“Douglas Coupland (January 11) calls the extreme pessimism he has encountered at a dinner party “noptimism”. He’s hit on something here.

“While few are denying that climate-related problems are arising, there are many who have become downright dogmatic about what you can talk, think, say, or believe about it.

“They have their own food dictates (plant-based meat replacements, no dairy, get rid of almonds, organic only, etc), documents that cannot be questioned (certain reports and simulations), a class of individuals who interpret what they must say and do who also cannot be questioned (specific authorised scientists and celebrities), and even have increasingly elaborate codes of conduct and behaviour that come with stains upon their humanity if they stray from the code (don’t fly, don’t use plastics, only buy certain safe brands for all products, recycle, ride a bicycle, etc).

“And if they do stray, they of course have ways to remove the stain (make a donation, volunteer, or confront a non-believer to convince them of the righteousness and truth of the cause).

“Logic no longer appears to guide those who live this way, as it seems to be a purely faith- and passion-based system. What we have here is a religion. So thank you to Mr Coupland for naming it. At least now we will all know how to address those individuals for whom negativity about the future is a matter of principle: Nopes.”

- Letter to the Financial Times from Curtis Fields, Cypress, Texas, 17 January 2020.

“’Why is the news so gloomy . . . why don’t you give us more good news?’ These questions are raised with depressing regularity on virtually every occasion television people brush with viewers. The accusation is directed not primarily at newspapers, which have the space to ensure that their readers’ diet is seldom unremittingly bad, but at television, with its often remorseless emphasis on disaster, conflict and failure.

“It is high time that we who work in television news started treating the accusation seriously. For seldom can a complaint repeated so freely, frequently and vehemently have generated so little discussion and debate among those against whom it is directed.

“BBC Television News has built up an enviable reputation for the careful balance its reporters and producers bring to news stories. Commercial television news broadcasters in Britain are also diligent in their search for balance. How ironic then, that a profession so committed to fairness and accuracy in the stories it does cover, does not fully extend those qualities to the news agenda – the choice of television news stories.

“Good stories are there – made all the more memorable by their rarity. But too frequently they are given low priority. News editors across the world stress the need for young reporters to hunt for conflict and criticism. If they don’t find it, fewer of their stories are used. So another generation of journalists is infected with old standards and judgements.

“It is always the Good News stories that are demoted or dropped if there is pressure on time or space. Judgements on the relative value of news stories have, on the whole, come to be based on the extent to which things go wrong. The bigger the tragedy, the greater the images of the disaster, the more prominence it acquires.

“I am not arguing for us to be blinded by the artificial shine sometimes placed on stories by public relations teams; nor should we succumb to the skill and blandishments of the spin doctors from the world of politics. But our proper desire not to fall victim to PR has developed into such scepticism that it makes us overly dismissive of positive stories.”

- Martyn Lewis, ‘Not my idea of good news’, The Independent, 26 April 1993.

Get your Free

financial review

In journalism and the mainstream media, ‘Noptimism’ sells. In the more rarified newsletter business, not to say in the arena of financial services, the environment is more nuanced. ‘Bad news’ will tend to keep investors sheltering in the presumed safety of cash or bonds; ‘good news’ may, perhaps, provoke interest in a specific stock or asset class. But as Charlie Munger would probably advise were he still with us: always follow the money. What is the writer’s (and publisher’s) interest in advocating this particular line ?

Following the wise advice of Rolf Dobelli, we try our hardest to avoid the mainstream media’s version of news altogether – in favour of informed longer form commentary – but there are clearly limits to how achievable this is. The two other must-read cautionary tales about the dangers to investors lurking in newspapers are from Thomas Schuster of the Institute for Communication and Media Studies at Leipzig University, and via the bestselling author, Michael Crichton. Schuster first:

“The media select, they interpret, they emotionalize and they create facts. The media not only reduce reality by lowering information density. They focus reality by accumulating information where ‘actually’ none exists. A typical stock market report looks like this: Stock X increased because… Index Y crashed due to… Prices Z continue to rise after… Most of these explanations are post-hoc rationalizations. An artificial logic is created, based on a simplistic understanding of the markets, which implies that there are simple explanations for most price movements; that price movements follow rules which then lead to systematic patterns; and of course that the news disseminated by the media decisively contribute to the emergence of price movements.”

Now Crichton, and what he calls the ‘Gell-Mann Amnesia Effect’:

“Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

“In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.”

You have been warned.

The following three separate, sensible, well-written pieces – from credible financial industry participants, not generalist journalists – have something in common. They all warn of the possibility, not to say probability, of looming inflation.

The first is from Sir Steven Wilkinson:

“..I am currently unsure of whether I have manoeuvred myself into an echo chamber of a clique of like-minded value investors who can see clearly that we are in “Fergie time” and thus close to a cataclysmic popping of the Everything Bubble (including money) or whether the current narrative (dangerously close to the end of the Everything Bubble, so man the life-boats) is now the popular view and therefore discounted? My view is coloured strongly by a moral conviction that what we have now (broken money, punishment of savers, risk free reward for insiders, etc.) is simply wrong and possibly even evil at a societal level, so what I think will happen and what I believe should happen (to purge the system of moral turpitude) are conflated at the margin. The technocratic disregard of the concerns and values of the saving classes personified in the ghastly Ms. Lagarde‘s most recent comments [“We should be happier to have a job than to have our savings protected”] disgust me personally..

The second is from the US fund manager Harris Kupperman via the Adventures In Capitalism website, and his December 4th 2019 commentary, Inflation is Coming:

“Of course, government policy drives all of this. I think it is obvious that we’ve finally reached the limits of monetary policy. Does the ECB taking rates 10 basis points more negative do anything but accelerate the bankruptcy of the Eurozone banking system? Does it increase consumption or capital expenditures? Of course not. If anything, it just starves the system of capital by taking everyone’s return on capital investment down towards zero and below. Who invests when expected returns are negative? What the world needs is a big reset of the system where leveraged firms default, solvent firms pick up the pieces and get to earn excess returns due to their past fiscal sobriety. Since we live in a democracy, that won’t happen, instead we will have extreme fiscal stimulus in order to kick the can further down the road.

“In October, I spent 15 hours in the Sheremetyevo airport in Moscow (damn connecting flight never showed). It hasn’t seen a dollar of cap-ex in years, but it’s still light years ahead of LaGuardia or LAX. Just wait until corporations learn how much they can make from a never-ending airport renovation project. Now multiply that by hundreds of airports in America that desperately need capital investment. Now add bridges, roads, bullet trains, water infrastructure and our electrical grid. Why are all the lobbyists trying to get us into wars with third world nations? Corporations would make more money fixing our infrastructure and it’s going to be a lot less politically contentious.

“If you think deflation is a fact of life, you clearly haven’t paid attention to history. Governments around the world have experienced a unique decade where they ran deficits and printed money without “bad inflation” which upsets voters. They think this is a new normal with no consequences. It isn’t. They’re already panicking with the S&P a few ticks from all-time highs. Soon politicians will go into ludicrous mode with fiscal stimulus.

“What will fiscal stimulus do to the equity market? I’m reminded of the 1970s—inflation is no friend to most stocks. What happens to trillions in negative yielding long-dated bonds if inflation ticks up? What happens to bond proxies like global large-cap equity indexes or real estate? What happens to risk-parity funds that are leveraged a few times over expecting bonds and equities to increase over time? What if both legs of the trade drop at the same time? No one is ready for inflation, but I believe it’s coming. Maybe not today or next week, but there is a powder keg of monetary supply just waiting to be unleashed by governments who think that inflation can never happen again. At first, markets will cheer a bit of inflation—then they’ll panic. The markets often do whatever the fewest people are positioned for. Who’s positioned for inflation? That’s about as contrarian as buying Argentine sovereign debt..

The third commentary came from the investment company Ruffer and their Chief Investment Officer Henry Maxey. It is entitled ‘Dismantling the deflation machine’ and if you wish to read the full piece, it featured in Ruffer’s 2020 Review. Here is a synopsis of Henry’s piece:

“Seeking to escape the inflation of the 1970s, policymakers have inadvertently engineered an equally powerful deflation machine. Over the past 30 years, this has been mightily reinforced by the transformation of China’s economy and the impact of technology.

“Today, a financial system that is structurally intolerant of inflation faces a changing political-economy regime that makes inflation inevitable. The markets have wired themselves to the wrong inevitabilities.

“Asset and wealth managers – and their clients – need to be prepared for some of the most important changes for a generation.”

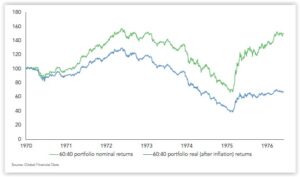

Let’s just say, for the sake of argument, that we are in for a period of 1970s-style stagflation: low growth, but with stubbornly high inflation. How would a traditional 60% equity / 40% bond portfolio perform in such an environment ? The following chart shows how such a portfolio would have fared in the 1970s.

Performance of a 60 / 40 Equity / Bond portfolio in the 1970s

After peaking in 1972, such a portfolio lost roughly 60% of its nominal value by 1974. In real, after-inflation terms, the loss over the same period equated to 70%.

You can see the 1970s era performance of individual asset classes (first UK Gilts, then stocks) in the following two charts from Frontier Capital Management LLP.

In inflation-adjusted terms, our 1970s UK Gilt portfolio lost over a third of its value. Worse still, Gilt investors then had to wait 12 years to make their money back.

Next, stocks.

A FTSE All-Share portfolio lost over 70% of its value and, similarly to Gilts, would have left investors waiting 11 years until they reached breakeven again.

In the interests of balance, we must of course add that 1970s-style inflation may not necessarily recur.

In the 1970s, inflation came by way of two developments. The first was monetary, the second was political. In 1971 President Nixon took the US dollar “off gold” – the link between the US dollar and US government gold reserves was severed, “temporarily”, of course. That amounted to a trial run of MMT, in that money could be printed to destruction, no longer constrained by the US’ gold reserves. And since all other currencies had been pegged to the dollar, it amounted to MMT on a global basis.

The second development was the Arab oil shock of 1973, during which oil prices surged by 400%.

We have seen what the impact of 1970s inflation was on traditional assets. One asset class ended up doing rather well on the back of these developments. You can see its performance in the chart below. That asset class, of course, was commodities.

The CRB commodity index during the 1970s

Source: Bloomberg LLP / Price Value Partners

Sir Steven Wilkinson is, of course, right to try and keep an open mind on the topic of inflation and potential monetary collapse. So should we all.

The problem, of course, is that after a decade of ridiculous, Basil Fawlty-ish monetary experimentation, investors have become immune to more of the same, since it seems to come with no inflationary consequences. But as our friend Grant Williams has consistently pointed out, “hasn’t is not the same as won’t”.

So in terms of portfolio protection, in addition to the asset diversification that we will always advocate, the one question that remains as a hardy perennial for the months and years to come is the same one that we seem to be asking now on a weekly basis:

Got Gold ?

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

“Douglas Coupland (January 11) calls the extreme pessimism he has encountered at a dinner party “noptimism”. He’s hit on something here.

“While few are denying that climate-related problems are arising, there are many who have become downright dogmatic about what you can talk, think, say, or believe about it.

“They have their own food dictates (plant-based meat replacements, no dairy, get rid of almonds, organic only, etc), documents that cannot be questioned (certain reports and simulations), a class of individuals who interpret what they must say and do who also cannot be questioned (specific authorised scientists and celebrities), and even have increasingly elaborate codes of conduct and behaviour that come with stains upon their humanity if they stray from the code (don’t fly, don’t use plastics, only buy certain safe brands for all products, recycle, ride a bicycle, etc).

“And if they do stray, they of course have ways to remove the stain (make a donation, volunteer, or confront a non-believer to convince them of the righteousness and truth of the cause).

“Logic no longer appears to guide those who live this way, as it seems to be a purely faith- and passion-based system. What we have here is a religion. So thank you to Mr Coupland for naming it. At least now we will all know how to address those individuals for whom negativity about the future is a matter of principle: Nopes.”

“’Why is the news so gloomy . . . why don’t you give us more good news?’ These questions are raised with depressing regularity on virtually every occasion television people brush with viewers. The accusation is directed not primarily at newspapers, which have the space to ensure that their readers’ diet is seldom unremittingly bad, but at television, with its often remorseless emphasis on disaster, conflict and failure.

“It is high time that we who work in television news started treating the accusation seriously. For seldom can a complaint repeated so freely, frequently and vehemently have generated so little discussion and debate among those against whom it is directed.

“BBC Television News has built up an enviable reputation for the careful balance its reporters and producers bring to news stories. Commercial television news broadcasters in Britain are also diligent in their search for balance. How ironic then, that a profession so committed to fairness and accuracy in the stories it does cover, does not fully extend those qualities to the news agenda – the choice of television news stories.

“Good stories are there – made all the more memorable by their rarity. But too frequently they are given low priority. News editors across the world stress the need for young reporters to hunt for conflict and criticism. If they don’t find it, fewer of their stories are used. So another generation of journalists is infected with old standards and judgements.

“It is always the Good News stories that are demoted or dropped if there is pressure on time or space. Judgements on the relative value of news stories have, on the whole, come to be based on the extent to which things go wrong. The bigger the tragedy, the greater the images of the disaster, the more prominence it acquires.

“I am not arguing for us to be blinded by the artificial shine sometimes placed on stories by public relations teams; nor should we succumb to the skill and blandishments of the spin doctors from the world of politics. But our proper desire not to fall victim to PR has developed into such scepticism that it makes us overly dismissive of positive stories.”

Get your Free

financial review

In journalism and the mainstream media, ‘Noptimism’ sells. In the more rarified newsletter business, not to say in the arena of financial services, the environment is more nuanced. ‘Bad news’ will tend to keep investors sheltering in the presumed safety of cash or bonds; ‘good news’ may, perhaps, provoke interest in a specific stock or asset class. But as Charlie Munger would probably advise were he still with us: always follow the money. What is the writer’s (and publisher’s) interest in advocating this particular line ?

Following the wise advice of Rolf Dobelli, we try our hardest to avoid the mainstream media’s version of news altogether – in favour of informed longer form commentary – but there are clearly limits to how achievable this is. The two other must-read cautionary tales about the dangers to investors lurking in newspapers are from Thomas Schuster of the Institute for Communication and Media Studies at Leipzig University, and via the bestselling author, Michael Crichton. Schuster first:

“The media select, they interpret, they emotionalize and they create facts. The media not only reduce reality by lowering information density. They focus reality by accumulating information where ‘actually’ none exists. A typical stock market report looks like this: Stock X increased because… Index Y crashed due to… Prices Z continue to rise after… Most of these explanations are post-hoc rationalizations. An artificial logic is created, based on a simplistic understanding of the markets, which implies that there are simple explanations for most price movements; that price movements follow rules which then lead to systematic patterns; and of course that the news disseminated by the media decisively contribute to the emergence of price movements.”

Now Crichton, and what he calls the ‘Gell-Mann Amnesia Effect’:

“Briefly stated, the Gell-Mann Amnesia effect is as follows. You open the newspaper to an article on some subject you know well. In Murray’s case, physics. In mine, show business. You read the article and see the journalist has absolutely no understanding of either the facts or the issues. Often, the article is so wrong it actually presents the story backward—reversing cause and effect. I call these the “wet streets cause rain” stories. Paper’s full of them.

“In any case, you read with exasperation or amusement the multiple errors in a story, and then turn the page to national or international affairs, and read as if the rest of the newspaper was somehow more accurate about Palestine than the baloney you just read. You turn the page, and forget what you know.”

You have been warned.

The following three separate, sensible, well-written pieces – from credible financial industry participants, not generalist journalists – have something in common. They all warn of the possibility, not to say probability, of looming inflation.

The first is from Sir Steven Wilkinson:

“..I am currently unsure of whether I have manoeuvred myself into an echo chamber of a clique of like-minded value investors who can see clearly that we are in “Fergie time” and thus close to a cataclysmic popping of the Everything Bubble (including money) or whether the current narrative (dangerously close to the end of the Everything Bubble, so man the life-boats) is now the popular view and therefore discounted? My view is coloured strongly by a moral conviction that what we have now (broken money, punishment of savers, risk free reward for insiders, etc.) is simply wrong and possibly even evil at a societal level, so what I think will happen and what I believe should happen (to purge the system of moral turpitude) are conflated at the margin. The technocratic disregard of the concerns and values of the saving classes personified in the ghastly Ms. Lagarde‘s most recent comments [“We should be happier to have a job than to have our savings protected”] disgust me personally..

The second is from the US fund manager Harris Kupperman via the Adventures In Capitalism website, and his December 4th 2019 commentary, Inflation is Coming:

“Of course, government policy drives all of this. I think it is obvious that we’ve finally reached the limits of monetary policy. Does the ECB taking rates 10 basis points more negative do anything but accelerate the bankruptcy of the Eurozone banking system? Does it increase consumption or capital expenditures? Of course not. If anything, it just starves the system of capital by taking everyone’s return on capital investment down towards zero and below. Who invests when expected returns are negative? What the world needs is a big reset of the system where leveraged firms default, solvent firms pick up the pieces and get to earn excess returns due to their past fiscal sobriety. Since we live in a democracy, that won’t happen, instead we will have extreme fiscal stimulus in order to kick the can further down the road.

“In October, I spent 15 hours in the Sheremetyevo airport in Moscow (damn connecting flight never showed). It hasn’t seen a dollar of cap-ex in years, but it’s still light years ahead of LaGuardia or LAX. Just wait until corporations learn how much they can make from a never-ending airport renovation project. Now multiply that by hundreds of airports in America that desperately need capital investment. Now add bridges, roads, bullet trains, water infrastructure and our electrical grid. Why are all the lobbyists trying to get us into wars with third world nations? Corporations would make more money fixing our infrastructure and it’s going to be a lot less politically contentious.

“If you think deflation is a fact of life, you clearly haven’t paid attention to history. Governments around the world have experienced a unique decade where they ran deficits and printed money without “bad inflation” which upsets voters. They think this is a new normal with no consequences. It isn’t. They’re already panicking with the S&P a few ticks from all-time highs. Soon politicians will go into ludicrous mode with fiscal stimulus.

“What will fiscal stimulus do to the equity market? I’m reminded of the 1970s—inflation is no friend to most stocks. What happens to trillions in negative yielding long-dated bonds if inflation ticks up? What happens to bond proxies like global large-cap equity indexes or real estate? What happens to risk-parity funds that are leveraged a few times over expecting bonds and equities to increase over time? What if both legs of the trade drop at the same time? No one is ready for inflation, but I believe it’s coming. Maybe not today or next week, but there is a powder keg of monetary supply just waiting to be unleashed by governments who think that inflation can never happen again. At first, markets will cheer a bit of inflation—then they’ll panic. The markets often do whatever the fewest people are positioned for. Who’s positioned for inflation? That’s about as contrarian as buying Argentine sovereign debt..

The third commentary came from the investment company Ruffer and their Chief Investment Officer Henry Maxey. It is entitled ‘Dismantling the deflation machine’ and if you wish to read the full piece, it featured in Ruffer’s 2020 Review. Here is a synopsis of Henry’s piece:

“Seeking to escape the inflation of the 1970s, policymakers have inadvertently engineered an equally powerful deflation machine. Over the past 30 years, this has been mightily reinforced by the transformation of China’s economy and the impact of technology.

“Today, a financial system that is structurally intolerant of inflation faces a changing political-economy regime that makes inflation inevitable. The markets have wired themselves to the wrong inevitabilities.

“Asset and wealth managers – and their clients – need to be prepared for some of the most important changes for a generation.”

Let’s just say, for the sake of argument, that we are in for a period of 1970s-style stagflation: low growth, but with stubbornly high inflation. How would a traditional 60% equity / 40% bond portfolio perform in such an environment ? The following chart shows how such a portfolio would have fared in the 1970s.

Performance of a 60 / 40 Equity / Bond portfolio in the 1970s

After peaking in 1972, such a portfolio lost roughly 60% of its nominal value by 1974. In real, after-inflation terms, the loss over the same period equated to 70%.

You can see the 1970s era performance of individual asset classes (first UK Gilts, then stocks) in the following two charts from Frontier Capital Management LLP.

In inflation-adjusted terms, our 1970s UK Gilt portfolio lost over a third of its value. Worse still, Gilt investors then had to wait 12 years to make their money back.

Next, stocks.

A FTSE All-Share portfolio lost over 70% of its value and, similarly to Gilts, would have left investors waiting 11 years until they reached breakeven again.

In the interests of balance, we must of course add that 1970s-style inflation may not necessarily recur.

In the 1970s, inflation came by way of two developments. The first was monetary, the second was political. In 1971 President Nixon took the US dollar “off gold” – the link between the US dollar and US government gold reserves was severed, “temporarily”, of course. That amounted to a trial run of MMT, in that money could be printed to destruction, no longer constrained by the US’ gold reserves. And since all other currencies had been pegged to the dollar, it amounted to MMT on a global basis.

The second development was the Arab oil shock of 1973, during which oil prices surged by 400%.

We have seen what the impact of 1970s inflation was on traditional assets. One asset class ended up doing rather well on the back of these developments. You can see its performance in the chart below. That asset class, of course, was commodities.

The CRB commodity index during the 1970s

Source: Bloomberg LLP / Price Value Partners

Sir Steven Wilkinson is, of course, right to try and keep an open mind on the topic of inflation and potential monetary collapse. So should we all.

The problem, of course, is that after a decade of ridiculous, Basil Fawlty-ish monetary experimentation, investors have become immune to more of the same, since it seems to come with no inflationary consequences. But as our friend Grant Williams has consistently pointed out, “hasn’t is not the same as won’t”.

So in terms of portfolio protection, in addition to the asset diversification that we will always advocate, the one question that remains as a hardy perennial for the months and years to come is the same one that we seem to be asking now on a weekly basis:

Got Gold ?

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price