“Peanut the Squirrel Coin, a cryptocurrency named after the eponymous pet that New York environmental authorities seized and euthanized on Oct. 30, commands a market cap of $1.7 billion..

“Tesla has rallied by 42% since Election Day despite the president-elect’s announced plans to end the $7,500 consumer tax credit for buying an EV. The United States accounts for 50% of the automaker’s sales..

“Nvidia Corp., America’s most valuable company, has a bigger weighting in the MSCI World Index than all the stocks in the U.K. or Canada or France.”

- ‘View from the crazy train’, Grant’s Interest Rate Observer, 22nd November 2024.

Get your Free

financial review

There is a time-honoured history of financial markets trading at crazy valuations for far longer than the more speculatively inclined punter can remain solvent. Take the following examples from February 2015. The Wall Street Journal reported that Carmine “Tom” Biscardi was on the hunt for Bigfoot, and was planning an IPO to fund the expedition:

“Mr. Biscardi and his partners hope to raise as much as $3 million by selling stock in Bigfoot Project Investments. They plan to spend the money making movies and selling DVDs, but are also budgeting $113,805 a year for expeditions to find the beast. Among the company’s goals, according to its filings with the Securities and Exchange Commission: “capture the creature known as Bigfoot.”

“Investment advisers caution that this IPO may not be for everyone. For starters, it involves DVDs, a dying technology, said Kathy Boyle, president at Chapin Hill Advisors. Then there is the Sasquatch issue. She reckons only true believers would be interested in such a speculative venture.”

Separately, Barry Ritholtz and Bloomberg drew attention to the fact that shares of The Grilled Cheese Truck Inc. had commenced trading on the OTCQX marketplace under the ticker GRLD:

“Let’s look at the fundamentals of the Ft. Lauderdale, Florida-based company. Based on the 18 million shares outstanding and a recent stock price of $6 the company has a market value of about $108 million. No matter how much you like grilled cheese… I can’t see this as a reasonable valuation.

“If you go to the company’s website, you will learn that ‘The company currently operates and licenses grilled cheese food trucks in the Los Angeles, CA area and Phoenix, AZ and is expanding into additional markets with the goal of becoming the largest operator in the gourmet grilled cheese space.’

“[A]ccording to the company’s financial statements, it has about $1 million of assets and almost $3 million in liabilities. In the third quarter of 2014, it had sales of almost $1 million, on which it had a net loss of more than $900,000.”

“I can’t think of a more interesting sign of the old irrational exuberance in equity markets than a publicly traded grilled cheese truck (four in this case) business trading at a $100-million-plus valuation. That sort of thing doesn’t happen unless there is significant excess in the markets.”

Note the similarities between the Bigfoot IPO and The Onion’s satirical market scoop from November 1999 (the date is instructive):

“Anabaena, a photosynthesizing, nitrogen-fixing algae with 1999 revenues estimated at $0 billion, will offer 200 million shares on the NASDAQ exchange next Wednesday under the stock symbol ALG. The shares are expected to open in the $47-$49 range.”

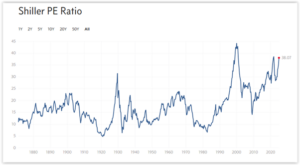

Readers of a more sceptical bent may take solace from two somewhat more reliable indicators. One is our old friend the Shiller p/e ratio or CAPE, which compares the market’s valuation to earnings over time – in this instance ten years. On this basis, the S&P 500 stock index has only been more expensive once, namely in early 2000, just before the dotcom bubble burst. Standing at 38 on a Shiller p/e basis, the US broad market has a historic average of just 17. To coin a phrase, look out below.

Source: https://www.multpl.com/shiller-pe

Another useful market indicator is Warren Buffett’s cash hoard at Berkshire Hathaway, which rose to a record $325 billion in the third quarter. There may be bargains in the US stock market, but Warren Buffett isn’t finding many.

An altogether more ominous indicator, touching on macro risk developments rather than just equity market valuations, was reported by Newsweek (‘How China could weaken the US dollar’) on 22nd November 2024:

“China’s recent $2 billion sale of U.S. dollar-denominated bonds, its first in three years, has drawn scrutiny for what one analyst said could be a warning to President-elect Donald Trump, who has threatened tariff hikes.

“The bonds were issued in two tranches: $1.25 billion maturing in 2027 with a 4.284 percent annual interest rate; and $750 million maturing in 2029 with a 4.34 percent rate. These rates were just 1 to 3 basis points (0.01 percent to 0.03 percent) higher than U.S. Treasurys, the safest and most trusted government debt. By contrast, even AAA-rated countries like Switzerland typically pay 10 to 20 basis points above U.S. Treasury rates. [China’s credit rating is A+ from Fitch and S&P.]

“Investor demand for the bonds was extraordinary, with the issuance oversubscribed nearly 20 times, drawing $40 billion in bids for just $2 billion in supply. This bid-to-cover ratio far exceeds the 2x to 3x ratios typical of U.S. Treasury auctions, according to Bureau of Public Debt data.”

Possible conclusions ? 1: China’s debt is mispriced. 2: US debt and the US dollar are mispriced. 3: Both Chinese and US debt are mispriced.

Our advice ? Enjoy the party, but dance near the door.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

“Peanut the Squirrel Coin, a cryptocurrency named after the eponymous pet that New York environmental authorities seized and euthanized on Oct. 30, commands a market cap of $1.7 billion..

“Tesla has rallied by 42% since Election Day despite the president-elect’s announced plans to end the $7,500 consumer tax credit for buying an EV. The United States accounts for 50% of the automaker’s sales..

“Nvidia Corp., America’s most valuable company, has a bigger weighting in the MSCI World Index than all the stocks in the U.K. or Canada or France.”

Get your Free

financial review

There is a time-honoured history of financial markets trading at crazy valuations for far longer than the more speculatively inclined punter can remain solvent. Take the following examples from February 2015. The Wall Street Journal reported that Carmine “Tom” Biscardi was on the hunt for Bigfoot, and was planning an IPO to fund the expedition:

“Mr. Biscardi and his partners hope to raise as much as $3 million by selling stock in Bigfoot Project Investments. They plan to spend the money making movies and selling DVDs, but are also budgeting $113,805 a year for expeditions to find the beast. Among the company’s goals, according to its filings with the Securities and Exchange Commission: “capture the creature known as Bigfoot.”

“Investment advisers caution that this IPO may not be for everyone. For starters, it involves DVDs, a dying technology, said Kathy Boyle, president at Chapin Hill Advisors. Then there is the Sasquatch issue. She reckons only true believers would be interested in such a speculative venture.”

Separately, Barry Ritholtz and Bloomberg drew attention to the fact that shares of The Grilled Cheese Truck Inc. had commenced trading on the OTCQX marketplace under the ticker GRLD:

“Let’s look at the fundamentals of the Ft. Lauderdale, Florida-based company. Based on the 18 million shares outstanding and a recent stock price of $6 the company has a market value of about $108 million. No matter how much you like grilled cheese… I can’t see this as a reasonable valuation.

“If you go to the company’s website, you will learn that ‘The company currently operates and licenses grilled cheese food trucks in the Los Angeles, CA area and Phoenix, AZ and is expanding into additional markets with the goal of becoming the largest operator in the gourmet grilled cheese space.’

“[A]ccording to the company’s financial statements, it has about $1 million of assets and almost $3 million in liabilities. In the third quarter of 2014, it had sales of almost $1 million, on which it had a net loss of more than $900,000.”

“I can’t think of a more interesting sign of the old irrational exuberance in equity markets than a publicly traded grilled cheese truck (four in this case) business trading at a $100-million-plus valuation. That sort of thing doesn’t happen unless there is significant excess in the markets.”

Note the similarities between the Bigfoot IPO and The Onion’s satirical market scoop from November 1999 (the date is instructive):

“Anabaena, a photosynthesizing, nitrogen-fixing algae with 1999 revenues estimated at $0 billion, will offer 200 million shares on the NASDAQ exchange next Wednesday under the stock symbol ALG. The shares are expected to open in the $47-$49 range.”

Readers of a more sceptical bent may take solace from two somewhat more reliable indicators. One is our old friend the Shiller p/e ratio or CAPE, which compares the market’s valuation to earnings over time – in this instance ten years. On this basis, the S&P 500 stock index has only been more expensive once, namely in early 2000, just before the dotcom bubble burst. Standing at 38 on a Shiller p/e basis, the US broad market has a historic average of just 17. To coin a phrase, look out below.

Source: https://www.multpl.com/shiller-pe

Another useful market indicator is Warren Buffett’s cash hoard at Berkshire Hathaway, which rose to a record $325 billion in the third quarter. There may be bargains in the US stock market, but Warren Buffett isn’t finding many.

An altogether more ominous indicator, touching on macro risk developments rather than just equity market valuations, was reported by Newsweek (‘How China could weaken the US dollar’) on 22nd November 2024:

“China’s recent $2 billion sale of U.S. dollar-denominated bonds, its first in three years, has drawn scrutiny for what one analyst said could be a warning to President-elect Donald Trump, who has threatened tariff hikes.

“The bonds were issued in two tranches: $1.25 billion maturing in 2027 with a 4.284 percent annual interest rate; and $750 million maturing in 2029 with a 4.34 percent rate. These rates were just 1 to 3 basis points (0.01 percent to 0.03 percent) higher than U.S. Treasurys, the safest and most trusted government debt. By contrast, even AAA-rated countries like Switzerland typically pay 10 to 20 basis points above U.S. Treasury rates. [China’s credit rating is A+ from Fitch and S&P.]

“Investor demand for the bonds was extraordinary, with the issuance oversubscribed nearly 20 times, drawing $40 billion in bids for just $2 billion in supply. This bid-to-cover ratio far exceeds the 2x to 3x ratios typical of U.S. Treasury auctions, according to Bureau of Public Debt data.”

Possible conclusions ? 1: China’s debt is mispriced. 2: US debt and the US dollar are mispriced. 3: Both Chinese and US debt are mispriced.

Our advice ? Enjoy the party, but dance near the door.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and also in systematic trend-following funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price