“In the year of Uzziah’s death, the Lord commissioned the prophet to go out and warn the people of the wrath to come. “Tell them what a worthless lot they are.” He said, “Tell them what is wrong, and why and what is going to happen unless they have a change of heart and straighten up. Don’t mince matters. Make it clear that they are positively down to their last chance. Give it to them good and strong and keep on giving it to them. I suppose perhaps I ought to tell you,” He added, “that it won’t do any good. The official class and their intelligentsia will turn up their noses at you and the masses will not even listen. They will all keep on in their own ways until they carry everything down to destruction, and you will probably be lucky if you get out with your life.”

“Isaiah had been very willing to take on the job — in fact, he had asked for it — but the prospect put a new face on the situation. It raised the obvious question: Why, if all that were so — if the enterprise were to be a failure from the start — was there any sense in starting it? “Ah,” the Lord said, “you do not get the point. There is a Remnant there that you know nothing about. They are obscure, unorganized, inarticulate, each one rubbing along as best he can. They need to be encouraged and braced up because when everything has gone completely to the dogs, they are the ones who will come back and build up a new society; and meanwhile, your preaching will reassure them and keep them hanging on. Your job is to take care of the Remnant, so be off now and set about it.”

- From ‘Isaiah’s Job’ by Albert Jay Knock; full essay available to read here.

Get your Free

financial review

It is something of a truism within the advertising industry that good advertising is the best way to destroy a bad product. The theory being that when people then try out the aforesaid bad product, and are hugely disappointed by its failings, they lose no time in telling their friends about its demerits, too. A variation on this theme has to do with the triumph of cheapness over quality; as Benjamin Franklin is believed to have said,

“The bitterness of poor quality remains long after the sweetness of low price is forgotten.”

(Those words will come to be engraved on the hearts of all ETF equity investors after the next bear market in stocks – which might well have just started.)

But there’s a paradox here, notably for asset managers, and especially for those setting up new businesses. On the one hand, you don’t necessarily want to advertise your business, at least in any ‘mass market’ way that might attract short-term customers not necessarily aligned with your own process. But on the other hand, how can you possibly tell your target market about your product, service or fund ? ‘Isaiah’s Job’ gets to the heart of the dilemma. You set out your stall and put out your message as best you can, and hope that some amongst ‘the Remnant’ will find it, and respond sympathetically to it. Whatever our religious convictions, we have a strong belief in the power of honest communications. Happily, today, the worldwide web, independent media and social media offer a way to at least try and address your target market without sacrificing your principles. Operating a website today is more or less costless. If you operate a website, you also have the potential for the equivalent of a television channel. If you operate a website, you also have the potential for the equivalent of a radio station – again, at virtually negligible cost. Which is one reason why, together with a technical analyst friend, Paul Rodriguez, we now record free, regular interviews with fellow professionals to discuss the state of the markets. We encourage you to dip into our archive here.

And it has long been a principle of ours never to engage with fund management companies that deploy mass market (paid-for) advertising. Going further, we believe asset management should be a cottage industry. Fund managers have (or at least should have) a fiduciary obligation to their clients, that puts the clients’ interests first. Mass market asset gathering firms are simply not capable of engaging with their customers on that basis.

The chief investment officer of one of the most successful investment funds in the world, the Yale Endowment, David Swensen, wrote an excellent book entitled ‘Unconventional Success’. Over the past 30 years, Yale has enjoyed an average annualised return of over 12% (more on the subject here). That title is an allusion to Keynes’ famous observation that fund managers, courtesy of endemic groupthink, tend to prefer (and consequently often deliver) conventional failure as opposed to unconventional success.

Swensen in his book pulls few punches. The fund management industry, for example, involves the

“interaction between sophisticated, profit-seeking providers of financial services [Keynes would have called them rentiers] and naïve, return-seeking consumers of investment products. The drive for profits by Wall Street and the mutual fund industry overwhelms the concept of fiduciary responsibility, leading to an all too predictable outcome: except in an inconsequential number of cases where individuals succeed through unusual skill or unreliable luck, the powerful financial services industry exploits vulnerable individual investors.”

The nature of ownership is crucial to the likely end return. To Swensen,

“The ownership structure of a fund management company plays a role in determining the likelihood of investor success. Mutual fund investors face the greatest challenge with investment management companies that provide returns to public shareholders or that funnel profits to a corporate parent – situations that place the conflict between profit generation and fiduciary responsibility in high relief. When a funds management subsidiary reports to a multiline financial services company, the scope for abuse of investor capital broadens dramatically. In contrast, private for-profit investment management organizations enjoy the option of playing the role of a benevolent capitalist, mitigating the drive for profits with concern for investor returns.”

In plainer English, the more mouths standing between you and your money that need to be fed, the poorer the ultimate investment return outcome is likely to be. In a rational world, investors would be well advised to favour smaller, entrepreneurial boutiques, or private partnerships, over larger, publicly listed full service investment operations – especially subsidiaries of banks or insurance companies – with all kinds of intermediary layers craving their share of your pie.

So before buying any fund, ask yourself some questions:

- How big is it ? The tree cannot grow to the sky. But try telling that to Blackrock, or to the average member of the Investment Association, or even to Vanguard, the world’s largest provider of passive funds (at a time when we would argue the need for discrimination in investment choices has never been higher). Managers’ pay is invariably linked to the size of funds under management. The more assets, the more pay. It takes guts, and principles, to turn money away and concentrate solely on investment performance. But that’s precisely what many smaller investment boutiques do on a regular basis.

- Has the manager invested his own money ? If he hasn’t, why should you ? Meaningful personal investment is by itself no guarantee of investment outperformance, but it shows the most basic alignment of interests between manager and investor.

- Is it independent, and owner-managed ? David Swensen has gone on record saying he prefers the smaller, private partnership over the larger, listed full service operator. How many mouths must your fees go on to feed ?

- Is the firm an asset manager, or an asset gatherer ? This gets to the heart of the challenge facing investors today. The investment world is polarised between asset managers, who focus their energies on delivering the best possible returns for their clients, and asset gatherers, who just want to maximize the number of clients. Most fund management firms fall into the latter category. Favour the former.

How to distinguish between the asset managers and the asset gatherers ? Try to find managers like the celebrated investor Jean-Marie Eveillard, who once remarked:

“I would rather lose half of my shareholders than half of my shareholders’ money.”

A notorious ‘victim’ of reverse PR was Adam Neumann, founder of the office leasing company WeWork, which will likely go down in history as the high water mark for Dotcom Insanity 2.0. FT Alphaville’s Jamie Powell:

“The following is a guest post by a successful reader of Alphaville who wishes to remain anonymous.

“A common complaint among my generation is that essential services like housing, education and transport have become so expensive that we’ve been excluded from enjoying the secure lifestyles many had before in their adult lives.

“However, I have proven the doubters wrong. By following some simple rules in life, I have retired at the age of 40 with enough money in the bank to live until I die.

“I know you all desperately want to know how I achieved such an astonishing feat, so here are the rules I followed which you too, dear reader, can emulate:

- Make coffee at home. You won’t believe what a $3.50 saving a day will do to your bank account over the longer term.

- Keep holidays cheap. I never spent more than $600 on a trip, which meant exploring my local areas a lot more on my time off.

- Bring pack lunches to work. Have you ever considered how expensive Pret a Manger is? Think about it.

- Take public transport. Uber should be saved for special occasions only. Trust me, it makes a big difference.

- Invest in passive funds. Pick those indexes with the lowest fees, such as those provided by Vanguard, and allocate your money every month. Compound interest is the greatest force known to man.

- Bro down. Found a preposterous shared office space economy, build it with no regard for its underlying economics, secure an obscene valuation from a gullible capitalist, run it into the ground, and walk away with $1bn in stock sales and a $185m consulting contract.

It literally is the easiest thing. Anyone can do it. Even you.”

Touché.

The story of WeWork really is a peach. For quasi-forensic analysis of the debacle, take Professor Scott Galloway’s tech blog, No Mercy / No Malice, which is simply a must-read. Scott nails the WeWork insanity (almost entirely fuelled by SoftBank) here. The following commentary from Scott dates from September 20th 2019; the fate of WeWork was already the chronicle of a death foretold (by Scott, amongst others):

“This was a case of immunities kicking in after the requisite SEC disclosure. As the greater fool theory has hit a wall, We will now need additional capital from the private markets, who are no longer under the influence. The firm will be forced to sell equity/issue debt at a price substantially lower than they had anticipated. A price unimaginable just 30 days ago.

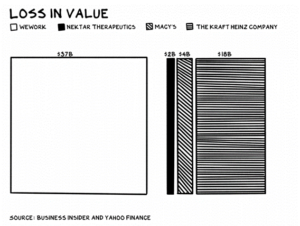

“We has gone from unicorn to distressed asset in 30 days. In just seven days, We lost more value than the three biggest losers in the S&P 500 have lost in the last year combined: Macy’s, Nektar Therapeutics, and Kraft Heinz.

“So, as a distressed asset, the playbook is fairly clear:

- Bring in new management. What got We here, isn’t going to get it where it needs to go. Each layer that comes off the We onion stinks more and more. The media has turned its attention to the Neumanns, and it’s as if the lights have been turned on at a cocaine-fuelled party that ended several hours too late. Everyone and everything suddenly looks bad, scary even.

- The firm needs to bust a move to break even pronto. The new CEO should be from a REIT, ideally a hospitality or commercial real estate REIT. My vote is Adam Markman, CFO of Equity Commonwealth — Sam Zell’s firm.

- Shed/close all non-core businesses. WeGrow and WeLive are vanity projects. As someone close to the firm told me yesterday, they distract Mr. Neumann from the core business, where he was wreaking havoc. A $13 million investment in a firm that makes wave pools to indulge Adam’s passion for surfing. Really? Really?

- Raise money after an adult conversation with SoftBank (“You f*cked up, you trusted us. Do you want to participate in the next round or get washed out?”)

- Focus on margin expansion vs. growth. We has a differentiated product in the marketplace, and should command a premium.

- Lay off all employees not directly tied to managing the core business. Reprice options for remaining employees, as the current options are now worthless and most execs will begin looking for other jobs. The most talented (the ones with the most options) will be the first to leave if they aren’t given substantial economics for staying in Saigon as the North Vietnamese roll into town.

- 3-5 new independent directors. Boards have their own dynamic, irrespective of the qualities of the individuals. The members of this board have formidable experience/CVs. Lew Frankfort (Director) is a first-ballot Hall of Fame retail exec, and he doesn’t strike me as the type of guy who’d be bullied by the CEO, or anybody else for that matter. Again, I just can’t figure out what the f*ck happened here. Who is the head of the audit committee, and was he (they were all dudes until last week) the one passing out MDMA before each audit meeting? Or, as a private firm, did they even have audit committee meetings? This is a board that approved a $13 million acquisition of a wave pool company. Or did they?

“The directors enabled an information pyramid scheme and indulged Adam, in exchange for hoping they could create enough valuation momentum, via nine rounds, to carry their shares to an exit in the public markets.

- SoftBank was reportedly considering propping up the IPO with $750 million in share purchases at the offering price. If that’s the case, shouldn’t they want to invest billions more at the now low-low 80%-off price? Or were they simply looking to pump and dump?

“The above likely won’t happen. Why? As I said two weeks ago, the lines between vision, bullsh*t, and fraud are pretty narrow. I can’t wrap my head around what’s gone on here. Something is wrong. Something stinks. Something … Just. Doesn’t. Add. Up.

“It’s beginning to smell like malfeasance at We. The lines between vision, bullsh*t, and fraud have been crossed here. To be clear, I’m not a journalist, nor a forensic accountant. This is pure speculation based on my experience as a CEO, investor, and director. Something is very, very wrong here. In no specific order:

- The board’s willingness to sell shares at 75% off (after seven days) says insiders knew the firm desperately needed money, and the price they advertised seven days before was not a real number (see above: malfeasance).

- Cult of personality firms seem especially vulnerable to massive declines in value or fraud. If you had to pick an analog for Adam Neumann (young, charismatic, visionary, with an outsized view of himself and a delusional view of the firm’s role in society), surrounded by gravitas/old white guys, who/what is more fitting than Elizabeth Holmes/Theranos?

- At the most recent all-hands (after the shelving of the IPO), Adam refused to take questions. Mr. Neumann is a narcissist, and to not indulge in a chance to spread more Adam means he’s now being advised by lawyers (“stick to your talking points, don’t say anything else, don’t take questions”). A bad sign.

“If you liked the Theranos documentary The Inventor: Out for Blood in Silicon Valley, you’ll love Community-Based EBITDA: The Story of We, coming soon to Hulu.

“..We has consistently been so far off on any forecasts in their original pitch deck that it appears numbers are more of a nuisance than reporting metrics. Their forecasted profits: $14 million for 2014, $64 million for 2015, $237 million for 2016, $542 million for 2017, and (wait for it) $1 billion for 2018.

“Except in 2018 the firm lost $1.6 billion, which is likely understated. SoftBank is the only investor since 2016, a rookie move in the world of investing. The lack of external, third-party validation can lead to everyone smoking their own supply, and more poor governance. Henry Hawksberry (pen name I think) wrote a blistering piece on Medium alleging, among other things, We was paying brokers 100% commissions, then figuring out how to turn expenses into revenues and pulling forward billables. If half of this is true, it’s fraud.

“Ok, the wolves are closing in. What to do? I know, we’ll provide an exclusive to a network that throws us softball questions and provides a veneer of legitimacy. CNBC, that’s the ticket. We’ll distract from the boring stuff, like numbers, and bring with us early tech investor Ashton Kutcher. The third and and a half man is masterful and, sitting next to Adam, raptures:

“I realised it was a technology company. I also realised that this company, through its technology, has greater capacity than any other company in the entire world to bring people together.” Really, Ashton, really? Aren’t misleading metrics and nomenclature just non-carbonated fraud?

Why. Would. They. Leave?

“The two most senior corporate communications exes, Jennifer Skyler and Dominic McMullan, both left recently, right before the IPO. Ok, so think about that. You are the belles of the ball of a firm about to IPO at $50 billion, and (in the case of Dominic) you announce, weeks before the IPO, “After becoming a dad (twice) in recent years, I’ve decided to take time off to spend with family in Brooklyn for now.” Yep, that makes sense. You know us men, always leaving right before the IPO to spend more time with our families.

“The head of comms, Jennifer Skyler, left a few weeks ago for AMEX. Uh huh, that makes even more sense. Who wouldn’t want to bolt from the second-most-anticipated IPO of the year to go flack about the new American Express Marriott Bonvoy Brilliant Card. What’s worse than spending all day every day at home with two baby boys or downtown at AMEX? Engaging in fraud.

“How did this happen?

“A frothy market coupled with our gross idolatry of innovators creates an ecosystem that enables incremental disingenuous acts such that, if We had gotten public and managed to spend their way out of this hole, they might be lauded as “visionary.” What if Ms. Holmes had been able to raise another $2 billion and the technology had begun to show promise? Wouldn’t she be on Oprah and CNBC, instead of HBO?

“We’ve witnessed a halving of journalists since 2008, while the number of corporate communications execs has tripled. In sum, the ratio of bullshit/spin to watchdogs has increased sixfold. In the last 24 hours, I’ve been contacted by the BBC, WSJ, and WaPo [the Washington Post] to comment on We. But before any press outlet contacted me, I heard from a senior comms person at We, after I mentioned on Pivot in January that WeWork will be in the news a lot in 2019, for all the wrong reasons..

“As a general rule, I return the call of every journalist and refuse to meet with any corporate communications exec.

“The halcyon of the markets coupled with feckless regulatory bodies and the decimation of investigative journalism has made the markets ripe for fraud. We is falling off the tree.

Predictions:

- In the next 30 days, a series of explosive investigative journalism pieces will document breathtaking malfeasance at We.

- In the next 60 days, a state attorney general, SEC, or other regulatory body will launch a formal investigations into We.

- Over the next 12 months, SoftBank’s Vision Fund will be shuttered..”

We were particularly struck by Scott’s data on the declining numbers of US journalists vs the explosion in the numbers of corporate PR flacks. Simon Black of ‘Sovereign Man’ summarised the whole debacle in brief:

“WeWork: one moron ruining it for everyone else.”

Avoiding high profile corporate disasters is less of a problem for investors well diversified by asset class, with portfolio protection (we favour precious metals and systematic trend-following funds), and who have a preference for attractive individual securities over the ownership of entire indices or markets. In any event, we have all been well and truly warned. Not all that glitters is gold.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

“In the year of Uzziah’s death, the Lord commissioned the prophet to go out and warn the people of the wrath to come. “Tell them what a worthless lot they are.” He said, “Tell them what is wrong, and why and what is going to happen unless they have a change of heart and straighten up. Don’t mince matters. Make it clear that they are positively down to their last chance. Give it to them good and strong and keep on giving it to them. I suppose perhaps I ought to tell you,” He added, “that it won’t do any good. The official class and their intelligentsia will turn up their noses at you and the masses will not even listen. They will all keep on in their own ways until they carry everything down to destruction, and you will probably be lucky if you get out with your life.”

“Isaiah had been very willing to take on the job — in fact, he had asked for it — but the prospect put a new face on the situation. It raised the obvious question: Why, if all that were so — if the enterprise were to be a failure from the start — was there any sense in starting it? “Ah,” the Lord said, “you do not get the point. There is a Remnant there that you know nothing about. They are obscure, unorganized, inarticulate, each one rubbing along as best he can. They need to be encouraged and braced up because when everything has gone completely to the dogs, they are the ones who will come back and build up a new society; and meanwhile, your preaching will reassure them and keep them hanging on. Your job is to take care of the Remnant, so be off now and set about it.”

Get your Free

financial review

It is something of a truism within the advertising industry that good advertising is the best way to destroy a bad product. The theory being that when people then try out the aforesaid bad product, and are hugely disappointed by its failings, they lose no time in telling their friends about its demerits, too. A variation on this theme has to do with the triumph of cheapness over quality; as Benjamin Franklin is believed to have said,

“The bitterness of poor quality remains long after the sweetness of low price is forgotten.”

(Those words will come to be engraved on the hearts of all ETF equity investors after the next bear market in stocks – which might well have just started.)

But there’s a paradox here, notably for asset managers, and especially for those setting up new businesses. On the one hand, you don’t necessarily want to advertise your business, at least in any ‘mass market’ way that might attract short-term customers not necessarily aligned with your own process. But on the other hand, how can you possibly tell your target market about your product, service or fund ? ‘Isaiah’s Job’ gets to the heart of the dilemma. You set out your stall and put out your message as best you can, and hope that some amongst ‘the Remnant’ will find it, and respond sympathetically to it. Whatever our religious convictions, we have a strong belief in the power of honest communications. Happily, today, the worldwide web, independent media and social media offer a way to at least try and address your target market without sacrificing your principles. Operating a website today is more or less costless. If you operate a website, you also have the potential for the equivalent of a television channel. If you operate a website, you also have the potential for the equivalent of a radio station – again, at virtually negligible cost. Which is one reason why, together with a technical analyst friend, Paul Rodriguez, we now record free, regular interviews with fellow professionals to discuss the state of the markets. We encourage you to dip into our archive here.

And it has long been a principle of ours never to engage with fund management companies that deploy mass market (paid-for) advertising. Going further, we believe asset management should be a cottage industry. Fund managers have (or at least should have) a fiduciary obligation to their clients, that puts the clients’ interests first. Mass market asset gathering firms are simply not capable of engaging with their customers on that basis.

The chief investment officer of one of the most successful investment funds in the world, the Yale Endowment, David Swensen, wrote an excellent book entitled ‘Unconventional Success’. Over the past 30 years, Yale has enjoyed an average annualised return of over 12% (more on the subject here). That title is an allusion to Keynes’ famous observation that fund managers, courtesy of endemic groupthink, tend to prefer (and consequently often deliver) conventional failure as opposed to unconventional success.

Swensen in his book pulls few punches. The fund management industry, for example, involves the

“interaction between sophisticated, profit-seeking providers of financial services [Keynes would have called them rentiers] and naïve, return-seeking consumers of investment products. The drive for profits by Wall Street and the mutual fund industry overwhelms the concept of fiduciary responsibility, leading to an all too predictable outcome: except in an inconsequential number of cases where individuals succeed through unusual skill or unreliable luck, the powerful financial services industry exploits vulnerable individual investors.”

The nature of ownership is crucial to the likely end return. To Swensen,

“The ownership structure of a fund management company plays a role in determining the likelihood of investor success. Mutual fund investors face the greatest challenge with investment management companies that provide returns to public shareholders or that funnel profits to a corporate parent – situations that place the conflict between profit generation and fiduciary responsibility in high relief. When a funds management subsidiary reports to a multiline financial services company, the scope for abuse of investor capital broadens dramatically. In contrast, private for-profit investment management organizations enjoy the option of playing the role of a benevolent capitalist, mitigating the drive for profits with concern for investor returns.”

In plainer English, the more mouths standing between you and your money that need to be fed, the poorer the ultimate investment return outcome is likely to be. In a rational world, investors would be well advised to favour smaller, entrepreneurial boutiques, or private partnerships, over larger, publicly listed full service investment operations – especially subsidiaries of banks or insurance companies – with all kinds of intermediary layers craving their share of your pie.

So before buying any fund, ask yourself some questions:

How to distinguish between the asset managers and the asset gatherers ? Try to find managers like the celebrated investor Jean-Marie Eveillard, who once remarked:

“I would rather lose half of my shareholders than half of my shareholders’ money.”

A notorious ‘victim’ of reverse PR was Adam Neumann, founder of the office leasing company WeWork, which will likely go down in history as the high water mark for Dotcom Insanity 2.0. FT Alphaville’s Jamie Powell:

“The following is a guest post by a successful reader of Alphaville who wishes to remain anonymous.

“A common complaint among my generation is that essential services like housing, education and transport have become so expensive that we’ve been excluded from enjoying the secure lifestyles many had before in their adult lives.

“However, I have proven the doubters wrong. By following some simple rules in life, I have retired at the age of 40 with enough money in the bank to live until I die.

“I know you all desperately want to know how I achieved such an astonishing feat, so here are the rules I followed which you too, dear reader, can emulate:

It literally is the easiest thing. Anyone can do it. Even you.”

Touché.

The story of WeWork really is a peach. For quasi-forensic analysis of the debacle, take Professor Scott Galloway’s tech blog, No Mercy / No Malice, which is simply a must-read. Scott nails the WeWork insanity (almost entirely fuelled by SoftBank) here. The following commentary from Scott dates from September 20th 2019; the fate of WeWork was already the chronicle of a death foretold (by Scott, amongst others):

“This was a case of immunities kicking in after the requisite SEC disclosure. As the greater fool theory has hit a wall, We will now need additional capital from the private markets, who are no longer under the influence. The firm will be forced to sell equity/issue debt at a price substantially lower than they had anticipated. A price unimaginable just 30 days ago.

“We has gone from unicorn to distressed asset in 30 days. In just seven days, We lost more value than the three biggest losers in the S&P 500 have lost in the last year combined: Macy’s, Nektar Therapeutics, and Kraft Heinz.

“So, as a distressed asset, the playbook is fairly clear:

“The directors enabled an information pyramid scheme and indulged Adam, in exchange for hoping they could create enough valuation momentum, via nine rounds, to carry their shares to an exit in the public markets.

“The above likely won’t happen. Why? As I said two weeks ago, the lines between vision, bullsh*t, and fraud are pretty narrow. I can’t wrap my head around what’s gone on here. Something is wrong. Something stinks. Something … Just. Doesn’t. Add. Up.

“It’s beginning to smell like malfeasance at We. The lines between vision, bullsh*t, and fraud have been crossed here. To be clear, I’m not a journalist, nor a forensic accountant. This is pure speculation based on my experience as a CEO, investor, and director. Something is very, very wrong here. In no specific order:

“If you liked the Theranos documentary The Inventor: Out for Blood in Silicon Valley, you’ll love Community-Based EBITDA: The Story of We, coming soon to Hulu.

“..We has consistently been so far off on any forecasts in their original pitch deck that it appears numbers are more of a nuisance than reporting metrics. Their forecasted profits: $14 million for 2014, $64 million for 2015, $237 million for 2016, $542 million for 2017, and (wait for it) $1 billion for 2018.

“Except in 2018 the firm lost $1.6 billion, which is likely understated. SoftBank is the only investor since 2016, a rookie move in the world of investing. The lack of external, third-party validation can lead to everyone smoking their own supply, and more poor governance. Henry Hawksberry (pen name I think) wrote a blistering piece on Medium alleging, among other things, We was paying brokers 100% commissions, then figuring out how to turn expenses into revenues and pulling forward billables. If half of this is true, it’s fraud.

“Ok, the wolves are closing in. What to do? I know, we’ll provide an exclusive to a network that throws us softball questions and provides a veneer of legitimacy. CNBC, that’s the ticket. We’ll distract from the boring stuff, like numbers, and bring with us early tech investor Ashton Kutcher. The third and and a half man is masterful and, sitting next to Adam, raptures:

“I realised it was a technology company. I also realised that this company, through its technology, has greater capacity than any other company in the entire world to bring people together.” Really, Ashton, really? Aren’t misleading metrics and nomenclature just non-carbonated fraud?

Why. Would. They. Leave?

“The two most senior corporate communications exes, Jennifer Skyler and Dominic McMullan, both left recently, right before the IPO. Ok, so think about that. You are the belles of the ball of a firm about to IPO at $50 billion, and (in the case of Dominic) you announce, weeks before the IPO, “After becoming a dad (twice) in recent years, I’ve decided to take time off to spend with family in Brooklyn for now.” Yep, that makes sense. You know us men, always leaving right before the IPO to spend more time with our families.

“The head of comms, Jennifer Skyler, left a few weeks ago for AMEX. Uh huh, that makes even more sense. Who wouldn’t want to bolt from the second-most-anticipated IPO of the year to go flack about the new American Express Marriott Bonvoy Brilliant Card. What’s worse than spending all day every day at home with two baby boys or downtown at AMEX? Engaging in fraud.

“How did this happen?

“A frothy market coupled with our gross idolatry of innovators creates an ecosystem that enables incremental disingenuous acts such that, if We had gotten public and managed to spend their way out of this hole, they might be lauded as “visionary.” What if Ms. Holmes had been able to raise another $2 billion and the technology had begun to show promise? Wouldn’t she be on Oprah and CNBC, instead of HBO?

“We’ve witnessed a halving of journalists since 2008, while the number of corporate communications execs has tripled. In sum, the ratio of bullshit/spin to watchdogs has increased sixfold. In the last 24 hours, I’ve been contacted by the BBC, WSJ, and WaPo [the Washington Post] to comment on We. But before any press outlet contacted me, I heard from a senior comms person at We, after I mentioned on Pivot in January that WeWork will be in the news a lot in 2019, for all the wrong reasons..

“As a general rule, I return the call of every journalist and refuse to meet with any corporate communications exec.

“The halcyon of the markets coupled with feckless regulatory bodies and the decimation of investigative journalism has made the markets ripe for fraud. We is falling off the tree.

Predictions:

We were particularly struck by Scott’s data on the declining numbers of US journalists vs the explosion in the numbers of corporate PR flacks. Simon Black of ‘Sovereign Man’ summarised the whole debacle in brief:

“WeWork: one moron ruining it for everyone else.”

Avoiding high profile corporate disasters is less of a problem for investors well diversified by asset class, with portfolio protection (we favour precious metals and systematic trend-following funds), and who have a preference for attractive individual securities over the ownership of entire indices or markets. In any event, we have all been well and truly warned. Not all that glitters is gold.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio – with no obligation at all:

Get your Free

financial review

…………

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price