be productive free enterprise, the idea of leeching off the labours of others is simply unthinkable.

We were struck, in a recent interview with the outstanding Austrian economist Guido Hülsmann that when asked what one thing he would do to change the system, his response was to get government out of the education business. As another Austrian economist, Sean Corrigan, puts it, the problem with the educational system is that it has fallen victim to Gramsci’s “long march through the institutions” – just as much of the mainstream media, including BBC News, and notoriously many writers for ‘The Financial Times’ and ‘The Economist’, have fallen victim to a delusional Marxist ignorance of, or contempt for, the merits of free market capitalism. Just how did we get into this mess? Orwell knew.

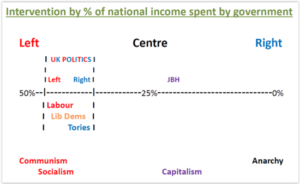

One friend we have made on Twitter / X over recent years is the London-based economist John Hearn, who teaches at the London Institute of Banking and Finance. We were shocked to see the following slide from one of John’s presentations, on the topic of government spending:

Source: The London Institute of Banking and Finance/John Hearn

In terms of government spending as a percentage of GDP, John’s own preference is close to 25% – there are certain services that the free market can’t provide. These are non-rival and non-excludable products we all require, such as law and order and street lighting. So unless you want to live in a Mad Max-style state of anarchic chaos, government spending will always be above 0%.

But it was a revelation to see John’s analysis of current political “largesse”: all three major political parties are clustered out there at close to 50% – a degree of government spending that would in different times have been associated exclusively with the sort of spending advocated by the hard left – and duly doggedly pursued by them until the economy finally collapses. Whatever happened to Thatcherism ? (We note en passant that John’s research was published before the recent rise of the Reform party.)

John’s “nightmare” consists of the following questions and statements, which we invite all readers to reflect upon:

- There seems to be an inexorable move towards state control in all countries including democracies

- The Communist revolutions rushed things and were found wanting;

- Who has ever heard a politician say that they can’t do something ?

- Who would vote for a politician who says that they will not do something ?

- Who sees cutting government spending and raising interest rates as a way to faster economic growth ?

- Who sees Brexit as a way of reducing national and international bureaucracy ?

John cites J.K. Galbraith:

“There are those people who don’t know and those people who don’t know that they don’t know.”

John adds of the second group,

“They’re the ones who become politicians.”

Why do we continue to revisit the (charred) ground of Brexit ? Perhaps because the overbearing EU leopard still shows no signs of changing its spots.

On 12th August, for example, Thierry Breton for the EU Commission posted a letter to Elon Musk on his own platform, threatening punishment if content posted on social media site X was found to place EU citizens at risk of “serious harm”. The letter was published hours before Musk interviewed US presidential candidate Donald Trump, also on X.

The EU has been investigating X, formerly Twitter, since last year over claims of non-compliance with its landmark Digital Services Act passed in 2022.

Musk responded to the letter from Breton with a meme from the 2008 film ‘Tropic Thunder’, that showed one character shouting: “Take a big step back and literally f**k your own face.” A Trump campaign spokesperson responded by saying: “The European Union should mind their own business instead of trying to meddle in the US presidential election.”

Amusingly, Brussels then accused its internal market commissioner of having gone rogue in sending the letter and disavowed its contents.

Nor is this growing authoritarian trend limited to Europe. As Joel Kotkin suggests in ‘Spiked’, America is increasingly resembling the EU:

“Europe may be fading from global relevance, but its influence is expanding within the US Democratic Party. Today, the party’s core beliefs echo those espoused by the European Union and much of the British establishment – an embrace of censorship, a draconian approach to climate change, support for trans ideology, the championing of race-based politics..”

“For many on the American left, Europe, as one academic describes it, offers ‘a progressive model from which the United States could learn’. Certainly, Europe’s elites favoured Joe Biden’s election, which was widely seen as making America ‘more European’. This model is inspired largely by Europe’s once successful but now deeply troubled social-market economy.”

So we now have the absurd state of affairs whereby emerging and until recently explicitly communist-run economies in Asia are pursuing comparatively far more free market policies and growing far more quickly and simultaneously offering far more attractive valuations than economies in the developed world..

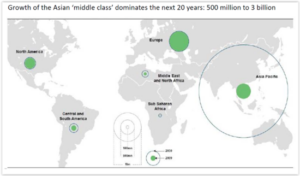

The map below shows the current middle class populations of the world’s various regions (size of middle class represented by the green circle) and the forecast size of those middle class populations by 2030 (size represented by the wider blue circumference), according to the OECD.

Source: OECD forecasts

In other words, while the US and Europe, for example, are likely to see little growth in their middle class populations, in large part because they’re already mature economies, the size of the Asian middle class is forecast to explode – from around 500 million people today to something like 3 billion people by 2030. And all of those people are going to want to drive cars, live in nice houses or apartments and – as the ASEAN fund manager James Hay puts it – enjoy high cholesterol just like the rest of us. If you want growth from your portfolio and you are not looking at Asia, you are looking in the wrong place.

Of course, not all emerging economies should be considered equal. While we like the longer term prospects for markets as varied as Vietnam and Japan, we have no exposure whatsoever in our own fund to China. This is partly down to issues of corporate governance (because there isn’t any), but largely down to a mixture of valuations (Chinese stocks are expensive by comparison to many regional rivals) and ongoing geo-political risk, including the current popularity of ‘reshoring’ which threatens to reverse much of the recent trend of ‘offshoring’ manufacturing which did so much to lift so much of Asia and in particular China out of poverty, admittedly at the expense of much of the Western working class.

The analyst and financial historian Russell Napier has recently warned that the West’s divorce from China will result in a profound supply shock for the West, along with adding to our inflationary concerns. In his lecture ‘Lessons from financial history’ he argues that a radical reappraisal of investor asset allocation is needed. He sees gold, commodities and ‘value’ equities as appropriate assets to hold in this largely dysfunctional environment. As longstanding readers will appreciate, we wholeheartedly agree.

So even in the midst of huge geopolitical uncertainty, there is opportunity. But it will not likely be found in ‘conventional’ or ‘traditional’ assets.

On a rainy evening during our last trip to Luxembourg, we braved the storms to cross the Pont Adolphe and visit 2 Place de Metz. It’s the address of BCEE, the Banque et Caisse d’Épargne de l’État, the State Savings Bank of Luxembourg. At one corner of the front wall is a bronze plaque, stating:

“Ici le 10 août 1952 la Haute Autorité de la C.E.C.A première Communauté Européenne a commence ses travaux.”

In English,

“Here on 10 August 1952 the High Authority of the C.E.C.A., the first European Community, began its work.”

The C.E.C.A. stands for Communauté Européenne du charbon et de l’acier & Industries – the European Coal and Steel Community (ECSC). This was an international organisation proposed by Robert Schuman, then French minister of foreign affairs, in 1950, as a way to prevent war between France and Germany. His intention was to make war “not only unthinkable but also materially impossible”.

The ECSC established a single market for coal and steel on behalf of France, Germany, Italy and the Benelux countries (Belgium, Netherlands and Luxembourg). Its aim: to “massively support the European coal and steel industries to enable them to modernize, optimize their production and reduce their costs, while taking care of improving the living conditions of their employees and their reintegration in the job market in the event of dismissal .” 2 Place de Metz is where the entire European project first began.

The intention to prevent further war in Europe was entirely noble. To do so in the form of a protectionist trade body, perhaps not so much.

When we visited 2 Place de Metz, we found giant ungainly piles of sand and construction materials just outside the building. The work of this organisation would seem to be some way from being completed.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

“Simon Schama writes eloquently again about Brexit, representative democracy and the threat to institutional order posed by unbridled populism (“Who speaks for the people?”, Life & Arts, October 5), but with little humility. Important points are made, but he infers the lazy trope that (Leave) voters did not have the “correct” facts, thus failing to accord with the managing classes’ prescription. Remain will win a second referendum, it will all have been a bad dream.

“An academic is a restless seeker of truth, which can mean uncomfortable journeys, but this is wishful thinking writ large, picking over whatever arguments can be made to delegitimise Leave voters.

“Professor Schama’s erudition would carry more weight if he showed that he had spent any of the past three years understanding the parts of the electorate his elevated status prevents him from connecting with. It might in fact ease his distress. Polls are rarely about facts, they concern principles and sentiment — on all sides. If the answer to historical questions is simply suggesting that “people were wrong”, then history books would be short indeed.”

“One of the dominant facts in English life during the past three quarters of a century has been the decay of ability in the ruling class… In intention, at any rate, the English intelligentsia are Europeanized. They take their cookery from Paris and their opinions from Moscow. In the general patriotism of the country they form a sort of island of dissident thought. England is perhaps the only great country whose intellectuals are ashamed of their own nationality. In left-wing circles it is always felt that there is something slightly disgraceful in being an Englishman and that it is a duty to snigger at every English institution, from horse racing to suet puddings. It is a strange fact, but it is unquestionably true that almost any English intellectual would feel more ashamed of standing to attention during ‘God save the King’ than of stealing from a poor box. All through the critical years many left-wingers were chipping away at English morale, trying to spread an outlook that was sometimes squashily pacifist, sometimes violently pro-Russian, but always anti-British.”

Get your Free

financial review

We recently spent a few days in Luxembourg, on business. Luxembourg City in the late summer is beautiful, offering delightful views from the old town and from the Chemin de la Corniche across the Alzette and Pétrusse river valleys.

The old city is a fortress. Nevertheless, Luxembourg has been invaded by just about everybody, including the Burgundians, the Spanish (twice), the French (twice), the Austrians, the Prussians, and most recently the Germans. It has a good claim to being the birthplace of the EU, a point we’ll get back to in due course.

Unsurprisingly, when we asked our hosts on the Avenue Monterey what they thought about Brexit, they reacted with a mixture of acute embarrassment and polite sympathy, as they might have done if we had just alluded to a mad relative locked in an attic. It would seem as if the recent years of tortuous progress towards some kind of departure from the EU have been entirely wasted because each side of the debate has been answering different questions, like two deaf men shouting at each other in a wind tunnel.

Contented Europhiles can’t understand why we could possibly want to leave an institution that has kept the peace in Europe for decades. Frustrated Brexiteers can’t understand why anyone would want to stay in an institution that immiserates most of its people and point out that europhiles have confused the EU with NATO.

As our erstwhile writing colleague Nick Hubble has observed, (ex UK) European defence spending has lately been somewhat underwhelming – a supposition confirmed by the fact that German soldiers on exercises after the Russian invasion of Ukraine were forced to use painted broomstick handles in lieu of real guns.

But as Nick has also pointed out, the British economy has done rather well out of Brexit Chaos. We particularly like his suggested poster:

Unemployment? Down!

GDP? Up! FDI? Record!

Inflation? Sweetspot!

Stockmarket? All-time highs!

We demand:

3 More Years

Of Brexit Chaos

The real casualty of Brexit has clearly not been the UK economy, but rather trust in UK institutions, most notably Parliament and our media.

Orwell was right. Putting aside the (non-trivial) issue of naked self-interest, the only reason we can find for so many British politicians having favoured Remain both in the run-up to the 2016 referendum and afterwards is a combination of national self-loathing and a complete lack of confidence in our country’s economic vitality. Remainer MPs (and one notes ominously our new Prime Minister’s fondness for locales like Davos over his native Westminster) are following Hilaire Belloc’s advice to Jim in the eponymous poem, clinging desperately to nanny’s skirts, so that they can

“..always keep ahold of nurse

For fear of finding something worse.”

The astonishing thing about our ongoing parliamentary preference for the Big (European) State is the complete blindness to its obvious economic flaws. For us, the political debate has never been between capitalism and socialism – that debate, after all, has been conclusively won, or at least you could be forgiven for thinking so, unless you are an academic – but between Big Government and small government, between authoritarianism and libertarianism, if you prefer.

If you are entirely dependent on Big Government for your paycheque, chances are you’ll be in favour of it. But for those of us engaged in what we hope will be productive free enterprise, the idea of leeching off the labours of others is simply unthinkable.

We were struck, in a recent interview with the outstanding Austrian economist Guido Hülsmann that when asked what one thing he would do to change the system, his response was to get government out of the education business. As another Austrian economist, Sean Corrigan, puts it, the problem with the educational system is that it has fallen victim to Gramsci’s “long march through the institutions” – just as much of the mainstream media, including BBC News, and notoriously many writers for ‘The Financial Times’ and ‘The Economist’, have fallen victim to a delusional Marxist ignorance of, or contempt for, the merits of free market capitalism. Just how did we get into this mess? Orwell knew.

One friend we have made on Twitter / X over recent years is the London-based economist John Hearn, who teaches at the London Institute of Banking and Finance. We were shocked to see the following slide from one of John’s presentations, on the topic of government spending:

Source: The London Institute of Banking and Finance/John Hearn

In terms of government spending as a percentage of GDP, John’s own preference is close to 25% – there are certain services that the free market can’t provide. These are non-rival and non-excludable products we all require, such as law and order and street lighting. So unless you want to live in a Mad Max-style state of anarchic chaos, government spending will always be above 0%.

But it was a revelation to see John’s analysis of current political “largesse”: all three major political parties are clustered out there at close to 50% – a degree of government spending that would in different times have been associated exclusively with the sort of spending advocated by the hard left – and duly doggedly pursued by them until the economy finally collapses. Whatever happened to Thatcherism ? (We note en passant that John’s research was published before the recent rise of the Reform party.)

John’s “nightmare” consists of the following questions and statements, which we invite all readers to reflect upon:

John cites J.K. Galbraith:

“There are those people who don’t know and those people who don’t know that they don’t know.”

John adds of the second group,

“They’re the ones who become politicians.”

Why do we continue to revisit the (charred) ground of Brexit ? Perhaps because the overbearing EU leopard still shows no signs of changing its spots.

On 12th August, for example, Thierry Breton for the EU Commission posted a letter to Elon Musk on his own platform, threatening punishment if content posted on social media site X was found to place EU citizens at risk of “serious harm”. The letter was published hours before Musk interviewed US presidential candidate Donald Trump, also on X.

The EU has been investigating X, formerly Twitter, since last year over claims of non-compliance with its landmark Digital Services Act passed in 2022.

Musk responded to the letter from Breton with a meme from the 2008 film ‘Tropic Thunder’, that showed one character shouting: “Take a big step back and literally f**k your own face.” A Trump campaign spokesperson responded by saying: “The European Union should mind their own business instead of trying to meddle in the US presidential election.”

Amusingly, Brussels then accused its internal market commissioner of having gone rogue in sending the letter and disavowed its contents.

Nor is this growing authoritarian trend limited to Europe. As Joel Kotkin suggests in ‘Spiked’, America is increasingly resembling the EU:

“Europe may be fading from global relevance, but its influence is expanding within the US Democratic Party. Today, the party’s core beliefs echo those espoused by the European Union and much of the British establishment – an embrace of censorship, a draconian approach to climate change, support for trans ideology, the championing of race-based politics..”

“For many on the American left, Europe, as one academic describes it, offers ‘a progressive model from which the United States could learn’. Certainly, Europe’s elites favoured Joe Biden’s election, which was widely seen as making America ‘more European’. This model is inspired largely by Europe’s once successful but now deeply troubled social-market economy.”

So we now have the absurd state of affairs whereby emerging and until recently explicitly communist-run economies in Asia are pursuing comparatively far more free market policies and growing far more quickly and simultaneously offering far more attractive valuations than economies in the developed world..

The map below shows the current middle class populations of the world’s various regions (size of middle class represented by the green circle) and the forecast size of those middle class populations by 2030 (size represented by the wider blue circumference), according to the OECD.

Source: OECD forecasts

In other words, while the US and Europe, for example, are likely to see little growth in their middle class populations, in large part because they’re already mature economies, the size of the Asian middle class is forecast to explode – from around 500 million people today to something like 3 billion people by 2030. And all of those people are going to want to drive cars, live in nice houses or apartments and – as the ASEAN fund manager James Hay puts it – enjoy high cholesterol just like the rest of us. If you want growth from your portfolio and you are not looking at Asia, you are looking in the wrong place.

Of course, not all emerging economies should be considered equal. While we like the longer term prospects for markets as varied as Vietnam and Japan, we have no exposure whatsoever in our own fund to China. This is partly down to issues of corporate governance (because there isn’t any), but largely down to a mixture of valuations (Chinese stocks are expensive by comparison to many regional rivals) and ongoing geo-political risk, including the current popularity of ‘reshoring’ which threatens to reverse much of the recent trend of ‘offshoring’ manufacturing which did so much to lift so much of Asia and in particular China out of poverty, admittedly at the expense of much of the Western working class.

The analyst and financial historian Russell Napier has recently warned that the West’s divorce from China will result in a profound supply shock for the West, along with adding to our inflationary concerns. In his lecture ‘Lessons from financial history’ he argues that a radical reappraisal of investor asset allocation is needed. He sees gold, commodities and ‘value’ equities as appropriate assets to hold in this largely dysfunctional environment. As longstanding readers will appreciate, we wholeheartedly agree.

So even in the midst of huge geopolitical uncertainty, there is opportunity. But it will not likely be found in ‘conventional’ or ‘traditional’ assets.

On a rainy evening during our last trip to Luxembourg, we braved the storms to cross the Pont Adolphe and visit 2 Place de Metz. It’s the address of BCEE, the Banque et Caisse d’Épargne de l’État, the State Savings Bank of Luxembourg. At one corner of the front wall is a bronze plaque, stating:

“Ici le 10 août 1952 la Haute Autorité de la C.E.C.A première Communauté Européenne a commence ses travaux.”

In English,

“Here on 10 August 1952 the High Authority of the C.E.C.A., the first European Community, began its work.”

The C.E.C.A. stands for Communauté Européenne du charbon et de l’acier & Industries – the European Coal and Steel Community (ECSC). This was an international organisation proposed by Robert Schuman, then French minister of foreign affairs, in 1950, as a way to prevent war between France and Germany. His intention was to make war “not only unthinkable but also materially impossible”.

The ECSC established a single market for coal and steel on behalf of France, Germany, Italy and the Benelux countries (Belgium, Netherlands and Luxembourg). Its aim: to “massively support the European coal and steel industries to enable them to modernize, optimize their production and reduce their costs, while taking care of improving the living conditions of their employees and their reintegration in the job market in the event of dismissal .” 2 Place de Metz is where the entire European project first began.

The intention to prevent further war in Europe was entirely noble. To do so in the form of a protectionist trade body, perhaps not so much.

When we visited 2 Place de Metz, we found giant ungainly piles of sand and construction materials just outside the building. The work of this organisation would seem to be some way from being completed.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price