“A failure is not always a mistake, it may simply be the best one can do under the circumstances. The real mistake is to stop trying.”

Get your Free

financial review

Although this correspondent has made plenty of mistakes in his investment career, the two biggest came at around the same time and were very closely related. Back in 2011/2012, we became convinced that – because of the severity of the global debt crisis and the inflationary response it would inevitably require from the world’s central banks – the gold price would effortlessly push higher even than the $1800 per oz. at which it was then trading, and lift the share prices of all gold miners in its wake. Both of those suspicions turned out to be incorrect (at least over the months and years immediately following).

We had committed two big errors. One was to allow ourselves to succumb to an overarching narrative. This is an ongoing risk for any investor. The second was to lose sight of underlying valuations. The reality, for any successful value investor, is that valuations always matter, and their importance shouldn’t be suspended, or over-ruled, simply because of a compelling-seeming story.

From the vantage point of late 2024, it seems incredible that we ever made this decade-long journey of extraordinary monetary stimulus without inflation taking off into the wide blue yonder. Of course, there has been massive inflation of asset prices along the way, just not so much of the (in any case heavily manipulated) CPI and RPI inflation that the media tends to report more soberly.

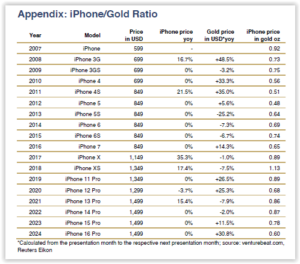

Whether we are experiencing inflation partly depends on how it is measured. In continually-being-devalued dollars, for example, we are experiencing plenty of it. The managers at Incrementum AG point out, for example, in their ‘In Gold We Trust’ special report of September 2024 (‘iPhone / Gold ratio’) that

“As a gold investor, you actually have to spend significantly less gold on the current iPhone than you did 17 years ago. The very first iPhone cost 0.92 ounces of gold in 2007. For this lesser amount of gold, however, you get much more iPhone. The current iPhone 16 Pro only has the name in common with the original iPhone. The performance of the iPhone 16 is completely different to that of the first iPhone generation. The performance improvements over the past 17 years have indeed been enormous.”

The price of iPhones in USD terms and in terms of gold ounces, courtesy of Incrementum, can be seen below:

Inflation is clearly in the eye of the beholder – and not all monies are created equal.

But as Russell Napier wrote in a recent ‘Solid Ground’ analysis,

“The good news is that we know what is coming next. The bad news is that we know what is coming next. The current war on deflation, a war lost if the shift in bond yields [lower] is to be believed, is bringing forth from the authorities not a new tactic but a whole new strategy – financial repression.. So, is the financial repression, now renamed modern monetary theory / makeup strategy / nominal GDP targeting, imminent ?”

In short, Russell expects an economic bust that may or may not be accompanied by a political one. As he observed,

“Many are to blame for the sudden outbreak in monetary theory madness, but the Fed must realise, at least in private, that their direct actions to boost asset prices have economically ‘orphaned’ many US citizens and created a political backlash.”

And what holds for the Fed also holds for the Bank of England and the European Central Bank, and the list hardly ends there.

So, how can we avoid some of the pitfalls that befell us a little over a decade ago, as we all peer into the future ?

Follow the turtles

On occasion we have referred to the so-called ‘turtle traders’. The origin of the turtles lies in an experiment conducted by two commodities speculators in the mid-1980s, Richard Dennis and Bill Eckhardt. Eckhardt believed that good traders were born, not made. Dennis believed they could be taught the principles of successful trading from scratch. To settle the bet, they advertised for trainee traders, no prior experience necessarily required, and having hired them after a series of Q&A tests, they gave each of them a pot of capital, mostly between $500,000 and $2,000,000, and set them off on their challenge. Dennis suspected that he could raise traders like turtles on a turtle farm. (A turtle farm, by all accounts, amounts to little more than a vat full of tiny baby turtles. Dennis had just been to one, having holidayed in Singapore.)

The upshot of the experiment is that the ‘turtles’ became some of the most storied traders in history. Over the next four years, according to Curtis Faith, one of the original turtles, they earned an average annual compound rate of return of 80%.

What were they taught ?

As a general introduction to the turtle story, we recommend Michael Covel’s website, ‘Turtle Trader’, and you can read more about those original rules here. The site itself is an excellent resource. We also recommend dipping into his extensive podcast archive.

The essence of the turtle trading approach, as with any other rules-based system, is that it is as much about managing risk as it is about harvesting returns. Manage your downside risk carefully, assuming the trading system is any good, and the upside returns will take care of themselves.

The turtle approach covered six individual aspects of trading, namely:

- Markets – what to buy or sell

- Position sizing – how much to buy or sell

- Entry points – when to buy or sell

- Stop losses – when to get out of a position (ahead of having to do so)

- Exits – when to get out of a winning position

- Tactics – how to buy or sell.

Just in the context of our own original error (overpaying for junior gold miners), a simple, rules-based approach would have prevented us from getting into the position in the first place (since the price technicals would already have been deteriorating). If we had overruled the first trading advice, subsequent rules would have forced us out. (In addition to applying some or all of these trading rules, a constant reminder not to fall prey to narrative fallacy would also have helped prevent us from ‘falling in love’ with gold exposure in this specific form.)

Position sizing would have ensured that we didn’t have too much skin in the game in any event. Entry points would have ensured that we bought carefully or not at all. Stop losses would have got us out once the positions started turning bad. As would exit points, in the event that the trades worked in our favour. And fundamental tactics would have most likely kept us out of putting on the position to begin with.

If you find any of this approach appealing (and if you’re open-minded, or interested in risk management in the context of either trading or investing, we think you absolutely should be), you can read a lot more about the original turtle trading rules here.

We should probably stress at this point that turtle trading, or systematic rules-based trading, is trading. It is inherently a speculative endeavour. That is not to say that it isn’t valid – only that it’s important that we differentiate between value investing, which is an inherently longer term process, and systematic trading. We like to incorporate both into our overall strategy, because we still maintain that true diversification remains the last thing approximating to a free lunch in finance. But adopting especially some of the risk-mitigation of turtle-like rules likely won’t do us or our capital any lasting harm. Quite the opposite – practical steps like adopting stop losses and maintaining appropriate position sizing should mean that we never encounter big problems from the outset.

There is, perversely perhaps, some good news here if Russell Napier turns out to be correct. Referring to his anticipated next wave of financial repression from our monetary authorities, he wrote the following warning as far back as 2019:

“Investors must be in no doubt that this is not more QE. It is a strategic shift in monetary policy aimed at benefiting debtors at the expense of creditors, and spenders at the expense of savers.. What investors need to grab fast now is gold, even as the markets price in ever clearer risks of deflation. In these past few weeks bond yields have shifted markedly lower and the gold price markedly higher. That’s a terrible combination that suggests that it is indeed all over now, at least for those who believe that markets are ultimately better at allocating resources than governments. If bond market moves do indeed augur another deflationary scare and a move to a new monetary strategy of financial repression, then gold is just beginning what could be a thirty-year bull market.” [Emphasis ours.]

In relation to gold, we repeat our longstanding advice: start with the physical asset itself (or the physical asset in ‘allocated’ form, by way of funds), then consider large cap miners including the royalty and streaming companies (since they don’t come with exploration and production risk), and then – if you think you have the stomach and risk appetite for it – consider the junior miners. But always consider their valuations first !

As for ourselves, we don’t claim to have a crystal ball quite as polished as Russell’s – he’s the financial historian, after all. We merely hope for the best while preparing for the worst in an almost infinitely complex – but increasingly challenging, and wildly monetarily unstable – world. And we think it makes sense to try and learn from some of the mistakes of the past in order to avoid repeating them in the future. If only central bankers and socialist chancellors could do the same.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

“A failure is not always a mistake, it may simply be the best one can do under the circumstances. The real mistake is to stop trying.”

Get your Free

financial review

Although this correspondent has made plenty of mistakes in his investment career, the two biggest came at around the same time and were very closely related. Back in 2011/2012, we became convinced that – because of the severity of the global debt crisis and the inflationary response it would inevitably require from the world’s central banks – the gold price would effortlessly push higher even than the $1800 per oz. at which it was then trading, and lift the share prices of all gold miners in its wake. Both of those suspicions turned out to be incorrect (at least over the months and years immediately following).

We had committed two big errors. One was to allow ourselves to succumb to an overarching narrative. This is an ongoing risk for any investor. The second was to lose sight of underlying valuations. The reality, for any successful value investor, is that valuations always matter, and their importance shouldn’t be suspended, or over-ruled, simply because of a compelling-seeming story.

From the vantage point of late 2024, it seems incredible that we ever made this decade-long journey of extraordinary monetary stimulus without inflation taking off into the wide blue yonder. Of course, there has been massive inflation of asset prices along the way, just not so much of the (in any case heavily manipulated) CPI and RPI inflation that the media tends to report more soberly.

Whether we are experiencing inflation partly depends on how it is measured. In continually-being-devalued dollars, for example, we are experiencing plenty of it. The managers at Incrementum AG point out, for example, in their ‘In Gold We Trust’ special report of September 2024 (‘iPhone / Gold ratio’) that

“As a gold investor, you actually have to spend significantly less gold on the current iPhone than you did 17 years ago. The very first iPhone cost 0.92 ounces of gold in 2007. For this lesser amount of gold, however, you get much more iPhone. The current iPhone 16 Pro only has the name in common with the original iPhone. The performance of the iPhone 16 is completely different to that of the first iPhone generation. The performance improvements over the past 17 years have indeed been enormous.”

The price of iPhones in USD terms and in terms of gold ounces, courtesy of Incrementum, can be seen below:

Inflation is clearly in the eye of the beholder – and not all monies are created equal.

But as Russell Napier wrote in a recent ‘Solid Ground’ analysis,

“The good news is that we know what is coming next. The bad news is that we know what is coming next. The current war on deflation, a war lost if the shift in bond yields [lower] is to be believed, is bringing forth from the authorities not a new tactic but a whole new strategy – financial repression.. So, is the financial repression, now renamed modern monetary theory / makeup strategy / nominal GDP targeting, imminent ?”

In short, Russell expects an economic bust that may or may not be accompanied by a political one. As he observed,

“Many are to blame for the sudden outbreak in monetary theory madness, but the Fed must realise, at least in private, that their direct actions to boost asset prices have economically ‘orphaned’ many US citizens and created a political backlash.”

And what holds for the Fed also holds for the Bank of England and the European Central Bank, and the list hardly ends there.

So, how can we avoid some of the pitfalls that befell us a little over a decade ago, as we all peer into the future ?

Follow the turtles

On occasion we have referred to the so-called ‘turtle traders’. The origin of the turtles lies in an experiment conducted by two commodities speculators in the mid-1980s, Richard Dennis and Bill Eckhardt. Eckhardt believed that good traders were born, not made. Dennis believed they could be taught the principles of successful trading from scratch. To settle the bet, they advertised for trainee traders, no prior experience necessarily required, and having hired them after a series of Q&A tests, they gave each of them a pot of capital, mostly between $500,000 and $2,000,000, and set them off on their challenge. Dennis suspected that he could raise traders like turtles on a turtle farm. (A turtle farm, by all accounts, amounts to little more than a vat full of tiny baby turtles. Dennis had just been to one, having holidayed in Singapore.)

The upshot of the experiment is that the ‘turtles’ became some of the most storied traders in history. Over the next four years, according to Curtis Faith, one of the original turtles, they earned an average annual compound rate of return of 80%.

What were they taught ?

As a general introduction to the turtle story, we recommend Michael Covel’s website, ‘Turtle Trader’, and you can read more about those original rules here. The site itself is an excellent resource. We also recommend dipping into his extensive podcast archive.

The essence of the turtle trading approach, as with any other rules-based system, is that it is as much about managing risk as it is about harvesting returns. Manage your downside risk carefully, assuming the trading system is any good, and the upside returns will take care of themselves.

The turtle approach covered six individual aspects of trading, namely:

Just in the context of our own original error (overpaying for junior gold miners), a simple, rules-based approach would have prevented us from getting into the position in the first place (since the price technicals would already have been deteriorating). If we had overruled the first trading advice, subsequent rules would have forced us out. (In addition to applying some or all of these trading rules, a constant reminder not to fall prey to narrative fallacy would also have helped prevent us from ‘falling in love’ with gold exposure in this specific form.)

Position sizing would have ensured that we didn’t have too much skin in the game in any event. Entry points would have ensured that we bought carefully or not at all. Stop losses would have got us out once the positions started turning bad. As would exit points, in the event that the trades worked in our favour. And fundamental tactics would have most likely kept us out of putting on the position to begin with.

If you find any of this approach appealing (and if you’re open-minded, or interested in risk management in the context of either trading or investing, we think you absolutely should be), you can read a lot more about the original turtle trading rules here.

We should probably stress at this point that turtle trading, or systematic rules-based trading, is trading. It is inherently a speculative endeavour. That is not to say that it isn’t valid – only that it’s important that we differentiate between value investing, which is an inherently longer term process, and systematic trading. We like to incorporate both into our overall strategy, because we still maintain that true diversification remains the last thing approximating to a free lunch in finance. But adopting especially some of the risk-mitigation of turtle-like rules likely won’t do us or our capital any lasting harm. Quite the opposite – practical steps like adopting stop losses and maintaining appropriate position sizing should mean that we never encounter big problems from the outset.

There is, perversely perhaps, some good news here if Russell Napier turns out to be correct. Referring to his anticipated next wave of financial repression from our monetary authorities, he wrote the following warning as far back as 2019:

“Investors must be in no doubt that this is not more QE. It is a strategic shift in monetary policy aimed at benefiting debtors at the expense of creditors, and spenders at the expense of savers.. What investors need to grab fast now is gold, even as the markets price in ever clearer risks of deflation. In these past few weeks bond yields have shifted markedly lower and the gold price markedly higher. That’s a terrible combination that suggests that it is indeed all over now, at least for those who believe that markets are ultimately better at allocating resources than governments. If bond market moves do indeed augur another deflationary scare and a move to a new monetary strategy of financial repression, then gold is just beginning what could be a thirty-year bull market.” [Emphasis ours.]

In relation to gold, we repeat our longstanding advice: start with the physical asset itself (or the physical asset in ‘allocated’ form, by way of funds), then consider large cap miners including the royalty and streaming companies (since they don’t come with exploration and production risk), and then – if you think you have the stomach and risk appetite for it – consider the junior miners. But always consider their valuations first !

As for ourselves, we don’t claim to have a crystal ball quite as polished as Russell’s – he’s the financial historian, after all. We merely hope for the best while preparing for the worst in an almost infinitely complex – but increasingly challenging, and wildly monetarily unstable – world. And we think it makes sense to try and learn from some of the mistakes of the past in order to avoid repeating them in the future. If only central bankers and socialist chancellors could do the same.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price