This correspondent was just six years old when ‘Rollerball’ was released at the cinema, which even allowing for the standards of a more liberal age would have made a viewing tricky. We had to settle for the ‘Harlem Heroes’ strip in 2000 AD comic (first edition published 1977), which even at the time seemed a blatant rip-off of the film, portraying an ultra-violent jet-pack-assisted sport called ‘Aeroball’. (The comic had form in this regard; Judge Dredd was not much more than a thinly-disguised Dirty Harry set in the future.) As dystopian foreshadowing of our current global predicament goes, ‘Rollerball’ will do as good as any. Readers will doubtless have seen some of its more obvious rivals: ‘V for Vendetta’; ‘Capricorn One’; ‘They Live’; perhaps ‘Quatermass II’. This correspondent recommends all of them.

Over 200 years ago, back in 1810, the Bullion Committee in Britain acknowledged that economic central planning of the type promoted by Rollerball’s “majors”, along with control of the money supply by way of interest rates, was essentially impossible:

“The most detailed knowledge of the actual trade of a country, combined with the profound Science in all the principles of Money and circulation, would not enable any man or set of men to adjust, and keep always adjusted, the right proportion of circulating medium in a country to the wants of trade.”

Sadly, it is the curious fate of every generation to forget the lessons learned by those that preceded it. As the most cursory glance at any edition of ‘The Financial Times’ or ‘The Economist’ will attest, the mainstream media are still in thrall to the unelected central banking technocrats whose easy money policies culminated in the Global Financial Crisis, and these same media are philosophically unable, or unwilling, to challenge the primacy of central planning and directed markets – or the perverse idea that easy money, having triggered a credit crisis, is at one and the same time the solution to it. Well, there’s no accounting for taste. Or intelligence.

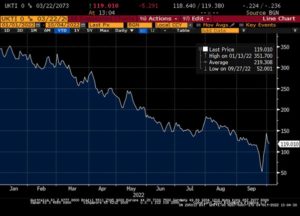

Here is what a central bank losing control of its bond market looks like. The chart below shows the price of the 50 year index-linked Gilt (UK government bond) during 2022.

Source: Bloomberg LLP.

Having headed south consistently throughout the year, this “risk-free” Gilt then contrived to lose more than half of its value in the week following Kwasi Kwarteng’s mini-budget of 23rd September. Egged on by distressed pension funds having used LDI strategies (LDI being apparently short for ‘Leave Derivatives alone, Idiots’), Gilt prices collapsed, forcing the Bank of England rather humiliatingly to reverse course on its planned Quantitative Tightening programme and embark, instead, on yet more QE to maintain orderly secondary markets in the UK’s debt. Zero interest rates, it turns out, act rather like black holes. Impossible to escape from. Regular readers will be aware that as discretionary managers we have no meaningful exposure to bonds, and none whatsoever to Gilts.

Is the UK bond market the canary in the coal mine for other similarly indebted sovereign bond markets and their hapless agent central banks ? We do, however, have meaningful exposure to gold, and silver, and to sensibly priced commodities companies more generally.

Why ? Largely because of their compelling valuations (notwithstanding their sometimes eye-watering price volatility), and partly out of a lingering suspicion that, per the Bank of England, when central banks and governments attempt to suppress their own countries’ bond yields, they risk losing control of their national currencies as well. Suffice to say, not even Jerome Powell can print gold.

Before he lost his mind and became a transhumanist shill for the World Economic Forum, Yuval Noah Harari wrote a very good book called ‘Sapiens’. ‘Sapiens’ sets out asking a straightforward question. 100,000 years ago, there were at least six types of human species inhabiting the earth: Homo soloensis, Homo rudolfensis, Homo ergaster, Homo erectus, Homo neanderthalensis, and Homo sapiens. Now, there is just one: Homo sapiens, or us. How did we come to beat all the others to evolutionary victory ?

Harari’s intriguing answer, or at least suggestion, is that it all comes down to belief. A village of a hundred people is small enough to look after itself; it has no need for external organisation or administration. But a city of a million ?

“Myths, it transpired, are stronger than anyone could have imagined. When the Agricultural Revolution opened opportunities for the creation of crowded cities and mighty empires, people invented stories about great gods, motherlands and joint stock companies to provide the needed social links. While human evolution was crawling at its usual snail’s pace, the human imagination was building astounding networks of mass cooperation, unlike any other ever seen on earth.”

To paraphrase Harari, Homo sapiens won because we are naturally drawn to stories. We like to tell them. We like to hear them. We like to believe them.

Two popular stories from our recent past turned out to be wrong. The first, narrated endlessly by the established powers that be, was that the UK would never vote to leave the EU. The second, narrated endlessly by the established powers that be, was that Americans would never vote for Donald Trump.

Both stories turned out to be wrong. They were, in other words, false narratives. Such is the danger of groupthink. As George S. Patton once remarked,

“If everyone is thinking alike, then somebody isn’t thinking.”

Here, then, is an alternative narrative.. Brexit was never supposed to happen as it involved a break from a loathsome but almost all-powerful European technocracy. The first Trump Presidency was never supposed to happen as it involved a break from a loathsome but almost all-powerful North American technocracy. When both of these black swans did happen in quick succession, it forced the Deep State’s otherwise soon-to-be-bankrupt hand. The result was a hastily confected ‘pandemic’, more honestly described as a PCR false positive pseudo-epidemic, paid for by US taxpayers’ largesse, funnelled illegally to China via Anthony Fauci, and conducted by a global health organisation run by a former Marxist terrorist and a billionaire software dilettante, neither of whom have any medical qualifications. The confected ‘pandemic’ required the accelerated roll-out not just of vaccines of dubious efficacy, but of associated technologies that would limit travel and normal social interaction, like the dreaded ‘Vax Passport’ – and the forced closure of the global economy in the form of ‘lockdowns’ that had never been used before in the entire history of epidemiological science. The confected ‘pandemic’ would be swiftly followed by other confected crises such as an acceleration in (reported) climate change and a military conflict in Ukraine that would be accompanied by some mysteriously one-sided media coverage – the coverage in question being universally supportive of a corrupt third world money laundry, one not even a member of NATO, whilst being uniformly hostile to Russia. The Ukraine conflict would trigger Europe to impose sanctions that would in turn equate to a manufactured and misreported energy crisis along with voluntary economic suicide. (The appropriate film for this part of the narrative: ‘Death Wish’.) The next plausible developments in this alternative narrative: further impoverishment of the working class, SMEs and all but a narrow financial elite; complete monetary disorder (a monetary ‘Great Reset’ perhaps ?); the introduction of Universal Basic Income, the price of which will be Central Bank Digital Currency, and the effective end of all economic and personal freedom. But would anyone believe this story ? They seemed to, at least in the fictive world of the 1970s: “Transport, food, communication, housing, luxury, energy. A few of us making decisions on a global basis for the common good..”

Spoiler alert. As Norman Jewison’s film rolls rapidly towards its climax, Jonathan (James Caan), the most successful player in the history of a sport he is now being hounded out of, travels to Geneva to investigate why the globalist elites have conspired to turn his professional career and his entire life upside down. It transpires that the very purpose of Rollerball is to demonstrate that the game is more powerful than any of its participants; his unassailable rise in the game is therefore a threat to the prevailing power structure. Jonathan pays a visit to the globalists’ supercomputer, appropriately named Zero, only to discover that its memory and logic circuits have become hopelessly corrupted. Jonathan returns to the Rollerball grand finale, which by now has become a murderous free-for-all wherein all rules and ethics are suspended. As a personification of the indomitable human spirit, Jonathan becomes literally the last man standing in the arena. As Jonathan performs his final victory lap to rousing applause, the figurehead of the globalist elites, Bartholomew, sensing that the crowd is no longer on his side, abandons the stadium, running for his life.

Perhaps they will show this film at Davos sometime.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

This correspondent was just six years old when ‘Rollerball’ was released at the cinema, which even allowing for the standards of a more liberal age would have made a viewing tricky. We had to settle for the ‘Harlem Heroes’ strip in 2000 AD comic (first edition published 1977), which even at the time seemed a blatant rip-off of the film, portraying an ultra-violent jet-pack-assisted sport called ‘Aeroball’. (The comic had form in this regard; Judge Dredd was not much more than a thinly-disguised Dirty Harry set in the future.) As dystopian foreshadowing of our current global predicament goes, ‘Rollerball’ will do as good as any. Readers will doubtless have seen some of its more obvious rivals: ‘V for Vendetta’; ‘Capricorn One’; ‘They Live’; perhaps ‘Quatermass II’. This correspondent recommends all of them.

Over 200 years ago, back in 1810, the Bullion Committee in Britain acknowledged that economic central planning of the type promoted by Rollerball’s “majors”, along with control of the money supply by way of interest rates, was essentially impossible:

“The most detailed knowledge of the actual trade of a country, combined with the profound Science in all the principles of Money and circulation, would not enable any man or set of men to adjust, and keep always adjusted, the right proportion of circulating medium in a country to the wants of trade.”

Sadly, it is the curious fate of every generation to forget the lessons learned by those that preceded it. As the most cursory glance at any edition of ‘The Financial Times’ or ‘The Economist’ will attest, the mainstream media are still in thrall to the unelected central banking technocrats whose easy money policies culminated in the Global Financial Crisis, and these same media are philosophically unable, or unwilling, to challenge the primacy of central planning and directed markets – or the perverse idea that easy money, having triggered a credit crisis, is at one and the same time the solution to it. Well, there’s no accounting for taste. Or intelligence.

Here is what a central bank losing control of its bond market looks like. The chart below shows the price of the 50 year index-linked Gilt (UK government bond) during 2022.

Source: Bloomberg LLP.

Having headed south consistently throughout the year, this “risk-free” Gilt then contrived to lose more than half of its value in the week following Kwasi Kwarteng’s mini-budget of 23rd September. Egged on by distressed pension funds having used LDI strategies (LDI being apparently short for ‘Leave Derivatives alone, Idiots’), Gilt prices collapsed, forcing the Bank of England rather humiliatingly to reverse course on its planned Quantitative Tightening programme and embark, instead, on yet more QE to maintain orderly secondary markets in the UK’s debt. Zero interest rates, it turns out, act rather like black holes. Impossible to escape from. Regular readers will be aware that as discretionary managers we have no meaningful exposure to bonds, and none whatsoever to Gilts.

Is the UK bond market the canary in the coal mine for other similarly indebted sovereign bond markets and their hapless agent central banks ? We do, however, have meaningful exposure to gold, and silver, and to sensibly priced commodities companies more generally.

Why ? Largely because of their compelling valuations (notwithstanding their sometimes eye-watering price volatility), and partly out of a lingering suspicion that, per the Bank of England, when central banks and governments attempt to suppress their own countries’ bond yields, they risk losing control of their national currencies as well. Suffice to say, not even Jerome Powell can print gold.

Before he lost his mind and became a transhumanist shill for the World Economic Forum, Yuval Noah Harari wrote a very good book called ‘Sapiens’. ‘Sapiens’ sets out asking a straightforward question. 100,000 years ago, there were at least six types of human species inhabiting the earth: Homo soloensis, Homo rudolfensis, Homo ergaster, Homo erectus, Homo neanderthalensis, and Homo sapiens. Now, there is just one: Homo sapiens, or us. How did we come to beat all the others to evolutionary victory ?

Harari’s intriguing answer, or at least suggestion, is that it all comes down to belief. A village of a hundred people is small enough to look after itself; it has no need for external organisation or administration. But a city of a million ?

“Myths, it transpired, are stronger than anyone could have imagined. When the Agricultural Revolution opened opportunities for the creation of crowded cities and mighty empires, people invented stories about great gods, motherlands and joint stock companies to provide the needed social links. While human evolution was crawling at its usual snail’s pace, the human imagination was building astounding networks of mass cooperation, unlike any other ever seen on earth.”

To paraphrase Harari, Homo sapiens won because we are naturally drawn to stories. We like to tell them. We like to hear them. We like to believe them.

Two popular stories from our recent past turned out to be wrong. The first, narrated endlessly by the established powers that be, was that the UK would never vote to leave the EU. The second, narrated endlessly by the established powers that be, was that Americans would never vote for Donald Trump.

Both stories turned out to be wrong. They were, in other words, false narratives. Such is the danger of groupthink. As George S. Patton once remarked,

“If everyone is thinking alike, then somebody isn’t thinking.”

Here, then, is an alternative narrative.. Brexit was never supposed to happen as it involved a break from a loathsome but almost all-powerful European technocracy. The first Trump Presidency was never supposed to happen as it involved a break from a loathsome but almost all-powerful North American technocracy. When both of these black swans did happen in quick succession, it forced the Deep State’s otherwise soon-to-be-bankrupt hand. The result was a hastily confected ‘pandemic’, more honestly described as a PCR false positive pseudo-epidemic, paid for by US taxpayers’ largesse, funnelled illegally to China via Anthony Fauci, and conducted by a global health organisation run by a former Marxist terrorist and a billionaire software dilettante, neither of whom have any medical qualifications. The confected ‘pandemic’ required the accelerated roll-out not just of vaccines of dubious efficacy, but of associated technologies that would limit travel and normal social interaction, like the dreaded ‘Vax Passport’ – and the forced closure of the global economy in the form of ‘lockdowns’ that had never been used before in the entire history of epidemiological science. The confected ‘pandemic’ would be swiftly followed by other confected crises such as an acceleration in (reported) climate change and a military conflict in Ukraine that would be accompanied by some mysteriously one-sided media coverage – the coverage in question being universally supportive of a corrupt third world money laundry, one not even a member of NATO, whilst being uniformly hostile to Russia. The Ukraine conflict would trigger Europe to impose sanctions that would in turn equate to a manufactured and misreported energy crisis along with voluntary economic suicide. (The appropriate film for this part of the narrative: ‘Death Wish’.) The next plausible developments in this alternative narrative: further impoverishment of the working class, SMEs and all but a narrow financial elite; complete monetary disorder (a monetary ‘Great Reset’ perhaps ?); the introduction of Universal Basic Income, the price of which will be Central Bank Digital Currency, and the effective end of all economic and personal freedom. But would anyone believe this story ? They seemed to, at least in the fictive world of the 1970s: “Transport, food, communication, housing, luxury, energy. A few of us making decisions on a global basis for the common good..”

Spoiler alert. As Norman Jewison’s film rolls rapidly towards its climax, Jonathan (James Caan), the most successful player in the history of a sport he is now being hounded out of, travels to Geneva to investigate why the globalist elites have conspired to turn his professional career and his entire life upside down. It transpires that the very purpose of Rollerball is to demonstrate that the game is more powerful than any of its participants; his unassailable rise in the game is therefore a threat to the prevailing power structure. Jonathan pays a visit to the globalists’ supercomputer, appropriately named Zero, only to discover that its memory and logic circuits have become hopelessly corrupted. Jonathan returns to the Rollerball grand finale, which by now has become a murderous free-for-all wherein all rules and ethics are suspended. As a personification of the indomitable human spirit, Jonathan becomes literally the last man standing in the arena. As Jonathan performs his final victory lap to rousing applause, the figurehead of the globalist elites, Bartholomew, sensing that the crowd is no longer on his side, abandons the stadium, running for his life.

Perhaps they will show this film at Davos sometime.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price