Conventional (that is to say, neo-Keynesian) economics is a bastard science. It is not, in fact, a science at all. When the Frenchman Léon Walras, who had serially failed at every job to which he had previously turned his hand, walked with his father one evening in 1858, he was advised by Walras Sr. to have a crack at “the creation of a scientific theory of economics”.

Walras Jr. had previously botched careers in academia, engineering, creative writing, journalism, and banking. That he had been rejected, twice, from France’s prestigious Ecole Polytechnique due to poor mathematical skills tells you everything you need to know about the birth of modern economics.

But Walras Jr. did not give up. Rather, he flunked again. Before Walras, economics had not even been a mathematical field. Eric Beinhocker in ‘The Origin of Wealth’ takes up the story:

“Walras and his compatriots were convinced that if the equations of differential calculus could capture the motions of planets and atoms in the universe, these same mathematical techniques could also capture the motion of human minds in the economy.”

In other words, Walras hijacked a bunch of principles from the realm of physics and then misapplied them to a grotesquely oversimplified model of his own economy. Modern economics, in other words, was born out of physics envy.

Walras was not alone. Beinhocker points out that he was “not the only economist during his era raiding physics textbooks in search of inspiration”; the British economist William Stanley Jevons is also cited for ‘borrowing’ from the theories of gravity, magnetism and electricity in an attempt to turn economics into a mathematical science.

It isn’t, and never can be.

“We have involved ourselves in a colossal muddle,”

wrote the British economist John Maynard Keynes in his essay ‘The Great Slump of 1930’;

“..having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time – perhaps for a long time.”

Keynes was right to warn about the baleful prospects for wealth. The Great Depression would run on for the best part of a decade.

But words matter, and their meanings matter. Keynes’ metaphor of economy-as-machine is not just inaccurate, it’s inappropriate. The economy is not some simple machine that can be driven back to equilibrium (an illusory state that doesn’t even exist in the real economy). The economy is as complex as human nature because the economy is human interaction on a global scale. The economy is us. And by extension, the financial markets are us, too.

Keynes would be proven right about the slump in wealth. But the ‘economy as a machine’ metaphor is invalid, just as Walrasian economics is invalid. The great insight of the so-called Austrian or Classical economic school, inspired by the likes of Ludwig von Mises and Friedrich Hayek, is that the economy is far too complex to be compared to a simple mechanism. The economy is subject to all of the hopes, fears, frailties and illogicalities of human beings. Good luck modelling that.

Not that it has stopped economists from trying.

A key prediction of traditional economics, for example, is that the economy as a whole must at some point reach equilibrium – a prediction made by both the general equilibrium theory of microeconomics as well as by standard macroeconomics. So how long does it take for the economy to reach that equilibrium ?

“In the 1970s, the Yale economist Herbert Scarf determined that the time to equilibrium scales exponentially with the number of products and services in the economy to the power of four. The intuition behind this relationship is straightforward: the more products and services, the longer it takes for all the prices and quantities to adjust.. if we optimistically assume that every decision in the economy is made at the speed of the world’s fastest supercomputer (currently IBM’s Blue Gene, at 70.72 trillion floating-point calculations per second), then using Scarf’s result, it would take a mere 4.5 quintillion years (4.5 x 1018) for the economy to reach general equilibrium after each exogenous shock. Given that shocks from factors such as technological change, political uncertainty, weather and changes in consumer tastes buffet the economy every second, and the universe is only about 12 billion years old (1.2 x 1010), this clearly presents a problem.”

The essential problem of traditional economics is that it assumes a largely closed system of, in Eric Beinhocker’s words, incredibly smart people in unbelievably simple worlds. The reality, as objective non-economist modern commentators tend to agree, is that the economy is closer to being a complex, adaptive, dynamic system – not unlike a living organic being, vulnerable to illnesses and other sudden exogenous outbreaks.

The yin to Keynes’ yang is the great Austrian economist Ludwig von Mises. As part of his magnum opus, ‘Human Action’, Mises wrote about the impossibility of economic calculation in the centrally planned economy:

“The paradox of “planning” is that it cannot plan, because of the absence of economic calculation. What is called a planned economy is no economy at all. It is just a system of groping about in the dark. There is no question of a rational choice of means for the best possible attainment of the ultimate ends sought. What is called conscious planning is precisely the elimination of conscious purposive action..

“The mathematical economists are almost exclusively intent upon the study of what they call economic equilibrium and the static state. Recourse to the imaginary construction of an evenly rotating economy is, as has been pointed out, an indispensable mental tool of economic reasoning. But it is a grave mistake to consider this auxiliary tool as anything else than an imaginary construction, and to overlook the fact that it has not only no counterpart in reality, but cannot even be thought through consistently to its ultimate logical consequences. The mathematical economist, blinded by the prepossession that economics must be constructed according to the pattern of Newtonian mechanics and is open to treatment by mathematical methods, misconstrues entirely the subject matter of his investigations. He no longer deals with human action but with a soulless mechanism mysteriously actuated by forces not open to further analysis. In the imaginary construction of the evenly rotating economy there is, of course, no room for the entrepreneurial function. Thus the mathematical economist eliminates the entrepreneur from his thought. He has no need for this mover and shaker whose never ceasing intervention prevents the imaginary system from reaching the state of perfect equilibrium and static conditions. He hates the entrepreneur as a disturbing element. The prices of the factors of production, as the mathematical economist sees it, are determined by the intersection of two curves, not by human action.”

Keynes was looking for a lever to move the economy. But the lever does not exist. The economy as machine does not exist. The metaphor he used is not grounded in objective reality.

Whether the current, seemingly controlled, demolition of global wealth and monetary stability is a function of accident, grotesque political incompetence, or something altogether more sinister, barely matters to those of us charged with shepherding our clients’ precious capital through this predicament as well as those that will follow. We must simply play the hand we’re dealt, with the cards available to us. To reiterate our investment strategy, we see merit in the following:

- Shares in cash-generative, unindebted businesses run by principled, shareholder-friendly entrepreneurs, where the shares of those businesses – for whatever reason – are available at a meaningful discount to any objective assessment of their fair value;

- Holdings in systematic trend-following funds that offer a combination of returns uncorrelated to traditional markets as well as the potential for outsized positive returns during lasting periods of acute market distress;

- Shares in cash-generative, unindebted businesses run by principled, shareholder-friendly entrepreneurs with the same ‘value’ characteristics previously cited, where those businesses derive their earnings from the provision of precious metals and other industrial commodities with tangible economic utility.

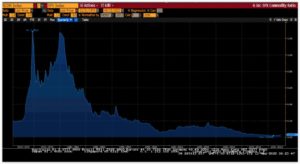

Speaking of real assets, here is a striking anomaly – and a terrific opportunity, in our view. The chart below shows the Bloomberg Commodities Index versus the S&P 500 Stock Index going back to 1970. You might think that given the inflationary world situation, investors would be scrambling to obtain inflation protection in the form of commodities. They are not. The reality is that commodities, and in turn commodities companies, have not been this cheap compared to the broader (US) stock market for over 50 years. This opportunity is reflected in our client portfolios.

Source: Bloomberg LLP.

To current geopolitics.. Sir Steven Wilkinson made a typically excellent submission to Substack last week:

“Our Humpty-Dumpty world got a whole lot more complicated when those two gas lines, Nordstream 1 and 2 were almost simultaneously placed hors de combat by what can only be an act of deliberate sabotage. The speculations have been gyrating faster than a whirling dervish after a mushroom trip in constructing a plausible whodunnit narrative, but I defer to the always prescient analytical Doomberg Team in their outstanding analysis this week in print and in several excellent podcast interviews, notably with Palisades Gold Radio and Grant Williams’ “Week in Doom”, who states that “somebody has done it and they know that they have done it and somebody else knows that they haven’t done it.” What we do know is that the aggrieved counterparty in this trade now has an invitation to retaliate, making a nasty situation a whole lot nastier as well as complicated for the climate communists, who are running out of places to hide as their “anti fascist” green policies (in name only) reveal them to be what we Right Wing Fascists have always known them to be, a billionaires’ grift program and predatory “war” requiring squillions of extra funds in the public coffers and an invisible terror to cow the children…

“In his conversation with Tom Brodrovics, Doomberg’s chief writer and spokesman provides a deeply incisive formula for thinking about the unavoidable trade-offs in the energy production challenge (around minute 40:00 in the conversation.) I reproduce it at length here, as I believe it to be the single most important thought I have yet heard articulated in the endlessly weary climate and energy production debate:

“In the green utopia as you describe it, there are no trade-offs. Literally, electricity is immaculately produced and batteries just magically appear and it’s a cake that bakes itself and the ingredients are free. But that is not reality.

“There is no perfect solution. Only trade-offs. The amount of primary energy we produce dictates the integrated standard of living of humanity. If we produce less primary energy, the standard of living goes down, in aggregate. And so the question is, does the integral standard of living of humanity matter to you? Is that a trade-off? Can we make do with less in your view? OK, well who gets to decide that and who has to make do with less? […}

“If we have decided collectively – and it might even be the best decision – that we want to organise our economy around the following equation:

The amount of standard of living divided by our carbon emissions

“Then that is a great optimization function. You can’t just look at carbon emissions without also looking at the numerator. So that ratio might be something you would want to optimize and there are intelligent ways to do that, that require very little technological invention and they include

- a massive renaissance of nuclear power

- a systemic replacement of coal with natural gas {…}

- and to continue to invest in the alternative energy sector so that if we get a major breakthrough we can quickly implement it…

“At their core these people [the environmentalists] do not want a highre numerator, they just want a lower denominator, which means a lot more dead people – let’s just call it what it is: anti-human malthusianism.”

~ Doomberg in conversation with Tom Brodrovics, Palisade Gold Radio (28th Sep. 22)

“It would appear that this largely self-inflicted energy crisis is a forcing function that has the potential to bring the entire elitist narrative crashing down around its ears as nation after nation replaces its Davos-centric climate communists and collectivist regimes with ‘Right Wing Fascists’ who promise to stop doing stuff that is inimical to life, prosperity and sanity. Pretty it is not going to be, but it might be effective.”

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Conventional (that is to say, neo-Keynesian) economics is a bastard science. It is not, in fact, a science at all. When the Frenchman Léon Walras, who had serially failed at every job to which he had previously turned his hand, walked with his father one evening in 1858, he was advised by Walras Sr. to have a crack at “the creation of a scientific theory of economics”.

Walras Jr. had previously botched careers in academia, engineering, creative writing, journalism, and banking. That he had been rejected, twice, from France’s prestigious Ecole Polytechnique due to poor mathematical skills tells you everything you need to know about the birth of modern economics.

But Walras Jr. did not give up. Rather, he flunked again. Before Walras, economics had not even been a mathematical field. Eric Beinhocker in ‘The Origin of Wealth’ takes up the story:

“Walras and his compatriots were convinced that if the equations of differential calculus could capture the motions of planets and atoms in the universe, these same mathematical techniques could also capture the motion of human minds in the economy.”

In other words, Walras hijacked a bunch of principles from the realm of physics and then misapplied them to a grotesquely oversimplified model of his own economy. Modern economics, in other words, was born out of physics envy.

Walras was not alone. Beinhocker points out that he was “not the only economist during his era raiding physics textbooks in search of inspiration”; the British economist William Stanley Jevons is also cited for ‘borrowing’ from the theories of gravity, magnetism and electricity in an attempt to turn economics into a mathematical science.

It isn’t, and never can be.

“We have involved ourselves in a colossal muddle,”

wrote the British economist John Maynard Keynes in his essay ‘The Great Slump of 1930’;

“..having blundered in the control of a delicate machine, the working of which we do not understand. The result is that our possibilities of wealth may run to waste for a time – perhaps for a long time.”

Keynes was right to warn about the baleful prospects for wealth. The Great Depression would run on for the best part of a decade.

But words matter, and their meanings matter. Keynes’ metaphor of economy-as-machine is not just inaccurate, it’s inappropriate. The economy is not some simple machine that can be driven back to equilibrium (an illusory state that doesn’t even exist in the real economy). The economy is as complex as human nature because the economy is human interaction on a global scale. The economy is us. And by extension, the financial markets are us, too.

Keynes would be proven right about the slump in wealth. But the ‘economy as a machine’ metaphor is invalid, just as Walrasian economics is invalid. The great insight of the so-called Austrian or Classical economic school, inspired by the likes of Ludwig von Mises and Friedrich Hayek, is that the economy is far too complex to be compared to a simple mechanism. The economy is subject to all of the hopes, fears, frailties and illogicalities of human beings. Good luck modelling that.

Not that it has stopped economists from trying.

A key prediction of traditional economics, for example, is that the economy as a whole must at some point reach equilibrium – a prediction made by both the general equilibrium theory of microeconomics as well as by standard macroeconomics. So how long does it take for the economy to reach that equilibrium ?

“In the 1970s, the Yale economist Herbert Scarf determined that the time to equilibrium scales exponentially with the number of products and services in the economy to the power of four. The intuition behind this relationship is straightforward: the more products and services, the longer it takes for all the prices and quantities to adjust.. if we optimistically assume that every decision in the economy is made at the speed of the world’s fastest supercomputer (currently IBM’s Blue Gene, at 70.72 trillion floating-point calculations per second), then using Scarf’s result, it would take a mere 4.5 quintillion years (4.5 x 1018) for the economy to reach general equilibrium after each exogenous shock. Given that shocks from factors such as technological change, political uncertainty, weather and changes in consumer tastes buffet the economy every second, and the universe is only about 12 billion years old (1.2 x 1010), this clearly presents a problem.”

The essential problem of traditional economics is that it assumes a largely closed system of, in Eric Beinhocker’s words, incredibly smart people in unbelievably simple worlds. The reality, as objective non-economist modern commentators tend to agree, is that the economy is closer to being a complex, adaptive, dynamic system – not unlike a living organic being, vulnerable to illnesses and other sudden exogenous outbreaks.

The yin to Keynes’ yang is the great Austrian economist Ludwig von Mises. As part of his magnum opus, ‘Human Action’, Mises wrote about the impossibility of economic calculation in the centrally planned economy:

“The paradox of “planning” is that it cannot plan, because of the absence of economic calculation. What is called a planned economy is no economy at all. It is just a system of groping about in the dark. There is no question of a rational choice of means for the best possible attainment of the ultimate ends sought. What is called conscious planning is precisely the elimination of conscious purposive action..

“The mathematical economists are almost exclusively intent upon the study of what they call economic equilibrium and the static state. Recourse to the imaginary construction of an evenly rotating economy is, as has been pointed out, an indispensable mental tool of economic reasoning. But it is a grave mistake to consider this auxiliary tool as anything else than an imaginary construction, and to overlook the fact that it has not only no counterpart in reality, but cannot even be thought through consistently to its ultimate logical consequences. The mathematical economist, blinded by the prepossession that economics must be constructed according to the pattern of Newtonian mechanics and is open to treatment by mathematical methods, misconstrues entirely the subject matter of his investigations. He no longer deals with human action but with a soulless mechanism mysteriously actuated by forces not open to further analysis. In the imaginary construction of the evenly rotating economy there is, of course, no room for the entrepreneurial function. Thus the mathematical economist eliminates the entrepreneur from his thought. He has no need for this mover and shaker whose never ceasing intervention prevents the imaginary system from reaching the state of perfect equilibrium and static conditions. He hates the entrepreneur as a disturbing element. The prices of the factors of production, as the mathematical economist sees it, are determined by the intersection of two curves, not by human action.”

Keynes was looking for a lever to move the economy. But the lever does not exist. The economy as machine does not exist. The metaphor he used is not grounded in objective reality.

Whether the current, seemingly controlled, demolition of global wealth and monetary stability is a function of accident, grotesque political incompetence, or something altogether more sinister, barely matters to those of us charged with shepherding our clients’ precious capital through this predicament as well as those that will follow. We must simply play the hand we’re dealt, with the cards available to us. To reiterate our investment strategy, we see merit in the following:

Speaking of real assets, here is a striking anomaly – and a terrific opportunity, in our view. The chart below shows the Bloomberg Commodities Index versus the S&P 500 Stock Index going back to 1970. You might think that given the inflationary world situation, investors would be scrambling to obtain inflation protection in the form of commodities. They are not. The reality is that commodities, and in turn commodities companies, have not been this cheap compared to the broader (US) stock market for over 50 years. This opportunity is reflected in our client portfolios.

Source: Bloomberg LLP.

To current geopolitics.. Sir Steven Wilkinson made a typically excellent submission to Substack last week:

“Our Humpty-Dumpty world got a whole lot more complicated when those two gas lines, Nordstream 1 and 2 were almost simultaneously placed hors de combat by what can only be an act of deliberate sabotage. The speculations have been gyrating faster than a whirling dervish after a mushroom trip in constructing a plausible whodunnit narrative, but I defer to the always prescient analytical Doomberg Team in their outstanding analysis this week in print and in several excellent podcast interviews, notably with Palisades Gold Radio and Grant Williams’ “Week in Doom”, who states that “somebody has done it and they know that they have done it and somebody else knows that they haven’t done it.” What we do know is that the aggrieved counterparty in this trade now has an invitation to retaliate, making a nasty situation a whole lot nastier as well as complicated for the climate communists, who are running out of places to hide as their “anti fascist” green policies (in name only) reveal them to be what we Right Wing Fascists have always known them to be, a billionaires’ grift program and predatory “war” requiring squillions of extra funds in the public coffers and an invisible terror to cow the children…

“In his conversation with Tom Brodrovics, Doomberg’s chief writer and spokesman provides a deeply incisive formula for thinking about the unavoidable trade-offs in the energy production challenge (around minute 40:00 in the conversation.) I reproduce it at length here, as I believe it to be the single most important thought I have yet heard articulated in the endlessly weary climate and energy production debate:

“In the green utopia as you describe it, there are no trade-offs. Literally, electricity is immaculately produced and batteries just magically appear and it’s a cake that bakes itself and the ingredients are free. But that is not reality.

“There is no perfect solution. Only trade-offs. The amount of primary energy we produce dictates the integrated standard of living of humanity. If we produce less primary energy, the standard of living goes down, in aggregate. And so the question is, does the integral standard of living of humanity matter to you? Is that a trade-off? Can we make do with less in your view? OK, well who gets to decide that and who has to make do with less? […}

“If we have decided collectively – and it might even be the best decision – that we want to organise our economy around the following equation:

The amount of standard of living divided by our carbon emissions

“Then that is a great optimization function. You can’t just look at carbon emissions without also looking at the numerator. So that ratio might be something you would want to optimize and there are intelligent ways to do that, that require very little technological invention and they include

“At their core these people [the environmentalists] do not want a highre numerator, they just want a lower denominator, which means a lot more dead people – let’s just call it what it is: anti-human malthusianism.”

~ Doomberg in conversation with Tom Brodrovics, Palisade Gold Radio (28th Sep. 22)

“It would appear that this largely self-inflicted energy crisis is a forcing function that has the potential to bring the entire elitist narrative crashing down around its ears as nation after nation replaces its Davos-centric climate communists and collectivist regimes with ‘Right Wing Fascists’ who promise to stop doing stuff that is inimical to life, prosperity and sanity. Pretty it is not going to be, but it might be effective.”

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price