“If a cat sits on a hot stove, that cat won’t sit on a hot stove again. That cat won’t sit on a cold stove either. That cat just doesn’t like stoves.”

—

Get your Free

financial review

—

When Benjamin Graham’s ‘The Intelligent Investor’ was first published in 1949, you could barely give US stocks away. The US economy had first been battered by the Great Depression, and then put on a war footing following the belated entry of the US into World War 2.

Stocks were generally treated with something close to revulsion. US investors were, by and large, far happier investing in US Treasury bonds instead. As a result, the US stock market was cheap. And it therefore represented a huge opportunity for those brave enough to take the plunge. Most US investors, however, were content to avoid all stoves.

As the investment commentator Morgan Housel points out, it has long been recognised that one of the most important drivers of investors’ returns is simply when they were born or, if you prefer, when they started out on their investment journey:

“In 2006 economists Ulrike Malmendier and Stefan Nagel from the National Bureau of Economic Research dug through 50 years of the Survey of Consumer Finances – a detailed look at what Americans do with their money.

“In theory people should make investment decisions based on their goals and the characteristics of the investment options available to them at the time (things like valuation and expected return). But that’s not what people do. The research showed that people’s lifetime investment decisions are heavily anchored to the experiences those investors had with different investments in their own generation – especially experiences early in their adult life.

“They wrote:

“Our results explain, for example, the relatively low rates of stock market participation among young households in the early 1980s (following the disappointing stock market returns in the 1970s depression) and the relatively high participation rates of young investors in the late 1990s (following the boom years in the 1990s).”

“This holds true across asset classes. Ten-year Treasury bonds lost almost half their value from 1973 to 1981, adjusted for inflation. Those who lived through these blows invested considerably less of their assets in fixed-income products than those who avoided them due to the luck of their birth year.

“Back to my generation, the Millennials, who have never experienced inflation [sic]: When we invest on our own, we put 59% of our assets in cash and bonds, and 28% in stocks, according to UBS Wealth Management. And of course we do: Many of us started making money in the teeth of the Great Recession and the largest bear market in generations, which also happened to be the period when bonds not only preserved but grew wealth as interest rates fell to 0%. That’s our history. That’s what we know. And what we know is more persuasive than what we read.”

Think about the final words in that extract: what we know is more persuasive than what we read.

What we particularly like about Housel is that, while he highlights the psychological flaws we all have as investors, he’s not judgmental about it. It’s simply a matter of fact. We can either try and deal with this failing, or choose to ignore it. Either way, we are obliged to live with it.

Not for the first time, this correspondent would highlight two experiences from his own career as seminal.

The first was the European Exchange Rate Mechanism (ERM) crisis of 1992. Barely a year into our first job in the City (as a bond salesman) we watched, largely on the sidelines, as Europe’s shambolic currency union began to disintegrate. Not knowing any better, we took our politicians at face value when they said they would do whatever it takes to keep the pound sterling in the ERM. An important lesson: never believe anything from politicians until it’s been officially denied.

We still remember an account of Black Wednesday from a publication that might even have been called ‘Central Banker’. In a desperate attempt to keep the pound hitched to an unsustainable exchange rate against the Deutschmark, the British chancellor, Norman Lamont, in conjunction with the Bank of England, managed to burn through something like £3 billion – which was a lot of money at the time. It was as if the chancellor had spent that afternoon casually lobbing schools and hospitals into the North Sea.

The second was the global financial crisis, and in particular the events following the disorderly collapse of Lehman Brothers in September 2008. At our then employer we had just obtained our authorisation from the regulator to conduct discretionary management, and this correspondent was solely responsible for managing these private client portfolios.

The failure of Lehman Brothers itself was not in itself the problem, but rather the sense of chaos that quickly engulfed all markets in its aftermath. The scariest thing we can remember from that time – apart from the generalised blind panic and confusion – was a 20% one-day decline in the share price of State Street Corporation, one of the largest financial custodians in the world. Not an investment bank or a High Street bank as such – just a custodian. These businesses were supposed to be solid, dull – and safe. In the light of this kind of volatility, it seemed as if all bets were suddenly off.

As we now know, the March 2009 post-Lehman market low was, with hindsight, a superb buying opportunity. But that is to ignore what the lived experience was like, at the time. At the time in question, it literally felt like the financial world was coming to an end.

Housel’s is a great piece. But there are, and there should be, no easy conclusions to draw from it. Some people’s early experiences of the financial markets will have given them sufficient fear of the “hot stove” that their portfolios languish in supposedly low-risk assets forever. As Berkshire Hathaway’s Charlie Munger bluntly called it a while back,

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

There speaks someone with the (un)natural temperament to ride out some storms !

Other people’s early experiences of the financial markets will have given them such incredible returns that they become practically immunised against the idea that markets can ever be risky in the first place. Housel cites managers in the early stage venture capital (VC) market that, purely by the luck of age, managed to avoid the worst of the first dotcom crash:

“We have a new generation of people in the Valley who say, ‘Let’s just go build things. Let’s not be held back by superstition.’

“This new generation might help explain why Silicon Valley risk-taking grew over the last five years. The number of VC funds, the number of VC-backed deals, the valuations those deals fetch, and the number of college grads to get into start-ups has surged. The typical Silicon Valley founder in your head might look like a 21-year tinkering in their dorm room, and some are. But the median age of a start-up founder is actually 40. Yet even a 40-year-old was likely in college during the dot-com rise and fall. They avoided the carnage. So they think about risk and reward in totally different ways than a 40-year-old founder did five or 10 years ago.”

There are clearly no hard and fast rules about market experience. But because we don’t believe in market timing (or at least we know that we can’t practise it successfully), we prefer to remove it from the equation entirely. We suggest you do, too. What we can all do, however, is diversify our assets sensibly.

Of the world’s major asset classes, property is pre-eminent, at over $200 trillion by value. Then comes “money”, which is effectively debt. Then the value of listed stocks. Then physical cash, then gold.

Within our client portfolios, we split the investible world into four “buckets”:

- Cash and bonds

- Unconstrained “value” equities and equity funds

- Uncorrelated (systematic trend-following) funds

- Real assets, notably the monetary metals, gold and silver, and related mining interests.

There are clearly other types of investment vehicle you could use. Morgan Housel, for example, specialises in venture capital investing. But we have no meaningful experience in the VC world, no meaningful contacts within it, and no special insight into valuations or opportunities within the sector.

That’s no great hardship for us, because there are plenty of other asset classes to invest into. The four above are perfectly sufficient for our purposes. You should invest into all those areas in which you feel comfortable or that fall within your “zone of competence”.

And then it comes down to objective valuations and prospects.

We still see little or no value whatsoever in the bond market – only a bellyful of risk. So the “cash and bonds” component of our portfolios tends to be a) modest anyway and b) limited just to cash, or “liquidity” if you prefer.

Unconstrained “value” stocks comprise a decent share of client portfolios. Precisely how much you should allocate to equity investments within your own portfolio is a decision that only you can make. As a rule of thumb, however, we typically allocate roughly 40% of client portfolios to value stocks, not least as a reflection of the comparative lack of value in other areas, notably bonds. For some investors that may be too low (especially if you have a long-time horizon ahead of you); for others, it may be too high.

There is no exact ‘right’ or ‘wrong’ figure. But if, like us, you’re concerned about high valuations across many markets, including (growth) stocks, you can mitigate some of that risk by limiting your exposure to the stock market, and you can mitigate some more by only focusing on genuine defensible value.

Favour the shares of businesses run by principled, shareholder-friendly management adept at the art of capital allocation – or favour funds that invest in these kinds of businesses. Don’t consciously overpay. If in doubt, wait for opportunities. The world’s a big place.

Systematic trend-following funds, being essentially a type of hedge fund, can often be difficult for retail investors to access, but are attractive for two specific reasons.

One is that their long-term returns have been impressive.

The other is that whatever their future returns, it’s highly likely that those returns will have precisely zero correlation to the stock and bond markets of the world. And this is exactly the sort of attribute you want – a complete lack of correlation to traditional markets – within a properly diversified portfolio.

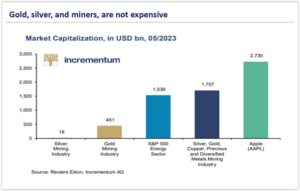

‘Real assets’ for us include the monetary metals, gold and silver, and related mining concerns, especially if they can be bought at attractive valuations – and today, they can be. The chart below shows that for comfortably less than the value of Apple alone, you can today buy every component in the silver, gold, copper, precious metals and diversified metals mining sector.

But why own gold ?

Because the world, straightforwardly, is carrying too much debt. If you accept our longstanding thesis that the accumulated government debt burden of “the West” is now effectively unpayable, you must, in turn, accept the thesis that there are three and only three ways in which that debt burden can be resolved.

Option 1 is for Western governments to “engineer” sufficient economic growth to service that debt. We doubt if this is possible anywhere.

Option 2 is for Western governments to default; to repudiate their debt. Since we also operate within a debt-based monetary system, in which money is lent into being by banks, a sovereign default by any major government would equate to something akin to Armageddon. Let’s park that option for a second.

By a process of elimination, logic, and thousands of years of history, we get to Option 3. Option 3 is an explicit policy of state-sanctioned inflationism. Governments will choose to inflate the debt away. In the words of the great Austrian economist Ludwig von Mises:

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

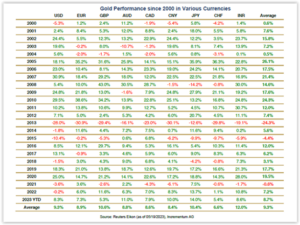

Why own gold? Because it makes sense, within a properly diversified portfolio, to have portfolio insurance. If you own a home, it makes sense to have fire insurance. Your investments are no different. And gold is now back, more relevant than ever. Incrementum show the recent returns:

Gold performance in various currencies, 2000 – 2023

If psychology is largely the investor’s problem, sensible diversification – accompanied by some objective valuation analysis – is surely at least part of the solution.

Benjamin Graham’s ‘The Intelligent Investor’ is evidently not to everyone’s taste. A recent one-star review on Amazon runs as follows:

“This might be a great book for those who are already very knowledgeable but for the rest of us, the obstacles are pretty much insuperable. I’ve been investing for a long time and have degrees in maths and computer science but still couldn’t get anything from it and returned my copy for a refund. The main text was written almost 70 years ago when the investing world was very different, and the more recent foreword still predates the 2008 crash since when everything has been very different again. So to benefit from it, you have to (a) know enough about the investment arena as it was in 1949 to understand the main text, (b) get enough from the foreword to see how to map that information across to the boom years earlier this century, and (c) figure out on your own what if any of it still applies in these days of negative interest rates, QE and other forms of funny money. Something more recent and more accessible to the non-professional investor would be a better bet for most of us I think.”

Whether or not you attach a great deal of significance to this review will be largely a function of whether you think human nature really changes. If you do, then the reviewer’s scepticism is justified. If you don’t, it clearly isn’t.

The language of ‘The Intelligent Investor’ is evidently a struggle for some. As the reviewer fairly points out, the book was written the best part of a century ago, so stylistically it will be an uphill struggle for some. But our take is that while the market environment can obviously change, human nature doesn’t, or at least not on any time scale visible to those who are investing in the here and now.

And if you find Benjamin Graham’s classic on value investing a little hard going, especially in these days of acutely funny money, someone close to home has written a modern treatise on the difficulties of investing at a time when central banks have collectively gone mad. It’s called ‘Investing Through the Looking Glass’ – and we much enjoyed writing it.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you, too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

“If a cat sits on a hot stove, that cat won’t sit on a hot stove again. That cat won’t sit on a cold stove either. That cat just doesn’t like stoves.”

—

Get your Free

financial review

—

When Benjamin Graham’s ‘The Intelligent Investor’ was first published in 1949, you could barely give US stocks away. The US economy had first been battered by the Great Depression, and then put on a war footing following the belated entry of the US into World War 2.

Stocks were generally treated with something close to revulsion. US investors were, by and large, far happier investing in US Treasury bonds instead. As a result, the US stock market was cheap. And it therefore represented a huge opportunity for those brave enough to take the plunge. Most US investors, however, were content to avoid all stoves.

As the investment commentator Morgan Housel points out, it has long been recognised that one of the most important drivers of investors’ returns is simply when they were born or, if you prefer, when they started out on their investment journey:

“In 2006 economists Ulrike Malmendier and Stefan Nagel from the National Bureau of Economic Research dug through 50 years of the Survey of Consumer Finances – a detailed look at what Americans do with their money.

“In theory people should make investment decisions based on their goals and the characteristics of the investment options available to them at the time (things like valuation and expected return). But that’s not what people do. The research showed that people’s lifetime investment decisions are heavily anchored to the experiences those investors had with different investments in their own generation – especially experiences early in their adult life.

“They wrote:

“Our results explain, for example, the relatively low rates of stock market participation among young households in the early 1980s (following the disappointing stock market returns in the 1970s depression) and the relatively high participation rates of young investors in the late 1990s (following the boom years in the 1990s).”

“This holds true across asset classes. Ten-year Treasury bonds lost almost half their value from 1973 to 1981, adjusted for inflation. Those who lived through these blows invested considerably less of their assets in fixed-income products than those who avoided them due to the luck of their birth year.

“Back to my generation, the Millennials, who have never experienced inflation [sic]: When we invest on our own, we put 59% of our assets in cash and bonds, and 28% in stocks, according to UBS Wealth Management. And of course we do: Many of us started making money in the teeth of the Great Recession and the largest bear market in generations, which also happened to be the period when bonds not only preserved but grew wealth as interest rates fell to 0%. That’s our history. That’s what we know. And what we know is more persuasive than what we read.”

Think about the final words in that extract: what we know is more persuasive than what we read.

What we particularly like about Housel is that, while he highlights the psychological flaws we all have as investors, he’s not judgmental about it. It’s simply a matter of fact. We can either try and deal with this failing, or choose to ignore it. Either way, we are obliged to live with it.

Not for the first time, this correspondent would highlight two experiences from his own career as seminal.

The first was the European Exchange Rate Mechanism (ERM) crisis of 1992. Barely a year into our first job in the City (as a bond salesman) we watched, largely on the sidelines, as Europe’s shambolic currency union began to disintegrate. Not knowing any better, we took our politicians at face value when they said they would do whatever it takes to keep the pound sterling in the ERM. An important lesson: never believe anything from politicians until it’s been officially denied.

We still remember an account of Black Wednesday from a publication that might even have been called ‘Central Banker’. In a desperate attempt to keep the pound hitched to an unsustainable exchange rate against the Deutschmark, the British chancellor, Norman Lamont, in conjunction with the Bank of England, managed to burn through something like £3 billion – which was a lot of money at the time. It was as if the chancellor had spent that afternoon casually lobbing schools and hospitals into the North Sea.

The second was the global financial crisis, and in particular the events following the disorderly collapse of Lehman Brothers in September 2008. At our then employer we had just obtained our authorisation from the regulator to conduct discretionary management, and this correspondent was solely responsible for managing these private client portfolios.

The failure of Lehman Brothers itself was not in itself the problem, but rather the sense of chaos that quickly engulfed all markets in its aftermath. The scariest thing we can remember from that time – apart from the generalised blind panic and confusion – was a 20% one-day decline in the share price of State Street Corporation, one of the largest financial custodians in the world. Not an investment bank or a High Street bank as such – just a custodian. These businesses were supposed to be solid, dull – and safe. In the light of this kind of volatility, it seemed as if all bets were suddenly off.

As we now know, the March 2009 post-Lehman market low was, with hindsight, a superb buying opportunity. But that is to ignore what the lived experience was like, at the time. At the time in question, it literally felt like the financial world was coming to an end.

Housel’s is a great piece. But there are, and there should be, no easy conclusions to draw from it. Some people’s early experiences of the financial markets will have given them sufficient fear of the “hot stove” that their portfolios languish in supposedly low-risk assets forever. As Berkshire Hathaway’s Charlie Munger bluntly called it a while back,

“If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century you’re not fit to be a common shareholder, and you deserve the mediocre result you’re going to get compared to the people who do have the temperament, who can be more philosophical about these market fluctuations.”

There speaks someone with the (un)natural temperament to ride out some storms !

Other people’s early experiences of the financial markets will have given them such incredible returns that they become practically immunised against the idea that markets can ever be risky in the first place. Housel cites managers in the early stage venture capital (VC) market that, purely by the luck of age, managed to avoid the worst of the first dotcom crash:

“We have a new generation of people in the Valley who say, ‘Let’s just go build things. Let’s not be held back by superstition.’

“This new generation might help explain why Silicon Valley risk-taking grew over the last five years. The number of VC funds, the number of VC-backed deals, the valuations those deals fetch, and the number of college grads to get into start-ups has surged. The typical Silicon Valley founder in your head might look like a 21-year tinkering in their dorm room, and some are. But the median age of a start-up founder is actually 40. Yet even a 40-year-old was likely in college during the dot-com rise and fall. They avoided the carnage. So they think about risk and reward in totally different ways than a 40-year-old founder did five or 10 years ago.”

There are clearly no hard and fast rules about market experience. But because we don’t believe in market timing (or at least we know that we can’t practise it successfully), we prefer to remove it from the equation entirely. We suggest you do, too. What we can all do, however, is diversify our assets sensibly.

Of the world’s major asset classes, property is pre-eminent, at over $200 trillion by value. Then comes “money”, which is effectively debt. Then the value of listed stocks. Then physical cash, then gold.

Within our client portfolios, we split the investible world into four “buckets”:

There are clearly other types of investment vehicle you could use. Morgan Housel, for example, specialises in venture capital investing. But we have no meaningful experience in the VC world, no meaningful contacts within it, and no special insight into valuations or opportunities within the sector.

That’s no great hardship for us, because there are plenty of other asset classes to invest into. The four above are perfectly sufficient for our purposes. You should invest into all those areas in which you feel comfortable or that fall within your “zone of competence”.

And then it comes down to objective valuations and prospects.

We still see little or no value whatsoever in the bond market – only a bellyful of risk. So the “cash and bonds” component of our portfolios tends to be a) modest anyway and b) limited just to cash, or “liquidity” if you prefer.

Unconstrained “value” stocks comprise a decent share of client portfolios. Precisely how much you should allocate to equity investments within your own portfolio is a decision that only you can make. As a rule of thumb, however, we typically allocate roughly 40% of client portfolios to value stocks, not least as a reflection of the comparative lack of value in other areas, notably bonds. For some investors that may be too low (especially if you have a long-time horizon ahead of you); for others, it may be too high.

There is no exact ‘right’ or ‘wrong’ figure. But if, like us, you’re concerned about high valuations across many markets, including (growth) stocks, you can mitigate some of that risk by limiting your exposure to the stock market, and you can mitigate some more by only focusing on genuine defensible value.

Favour the shares of businesses run by principled, shareholder-friendly management adept at the art of capital allocation – or favour funds that invest in these kinds of businesses. Don’t consciously overpay. If in doubt, wait for opportunities. The world’s a big place.

Systematic trend-following funds, being essentially a type of hedge fund, can often be difficult for retail investors to access, but are attractive for two specific reasons.

One is that their long-term returns have been impressive.

The other is that whatever their future returns, it’s highly likely that those returns will have precisely zero correlation to the stock and bond markets of the world. And this is exactly the sort of attribute you want – a complete lack of correlation to traditional markets – within a properly diversified portfolio.

‘Real assets’ for us include the monetary metals, gold and silver, and related mining concerns, especially if they can be bought at attractive valuations – and today, they can be. The chart below shows that for comfortably less than the value of Apple alone, you can today buy every component in the silver, gold, copper, precious metals and diversified metals mining sector.

But why own gold ?

Because the world, straightforwardly, is carrying too much debt. If you accept our longstanding thesis that the accumulated government debt burden of “the West” is now effectively unpayable, you must, in turn, accept the thesis that there are three and only three ways in which that debt burden can be resolved.

Option 1 is for Western governments to “engineer” sufficient economic growth to service that debt. We doubt if this is possible anywhere.

Option 2 is for Western governments to default; to repudiate their debt. Since we also operate within a debt-based monetary system, in which money is lent into being by banks, a sovereign default by any major government would equate to something akin to Armageddon. Let’s park that option for a second.

By a process of elimination, logic, and thousands of years of history, we get to Option 3. Option 3 is an explicit policy of state-sanctioned inflationism. Governments will choose to inflate the debt away. In the words of the great Austrian economist Ludwig von Mises:

“The most important thing to remember is that inflation is not an act of God, that inflation is not a catastrophe of the elements or a disease that comes like the plague. Inflation is a policy.”

Why own gold? Because it makes sense, within a properly diversified portfolio, to have portfolio insurance. If you own a home, it makes sense to have fire insurance. Your investments are no different. And gold is now back, more relevant than ever. Incrementum show the recent returns:

Gold performance in various currencies, 2000 – 2023

If psychology is largely the investor’s problem, sensible diversification – accompanied by some objective valuation analysis – is surely at least part of the solution.

Benjamin Graham’s ‘The Intelligent Investor’ is evidently not to everyone’s taste. A recent one-star review on Amazon runs as follows:

“This might be a great book for those who are already very knowledgeable but for the rest of us, the obstacles are pretty much insuperable. I’ve been investing for a long time and have degrees in maths and computer science but still couldn’t get anything from it and returned my copy for a refund. The main text was written almost 70 years ago when the investing world was very different, and the more recent foreword still predates the 2008 crash since when everything has been very different again. So to benefit from it, you have to (a) know enough about the investment arena as it was in 1949 to understand the main text, (b) get enough from the foreword to see how to map that information across to the boom years earlier this century, and (c) figure out on your own what if any of it still applies in these days of negative interest rates, QE and other forms of funny money. Something more recent and more accessible to the non-professional investor would be a better bet for most of us I think.”

Whether or not you attach a great deal of significance to this review will be largely a function of whether you think human nature really changes. If you do, then the reviewer’s scepticism is justified. If you don’t, it clearly isn’t.

The language of ‘The Intelligent Investor’ is evidently a struggle for some. As the reviewer fairly points out, the book was written the best part of a century ago, so stylistically it will be an uphill struggle for some. But our take is that while the market environment can obviously change, human nature doesn’t, or at least not on any time scale visible to those who are investing in the here and now.

And if you find Benjamin Graham’s classic on value investing a little hard going, especially in these days of acutely funny money, someone close to home has written a modern treatise on the difficulties of investing at a time when central banks have collectively gone mad. It’s called ‘Investing Through the Looking Glass’ – and we much enjoyed writing it.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you, too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price