“If I wanted to become a tramp, I would seek information and advice from the most successful tramp I could find. If I wanted to become a failure, I would seek advice from men who had never succeeded. If I wanted to succeed in all things, I would look around me for those who are succeeding and do as they have done.”

Get your Free

financial review

There is an investment strategy that has been one of the most consistently profitable in the world – for centuries. It is also one of the most secretive. It is mostly used by a small number of traders who happen to know the strategy – but it doesn’t even require huge amounts of capital. And anyone can be taught the basics in minutes.

Intrigued ? Just read on.

What follows is perhaps the most extraordinary story in investment. It is all the more extraordinary because it happens to be true.

The movie ‘Trading Places’ was based on a true story.

If you haven’t seen the film yet, you should. It is one of the funniest comedies about Wall Street ever made – not a huge field, admittedly. In it, two unscrupulous commodity brokers wager that they can take a vagrant (Eddie Murphy) off the street and turn him into a successful trader.

The film was a smash hit, symbolic of a more innocent age (specifically 1983) when interference in innocent people’s lives by gambling financiers was the exception rather than the rule.

At precisely the same time, the commodities trader Richard Dennis set out to show that anybody could become a successful trader provided they were simply taught properly.

His partner, Bill Eckhardt, disagreed – and a wager was born.

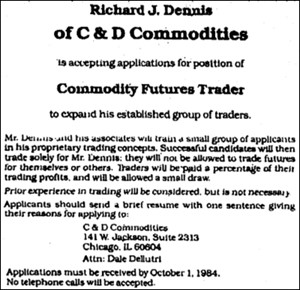

Dennis placed classified ads in the back of Barron’s magazine. This is what they looked like:

Prior experience was not necessary. But applicants did have to complete a psychological profile. Among the test were some true-false questions, such as:

- The majority of traders are always wrong

- It’s good to follow hunches in trading

- It’s good to average down when buying

- A trader should be willing to let profits turn into losses

- Needing and wanting money are good motivators to good trading..

He ended up with two classes of what he called ‘turtles’, named after a visit to a Singaporean turtle farm. Dennis believed that successful traders could be raised, like baby turtles in a vat of water, simply by being taught the fundamental principles of trading.

And Dennis didn’t rig the experiment. Among those selected for the trial were graduates in piano and music theory, an accountant, a geologist, an unemployed guy, and someone from the United States Air Force Academy. Typical business students they were not.

Long story short, Richard Dennis won his bet.

He hired fewer than two dozen novice traders. Jerry Parker was among them. He is now believed to be worth upwards of $700 million.

$1000 invested with fellow ‘turtle’ Tom Shanks’ Hawksbill Capital in 1988 would now be worth something north of $100,000.

Turtles Paul Rabar, Mike Carr, Howard Seidler and Jim DiMaria all set up fantastically successful trading firms after their experience with Dennis.

So what did Dennis teach them ?

There are only two ways consistently to make money from the financial markets. One of them is value investing. Buying high quality assets for less than they’re fundamentally worth is a credible and immensely successful strategy over the medium term.

The other is what we can call momentum.

Old hands in the City and on Wall Street tend to favour fundamental analysis of the markets. They waste their time discussing and debating the future course of the economy, of interest rates, and inflation. This is all very interesting – perhaps – but fundamentals tell you nothing about how to make money. All of that information is already in the price. And fundamentals are also somewhat subjective – take two economists, ask for their opinion, and you’ll get at least three answers.

Another way to look at financial markets is by using technical analysis. This is not as complicated as it might sound. It simply means looking at the price history of financial assets.

The reality, which is something that Dennis intuitively knew, and that he went on to teach his turtles, is that price is the only metric worth trusting. You can have a view about the future path of interest rates, for example. You may think they’re going lower. But that view might be 100% wrong.

Everything else is subjective.

So this is the system that Dennis taught. It’s a trading strategy that today goes by the title of ‘systematic trend-following’.

‘Systematic’ because there’s a clearly articulated system. This is a rules-based approach to trading. For example, one rule might be:

- When a given market trades at a new 52-week high, then buy it.

Another rule might be:

- When a given market trades at a new 52-week low, then sell it.

These are clearly simple examples. A decent ‘systematic, trend-following’ system will likely incorporate a wide variety of rules, incorporating guidance on when to get in, when to get out, and how to size positions.

The point being, once you have established that set of rules, you don’t deviate from them. At all. They can clearly be refined, over time. But they should never, under any account, be abandoned.

Unlike many trading approaches, systematic trend-following requires no special understanding of any given market. In fact, we have a friend with a small trend-following fund who assures us that he’s perfectly happy to trade markets ‘blind’ – he doesn’t even need to know exactly what he’s trading, he just needs to know the price history and he can make his trade entry and exit decisions based on that alone.

Trend-followers are not remotely interested in macro-economic analysis. If they use Wall Street research at all, it will be to prop up a wobbly chair leg.

What does interest trend-followers is catching a ride on big market trends. This is the key to the success of trend-following as an investment (trading) strategy. Markets have a tendency to make big moves that come as a complete surprise to most investors. But not to trend-followers: big “surprise” moves is precisely what they live for. It’s the source of their outsized profits. Check out, for example, the cocoa price in recent months for more on this theme.

Today’s trend-followers are following a path laid down by one of the most successful stock traders in history – Jesse Livermore (1877-1940). Livermore’s nicknames included ‘the Boy Plunger’ and ‘the Great Bear of Wall Street’. Livermore managed to make, and then lose, several fortunes. But he was not a creature of some long-lived bull market, like so many of today’s accidentally successful hedge fund managers. After the 1929 Crash, he ended up worth $100 million, when many of his trading rivals lost everything.

Happily for the wannabe trader today, Jesse Livermore’s approach is just as valid as it’s always been. As he said himself,

“There is nothing new in Wall Street. There can’t be, because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

The beauty of trend-following is that it requires just two things: greed and fear. And not on your part, but on the part of your fellow investors. As the market oscillates between these two emotional extremes, prices form trends. The direction and intensity of those trends reflect whichever emotion currently has the upper hand in the psychology of the average investor.

The principles of trend-following, then, are not complex. Most of them are concerned with determining how much risk to take on each trade. This remains the case whether you are buying shares or shorting them (selling them with the intention of buying them back later at a lower price). This is known in the trade as risk management.

A particularly appealing aspect of trend-following is that it’s typically a low risk strategy. The best trend-following funds are actually very low risk vehicles. When we use the word ‘risk’ here, we should probably be more explicit. We define risk not as short term price volatility but rather as “the possibility of a permanent loss of capital”. If a trend-following manager knows how to size his positions appropriately, and rigidly obeys his own system no matter what, he is highly unlikely to incur a blow-up. Managers blow up when they don’t know what they’re doing, when they don’t follow a system, or when their systems are obviously flawed.

Trend-following might be the perfect antidote to Wall Street machismo and excess. (One of Richard Dennis’ most successful ‘turtles’ was Liz Cheval, the founder of EMC Capital Management, who sadly died in March 2013.)

It certainly flies in the face of traditional theories about efficient markets. (The Efficient Market Hypothesis is a load of bull.)

But trend-following is not easy. It requires an iron psychological discipline in buying or selling when your system’s signals say so, irrespective of how you might feel about the market’s overall direction. The trick is to abandon ego altogether, and just follow the momentum of the market. As our trend-following friend concedes, having the discipline to follow the instructions of your system without question can be immensely difficult. Imagine buying a futures contract – in anything – nine times in a row, only to be stopped out by an adverse short term price movement. And then your system tells you, once again, to buy that instrument. As our friend says, sometimes it’s like coming in to work and having your arm broken, ten days in a row.

Jesse Livermore understood this. As he said himself,

“The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the man of inferior emotional balance, or for the get-rich-quick adventurer. They will die poor.”

So trend-following isn’t necessarily easy, but it can be extraordinarily profitable.

Some examples, via Michael Covel’s excellent Trend Following website:

“[The] Trend following strategy performs above average when market bubbles pop, when the Black Swan arrives. For example, trend following made huge money during the Stock Crash (1973–74), Black Monday (1987), Barings Bank (1995), LTCM & Asian Crisis (1998), Stock Crash (2000-02), 9/11 (2001), Great Recession (2008-09), Oil Market (2014-16), Brexit (2016), Covid-19 (March, 2020) and all of 2022-4.

“John W. Henry: Henry is a trend following trader featured in Trend Following. He is worth $2.1 billion (source). He used his trend following gains to buy the Boston Red Sox for $700 million.

“Bruce Kovner: Kovner is a trend following trader featured in Jack Schwager’s ‘Market Wizards.’ He was trained by trend follower Michael Marcus. Marcus was trained by Ed Seykota. More on Seykota can be found in Trend Following. Kovner is worth over $5.3 billion (source).

“Bill Dunn: Dunn is a trend following trader featured in Trend Following. Dunn made $80 million in 2008 when the rest of the world was blowing up.

“Michael Marcus: Marcus is a trend following trader featured in Jack Schwager’s Market Wizards. He turned an initial $30,000 into $80 million (source).

“David Harding: Harding is a trend following trader featured in Trend Following. He is worth over $1.387 billion (source).

“Ed Seykota: Seykota is a trend following trader featured in Trend Following. He turned $5,000 into $15 million over 12 years in his model account (an actual client account).

“Kenneth Tropin: Tropin is a trend follower who made $120 million in 2008 as buy and hold collapsed. Earlier in his career he led John W. Henry’s firm.

“Those trend followers all started as one-man shops and that is inspirational.”

This is why we use trend-following funds. Whatever their returns, they offer a high likelihood of giving us returns that are completely uncorrelated to the stock and bond markets of the world. And this is precisely what you want within a diversified portfolio. If you own stocks and bonds and gold, for example, you probably also want to own instruments that aren’t correlated in any way to those assets. Enter trend-following funds.

There’s also a serious point about volatility here. If you seek outsized returns, you will have to accept outsized volatility. But volatility in and of itself is nothing to be concerned about – provided the system works over time.

So we use trend-following funds for two key reasons:

- We seek uncorrelated returns that are distinct from the traditional asset classes of stocks and bonds;

- We expect to enjoy positive returns during periods of extreme systemic distress.

You’ll probably agree that if somebody offered you the chance to make over 100% returns in a year like 2008, you’d bite their arm off.

There are no guarantees here, of course. As the regulator loves for us to point out, past performance is not necessarily any guarantee of future returns.

But the reality is that systematic trend-following has been a successful trading strategy for hundreds of years. Probably the first trend-following traders emerged in Japan’s rice futures markets centuries ago.

And trend-following funds typically operate through futures markets.

Why ?

Because futures markets are invariably the deepest and most liquid of financial markets.

If you have literally millions of dollars to deploy, you want to put those dollars to work in a market where you won’t move prices too far against you when you enter a trade. Futures markets offer that liquidity and market depth.

And trend-following managers typically like to trade as many different markets as possible, because the higher the number of markets they trade in, the higher the likelihood that they’ll be able to ride strongly trending prices.

So a typical trend-following fund, at any one point in time, might well be monitoring equity index futures, bond index futures, currency futures, and hard and soft commodity futures.

And because a trend-follower is just as happy to go short as to go long a market (i.e. they have complete flexibility to sell short as well as buy individual markets), they can really make hay when markets collapse – they simply ride that trend down. Most conventional asset managers can only sit on the sidelines watching their long-only portfolios bleed out capital.

So in the interests of pragmatism it makes sense, to us, to start looking at instruments that offer us the potential to make money even when markets fall. Hence trend-following funds.

Now, we are unashamed value investors. But when it comes to the fight to protect and grow people’s money, we like to deploy as many different weapons as possible. And having used trend-following funds for over 20 years, we are convinced that they have a role to play in any balanced portfolio.

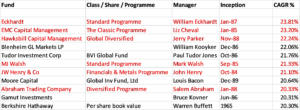

We’ve left what we consider the most impressive piece of evidence on behalf of trend-followers until last.

Our trend-following manager friend ran his own data a few years ago.

He conducted a search for some of the best performing funds in history.

His requirements were simple, but very stringent. To qualify, a fund a) had to have been going for 20 years, and b) had to have generated annualised returns of at least 20%. To last 20 years in the fund management business is itself impressive, but to do so whilst generating on average 20% returns is ludicrously difficult.

The results of his search are shown below.

He came up with eleven funds. Generously, he included Berkshire Hathaway, which isn’t strictly a fund but a listed holding company.

Here’s the kicker. Of those eleven funds, six of them were trend-followers. You can see them in red in the table below.

Funds with a 20 year track record that have generated 20% annualised average returns

(Source: Lawrence Clarke Investment Management)

And notice, too, that at the top of the list is our very own Bill Eckhardt, who had that initial bet with Richard Dennis about the turtles. There is clearly more than meets the eye when it comes to trend-following funds. We rate this strategy so highly we call it, respectfully, the best kept secret in finance.

What’s astonishing is that in the face of so much compelling evidence, trend-followers don’t manage more money. Why ?

Because institutional investors, who really should know better, get spooked by the volatility profile of trend-followers. Which is insane. Institutional investors ought to be grown-up about the idea of experiencing volatile performance. Pursuing a long term objective, institutional managers should be completely indifferent to short term swings in the net asset value of funds. But they’re not. They get terrified by it. As a result, that leaves huge amounts of money on the table for those of us who have a grown-up attitude towards risk.

And this is why we absolutely believe that the individual investor has some terrific advantages over the professionals. Professional investors are like sheep. Most of them are benchmarked against some utterly inappropriate index, and can barely deviate from it. Being long-only managers, when the market falls, they’re obligated to go down lockstep with it. And being obsessed about retaining their clients, they’re invariably fazed by short term volatility. They would much rather achieve a smooth 6% than a volatile 12%. Not for us, thank you.

There are two ways in which you can get exposure to systematic trend-following. One of them is to do it yourself. As Dirty Harry once remarked, a man has to know his limitations. We know ours. We don’t possess the psychological make-up to trade actively and profitably. We are very comfortable investing for the longer term after deep analysis. We don’t like short term trading and therefore we don’t do it. But by the same token we are very comfortable allocating capital to good trend-following traders. If what you’ve read here interests you, visit Michael Covel’s turtle trader website, a fabulous free resource crammed with information about the turtles, about trend-following, and how you can ‘do it yourself’ if you feel so inclined.

The other way, of course, is to pay someone to do it for you, which is our preferred route to the strategy. One caveat, though: because trend-following is essentially a sub-set of the hedge fund universe, these funds come with the same baggage as hedge funds: often high minimum entry levels, sometimes high fees, leverage, and so on. These are most definitely not ‘widows and orphans’ investment vehicles.

There are two more investment resources that are worth their weight in gold, and they provide a ton of useful advice for the self-directed trader: Jack Schwager’s books ‘Market Wizards’ and ‘The New Market Wizards’ are among the best books ever written about the art of successful trading. Required reading for anyone looking either to trade for themselves, or for help in identifying decent third party asset managers.

There is an investment strategy that has been one of the most consistently profitable in the world – for centuries. It is also one of the most secretive. It is mostly used by a small number of traders who happen to know the strategy – but it doesn’t even require huge amounts of capital. And anyone can be taught the basics in minutes.

Intrigued ? We are.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

“If I wanted to become a tramp, I would seek information and advice from the most successful tramp I could find. If I wanted to become a failure, I would seek advice from men who had never succeeded. If I wanted to succeed in all things, I would look around me for those who are succeeding and do as they have done.”

Get your Free

financial review

There is an investment strategy that has been one of the most consistently profitable in the world – for centuries. It is also one of the most secretive. It is mostly used by a small number of traders who happen to know the strategy – but it doesn’t even require huge amounts of capital. And anyone can be taught the basics in minutes.

Intrigued ? Just read on.

What follows is perhaps the most extraordinary story in investment. It is all the more extraordinary because it happens to be true.

The movie ‘Trading Places’ was based on a true story.

If you haven’t seen the film yet, you should. It is one of the funniest comedies about Wall Street ever made – not a huge field, admittedly. In it, two unscrupulous commodity brokers wager that they can take a vagrant (Eddie Murphy) off the street and turn him into a successful trader.

The film was a smash hit, symbolic of a more innocent age (specifically 1983) when interference in innocent people’s lives by gambling financiers was the exception rather than the rule.

At precisely the same time, the commodities trader Richard Dennis set out to show that anybody could become a successful trader provided they were simply taught properly.

His partner, Bill Eckhardt, disagreed – and a wager was born.

Dennis placed classified ads in the back of Barron’s magazine. This is what they looked like:

Prior experience was not necessary. But applicants did have to complete a psychological profile. Among the test were some true-false questions, such as:

He ended up with two classes of what he called ‘turtles’, named after a visit to a Singaporean turtle farm. Dennis believed that successful traders could be raised, like baby turtles in a vat of water, simply by being taught the fundamental principles of trading.

And Dennis didn’t rig the experiment. Among those selected for the trial were graduates in piano and music theory, an accountant, a geologist, an unemployed guy, and someone from the United States Air Force Academy. Typical business students they were not.

Long story short, Richard Dennis won his bet.

He hired fewer than two dozen novice traders. Jerry Parker was among them. He is now believed to be worth upwards of $700 million.

$1000 invested with fellow ‘turtle’ Tom Shanks’ Hawksbill Capital in 1988 would now be worth something north of $100,000.

Turtles Paul Rabar, Mike Carr, Howard Seidler and Jim DiMaria all set up fantastically successful trading firms after their experience with Dennis.

So what did Dennis teach them ?

There are only two ways consistently to make money from the financial markets. One of them is value investing. Buying high quality assets for less than they’re fundamentally worth is a credible and immensely successful strategy over the medium term.

The other is what we can call momentum.

Old hands in the City and on Wall Street tend to favour fundamental analysis of the markets. They waste their time discussing and debating the future course of the economy, of interest rates, and inflation. This is all very interesting – perhaps – but fundamentals tell you nothing about how to make money. All of that information is already in the price. And fundamentals are also somewhat subjective – take two economists, ask for their opinion, and you’ll get at least three answers.

Another way to look at financial markets is by using technical analysis. This is not as complicated as it might sound. It simply means looking at the price history of financial assets.

The reality, which is something that Dennis intuitively knew, and that he went on to teach his turtles, is that price is the only metric worth trusting. You can have a view about the future path of interest rates, for example. You may think they’re going lower. But that view might be 100% wrong.

Everything else is subjective.

So this is the system that Dennis taught. It’s a trading strategy that today goes by the title of ‘systematic trend-following’.

‘Systematic’ because there’s a clearly articulated system. This is a rules-based approach to trading. For example, one rule might be:

Another rule might be:

These are clearly simple examples. A decent ‘systematic, trend-following’ system will likely incorporate a wide variety of rules, incorporating guidance on when to get in, when to get out, and how to size positions.

The point being, once you have established that set of rules, you don’t deviate from them. At all. They can clearly be refined, over time. But they should never, under any account, be abandoned.

Unlike many trading approaches, systematic trend-following requires no special understanding of any given market. In fact, we have a friend with a small trend-following fund who assures us that he’s perfectly happy to trade markets ‘blind’ – he doesn’t even need to know exactly what he’s trading, he just needs to know the price history and he can make his trade entry and exit decisions based on that alone.

Trend-followers are not remotely interested in macro-economic analysis. If they use Wall Street research at all, it will be to prop up a wobbly chair leg.

What does interest trend-followers is catching a ride on big market trends. This is the key to the success of trend-following as an investment (trading) strategy. Markets have a tendency to make big moves that come as a complete surprise to most investors. But not to trend-followers: big “surprise” moves is precisely what they live for. It’s the source of their outsized profits. Check out, for example, the cocoa price in recent months for more on this theme.

Today’s trend-followers are following a path laid down by one of the most successful stock traders in history – Jesse Livermore (1877-1940). Livermore’s nicknames included ‘the Boy Plunger’ and ‘the Great Bear of Wall Street’. Livermore managed to make, and then lose, several fortunes. But he was not a creature of some long-lived bull market, like so many of today’s accidentally successful hedge fund managers. After the 1929 Crash, he ended up worth $100 million, when many of his trading rivals lost everything.

Happily for the wannabe trader today, Jesse Livermore’s approach is just as valid as it’s always been. As he said himself,

“There is nothing new in Wall Street. There can’t be, because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.”

The beauty of trend-following is that it requires just two things: greed and fear. And not on your part, but on the part of your fellow investors. As the market oscillates between these two emotional extremes, prices form trends. The direction and intensity of those trends reflect whichever emotion currently has the upper hand in the psychology of the average investor.

The principles of trend-following, then, are not complex. Most of them are concerned with determining how much risk to take on each trade. This remains the case whether you are buying shares or shorting them (selling them with the intention of buying them back later at a lower price). This is known in the trade as risk management.

A particularly appealing aspect of trend-following is that it’s typically a low risk strategy. The best trend-following funds are actually very low risk vehicles. When we use the word ‘risk’ here, we should probably be more explicit. We define risk not as short term price volatility but rather as “the possibility of a permanent loss of capital”. If a trend-following manager knows how to size his positions appropriately, and rigidly obeys his own system no matter what, he is highly unlikely to incur a blow-up. Managers blow up when they don’t know what they’re doing, when they don’t follow a system, or when their systems are obviously flawed.

Trend-following might be the perfect antidote to Wall Street machismo and excess. (One of Richard Dennis’ most successful ‘turtles’ was Liz Cheval, the founder of EMC Capital Management, who sadly died in March 2013.)

It certainly flies in the face of traditional theories about efficient markets. (The Efficient Market Hypothesis is a load of bull.)

But trend-following is not easy. It requires an iron psychological discipline in buying or selling when your system’s signals say so, irrespective of how you might feel about the market’s overall direction. The trick is to abandon ego altogether, and just follow the momentum of the market. As our trend-following friend concedes, having the discipline to follow the instructions of your system without question can be immensely difficult. Imagine buying a futures contract – in anything – nine times in a row, only to be stopped out by an adverse short term price movement. And then your system tells you, once again, to buy that instrument. As our friend says, sometimes it’s like coming in to work and having your arm broken, ten days in a row.

Jesse Livermore understood this. As he said himself,

“The game of speculation is the most uniformly fascinating game in the world. But it is not a game for the stupid, the mentally lazy, the man of inferior emotional balance, or for the get-rich-quick adventurer. They will die poor.”

So trend-following isn’t necessarily easy, but it can be extraordinarily profitable.

Some examples, via Michael Covel’s excellent Trend Following website:

“[The] Trend following strategy performs above average when market bubbles pop, when the Black Swan arrives. For example, trend following made huge money during the Stock Crash (1973–74), Black Monday (1987), Barings Bank (1995), LTCM & Asian Crisis (1998), Stock Crash (2000-02), 9/11 (2001), Great Recession (2008-09), Oil Market (2014-16), Brexit (2016), Covid-19 (March, 2020) and all of 2022-4.

“John W. Henry: Henry is a trend following trader featured in Trend Following. He is worth $2.1 billion (source). He used his trend following gains to buy the Boston Red Sox for $700 million.

“Bruce Kovner: Kovner is a trend following trader featured in Jack Schwager’s ‘Market Wizards.’ He was trained by trend follower Michael Marcus. Marcus was trained by Ed Seykota. More on Seykota can be found in Trend Following. Kovner is worth over $5.3 billion (source).

“Bill Dunn: Dunn is a trend following trader featured in Trend Following. Dunn made $80 million in 2008 when the rest of the world was blowing up.

“Michael Marcus: Marcus is a trend following trader featured in Jack Schwager’s Market Wizards. He turned an initial $30,000 into $80 million (source).

“David Harding: Harding is a trend following trader featured in Trend Following. He is worth over $1.387 billion (source).

“Ed Seykota: Seykota is a trend following trader featured in Trend Following. He turned $5,000 into $15 million over 12 years in his model account (an actual client account).

“Kenneth Tropin: Tropin is a trend follower who made $120 million in 2008 as buy and hold collapsed. Earlier in his career he led John W. Henry’s firm.

“Those trend followers all started as one-man shops and that is inspirational.”

This is why we use trend-following funds. Whatever their returns, they offer a high likelihood of giving us returns that are completely uncorrelated to the stock and bond markets of the world. And this is precisely what you want within a diversified portfolio. If you own stocks and bonds and gold, for example, you probably also want to own instruments that aren’t correlated in any way to those assets. Enter trend-following funds.

There’s also a serious point about volatility here. If you seek outsized returns, you will have to accept outsized volatility. But volatility in and of itself is nothing to be concerned about – provided the system works over time.

So we use trend-following funds for two key reasons:

You’ll probably agree that if somebody offered you the chance to make over 100% returns in a year like 2008, you’d bite their arm off.

There are no guarantees here, of course. As the regulator loves for us to point out, past performance is not necessarily any guarantee of future returns.

But the reality is that systematic trend-following has been a successful trading strategy for hundreds of years. Probably the first trend-following traders emerged in Japan’s rice futures markets centuries ago.

And trend-following funds typically operate through futures markets.

Why ?

Because futures markets are invariably the deepest and most liquid of financial markets.

If you have literally millions of dollars to deploy, you want to put those dollars to work in a market where you won’t move prices too far against you when you enter a trade. Futures markets offer that liquidity and market depth.

And trend-following managers typically like to trade as many different markets as possible, because the higher the number of markets they trade in, the higher the likelihood that they’ll be able to ride strongly trending prices.

So a typical trend-following fund, at any one point in time, might well be monitoring equity index futures, bond index futures, currency futures, and hard and soft commodity futures.

And because a trend-follower is just as happy to go short as to go long a market (i.e. they have complete flexibility to sell short as well as buy individual markets), they can really make hay when markets collapse – they simply ride that trend down. Most conventional asset managers can only sit on the sidelines watching their long-only portfolios bleed out capital.

So in the interests of pragmatism it makes sense, to us, to start looking at instruments that offer us the potential to make money even when markets fall. Hence trend-following funds.

Now, we are unashamed value investors. But when it comes to the fight to protect and grow people’s money, we like to deploy as many different weapons as possible. And having used trend-following funds for over 20 years, we are convinced that they have a role to play in any balanced portfolio.

We’ve left what we consider the most impressive piece of evidence on behalf of trend-followers until last.

Our trend-following manager friend ran his own data a few years ago.

He conducted a search for some of the best performing funds in history.

His requirements were simple, but very stringent. To qualify, a fund a) had to have been going for 20 years, and b) had to have generated annualised returns of at least 20%. To last 20 years in the fund management business is itself impressive, but to do so whilst generating on average 20% returns is ludicrously difficult.

The results of his search are shown below.

He came up with eleven funds. Generously, he included Berkshire Hathaway, which isn’t strictly a fund but a listed holding company.

Here’s the kicker. Of those eleven funds, six of them were trend-followers. You can see them in red in the table below.

Funds with a 20 year track record that have generated 20% annualised average returns

(Source: Lawrence Clarke Investment Management)

And notice, too, that at the top of the list is our very own Bill Eckhardt, who had that initial bet with Richard Dennis about the turtles. There is clearly more than meets the eye when it comes to trend-following funds. We rate this strategy so highly we call it, respectfully, the best kept secret in finance.

What’s astonishing is that in the face of so much compelling evidence, trend-followers don’t manage more money. Why ?

Because institutional investors, who really should know better, get spooked by the volatility profile of trend-followers. Which is insane. Institutional investors ought to be grown-up about the idea of experiencing volatile performance. Pursuing a long term objective, institutional managers should be completely indifferent to short term swings in the net asset value of funds. But they’re not. They get terrified by it. As a result, that leaves huge amounts of money on the table for those of us who have a grown-up attitude towards risk.

And this is why we absolutely believe that the individual investor has some terrific advantages over the professionals. Professional investors are like sheep. Most of them are benchmarked against some utterly inappropriate index, and can barely deviate from it. Being long-only managers, when the market falls, they’re obligated to go down lockstep with it. And being obsessed about retaining their clients, they’re invariably fazed by short term volatility. They would much rather achieve a smooth 6% than a volatile 12%. Not for us, thank you.

There are two ways in which you can get exposure to systematic trend-following. One of them is to do it yourself. As Dirty Harry once remarked, a man has to know his limitations. We know ours. We don’t possess the psychological make-up to trade actively and profitably. We are very comfortable investing for the longer term after deep analysis. We don’t like short term trading and therefore we don’t do it. But by the same token we are very comfortable allocating capital to good trend-following traders. If what you’ve read here interests you, visit Michael Covel’s turtle trader website, a fabulous free resource crammed with information about the turtles, about trend-following, and how you can ‘do it yourself’ if you feel so inclined.

The other way, of course, is to pay someone to do it for you, which is our preferred route to the strategy. One caveat, though: because trend-following is essentially a sub-set of the hedge fund universe, these funds come with the same baggage as hedge funds: often high minimum entry levels, sometimes high fees, leverage, and so on. These are most definitely not ‘widows and orphans’ investment vehicles.

There are two more investment resources that are worth their weight in gold, and they provide a ton of useful advice for the self-directed trader: Jack Schwager’s books ‘Market Wizards’ and ‘The New Market Wizards’ are among the best books ever written about the art of successful trading. Required reading for anyone looking either to trade for themselves, or for help in identifying decent third party asset managers.

There is an investment strategy that has been one of the most consistently profitable in the world – for centuries. It is also one of the most secretive. It is mostly used by a small number of traders who happen to know the strategy – but it doesn’t even require huge amounts of capital. And anyone can be taught the basics in minutes.

Intrigued ? We are.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price