Life transcends satire when someone of the intellectual rigour, economic utility and moral bravery of Ben Bernanke becomes a joint recipient of the Nobel prize for economics (more accurately, the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel). If only there were an example of Hollywood absolutely nailing the concept of an idiot savant let loose in the realm of politics and economics. Happily, there is..

1979’s Being There was Peter Sellers’ last film. Nominated for an Academy Award – he lost out to Dustin Hoffman for Kramer vs. Kramer – Sellers plays a simple-minded gardener, Chance, who through a sequence of random events ends up as a policy consultant and trusted adviser to the President of the United States. But Chance, who has no family and lives alone, has no knowledge of the world other than the facile programmes and advertisements that he continually watches on TV. His bland statements about horticulture – “As long as the roots are not severed, all is well,” and “There will be growth in the spring” – are taken as informed macro-economic and political insight. When the President dies, Chance is widely considered to be his best replacement.

Ever more ridiculous news and political dispatches from Clownworld seem to be filling up everybody’s inboxes at present. A friend in the industry, the Zurich-based fund manager Tony Deden, has written nicely about the vortex of despair that will tend to suck in all investors unable to properly manage either their time or their consumption of investment media:

Daily, my mail box is full of emails, many of which come from well-meaning friends. ‘Have you seen this article?’ or ‘Do you know this guru?’ I follow the links as I frantically go from thenewyorktimes.com to financialarmageddon.com and everywhere in between. ‘The dollar will rebound’, ‘Gold is another bubble’, ‘Buy bonds’, ‘Sell bonds’, ‘Pork bellies are undervalued’, and so on. I pretend to read some of these writings just so that I can make up something to say should they follow up the email with a telephone call. In an enduring quest for understanding and picking kernels of knowledge, I find myself surrounded in an epochal – and mad – battle of the optimists versus the pessimists.

Honestly, there are intractable and momentous problems which should be the cause of considerable pessimism. But when it comes to action with other people’s money – particularly the irreplaceable kind – merely on account of the free advice of a well-known guru who writes for the-world-is-coming-to-an-end.com is complete madness. To follow the advice of an analyst working for a bank that can’t even manage its own balance sheet and who is intentionally or accidentally divorced from reality, is madness squared.

There are very few financial journalists that we have any time for. One of the rare exceptions is Jason Zweig, a Wall Street Journal columnist and author. Asked at a journalism conference how he defined his job, Jason gave the following response:

My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good. [Emphasis ours.]

Jason Zweig has clearly spent a lot of time considering what is in the best interests of his readers.

Instead of pandering to investors’ own worst tendencies, I try to push back. My role is also to remind them constantly that knowing what not to do is much more important than what to do. Approximately 99% of the time, the single most important thing investors should do is absolutely nothing.

So when it comes to the mainstream financial media, it’s less a question of knowing who to follow, than knowing that it’s best not to follow pretty much everyone.

We increasingly find that the financial commentators most worthy of our attention are bloggers who also happen to be fund managers or professional advisers. In the words of Nassim Taleb, they have skin in the game. This is not to denigrate all financial journalists, but when it comes to skin in the game, most of them have none. Those bloggers who do bring value to their readers also tend to work for small, entrepreneurial boutiques. Larger, more established firms simply have too much internal bureaucracy and compliance to allow their staff to post freely on platforms like Twitter or Substack.

Of the bloggers we follow and unreservedly recommend, some of the best would include, in no particular order Morgan Housel, Meb Faber, Howard Marks (not strictly a blogger but a highly respected fund manager and writer), David Merkel, Cullen Roche and Jesse Felder. Note that all of these commentators are based in the US. This is not to discriminate against British bloggers, but with some highly honourable exceptions (take a bow, for example, Steven Wilkinson), we just don’t have either the quality or the quantity to make it a fair fight.

So in the spirit of Jason Zweig’s advice to do little or nothing whenever possible, and on the presumption that most news, let alone market commentary, is fundamentally irrelevant to any sensible investment process, what should we be looking for ? We should be looking for hard evidence that our investment thesis might be wrong. Otherwise, we should be looking for gifted managers (either of high quality companies, or of specific funds) who have proven themselves to be adept at allocating capital.

Any investment adviser will tell you, quite correctly, that the single most important decision you can make relates to the asset allocation breakdown of your portfolio.

Deciding whether or not to buy Amazon or Tesla stock (or deciding whether to short them, for that matter) is far less important than deciding how much of your portfolio to allocate to listed equities in the first place.

Which is why listening to the economist John Hearn (@jbhearn on Twitter) is so refreshing. Because his answers are clear, honest and unequivocal. When we recently asked John his prediction for financial markets, his answer was straightforward: interest rates are going up, so financial asset prices are likely to fall.

Since John has been unerringly correct, this will inevitably impact most investors, because most investors – especially pension schemes – have the lion’s share of their assets invested in listed equity and government and corporate debt. And, frankly, not much else. (If interest rates continue to rise, property prices are unlikely to do well either.)

Warnings from history

Time, then, for some old favourites.

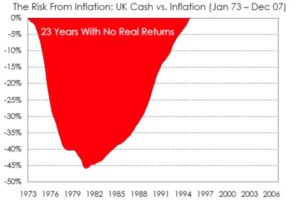

The charts below, courtesy of Frontier Capital Management, show the sort of damage that investors conceivably face when stock and bond markets conclusively turn.

During the stagflation of the 1970s, investors in UK government bonds, or Gilts, incurred a drawdown (peak to trough loss) of over 35%. A Gilt investor in 1973 had to wait until 1985 before he was at break-even again.

The scale of the losses for stock market investors was more severe than that.

Investors in the FTSE All-Share suffered a drawdown of over 70%. As with Gilt investors, they had to wait for over a decade before they were making any money in real terms.

We’ve saved the best (i.e. worst) for last. An investor simply with money on deposit a) incurred a drawdown of over 45%, and b) had to wait for 23 years simply to see a positive real return.

Could history repeat itself ? It already seems to be doing precisely that.

Which is why we suggest that electing to use cheap ETFs (exchange traded funds) or index-trackers at this particular moment in time carries an extraordinary degree of risk. Investors doing so are being penny wise but pound foolish. Just because a fund is cheap to own does not guarantee superior returns in the future. Especially if investors are buying those funds with the possibility of further downside to come. Those investors are also unable to benefit from any real discernment – market trackers or market ETFs by definition give you exposure to the entire market, warts and all. Since our investment philosophy is to try and generate meaningful positive returns whilst simultaneously avoiding significant negative returns, there are unlikely to be many scenarios in which whole of market trackers or ETFs – in equity markets, at any rate – ever feature within our investible universe.

Because we don’t believe in market timing, we will always be more or less fully invested. Just not exclusively in stocks. In addition to maintaining a portfolio of value-inclined equities or equity funds, our clients are also invested in absolute return funds and precious metal-related investments. (No bitcoin yet though, and possibly never. We note that John Hearn doesn’t see much value in cryptocurrencies either.)

The history of the last two centuries shows that the Anglo-Saxon stock markets (i.e. those of the US and the UK) have been among the winners, with annualised real returns for shareholders of between 6 % and 7%. But those are average figures, and they fail to take into account the scary volatility that comes with equity market investing. They also fail to reflect those periods when shareholders simply lost out. Investors in the US market in 1929, for example, had to wait until 1954 before they had earned their money back. It is perfectly plausible that investors in the US market today may ultimately have to wait years if not decades to enjoy a positive real return. And the Anglo-Saxon markets were stand-out performers. Other markets and other investors in those markets were not so lucky. Some markets closed – in the midst of war or revolution – and never reopened. So the best financial commentators are those who continually reinforce the message of sticking with your investment philosophy when times get tough.

Being There

By some accounts Peter Sellers was the perfect choice to play Chance, the gardener in Hal Ashby’s 1979 film. To many onlookers, Sellers the individual was something of a cipher, an actor who claimed to have no real identity outside the roles that he played on screen. As regards traditional (broad stock and bond) markets in 2022, we have a real choice. We simply do not have to be there.

From the moment we rise in the morning until the moment we retire to bed, we are all assailed by information, news and data. Thirty years ago, in a pre-Internet age, the best investors were those with the best information funnels. Information was comparatively rare and hard to come by, and correspondingly valuable. Today, media choice is almost infinite. Everybody has an opinion, and a social media platform to share it on. Today, the best investors will be those with the best information filters. Choose your sources sparingly.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Life transcends satire when someone of the intellectual rigour, economic utility and moral bravery of Ben Bernanke becomes a joint recipient of the Nobel prize for economics (more accurately, the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel). If only there were an example of Hollywood absolutely nailing the concept of an idiot savant let loose in the realm of politics and economics. Happily, there is..

1979’s Being There was Peter Sellers’ last film. Nominated for an Academy Award – he lost out to Dustin Hoffman for Kramer vs. Kramer – Sellers plays a simple-minded gardener, Chance, who through a sequence of random events ends up as a policy consultant and trusted adviser to the President of the United States. But Chance, who has no family and lives alone, has no knowledge of the world other than the facile programmes and advertisements that he continually watches on TV. His bland statements about horticulture – “As long as the roots are not severed, all is well,” and “There will be growth in the spring” – are taken as informed macro-economic and political insight. When the President dies, Chance is widely considered to be his best replacement.

Ever more ridiculous news and political dispatches from Clownworld seem to be filling up everybody’s inboxes at present. A friend in the industry, the Zurich-based fund manager Tony Deden, has written nicely about the vortex of despair that will tend to suck in all investors unable to properly manage either their time or their consumption of investment media:

Daily, my mail box is full of emails, many of which come from well-meaning friends. ‘Have you seen this article?’ or ‘Do you know this guru?’ I follow the links as I frantically go from thenewyorktimes.com to financialarmageddon.com and everywhere in between. ‘The dollar will rebound’, ‘Gold is another bubble’, ‘Buy bonds’, ‘Sell bonds’, ‘Pork bellies are undervalued’, and so on. I pretend to read some of these writings just so that I can make up something to say should they follow up the email with a telephone call. In an enduring quest for understanding and picking kernels of knowledge, I find myself surrounded in an epochal – and mad – battle of the optimists versus the pessimists.

Honestly, there are intractable and momentous problems which should be the cause of considerable pessimism. But when it comes to action with other people’s money – particularly the irreplaceable kind – merely on account of the free advice of a well-known guru who writes for the-world-is-coming-to-an-end.com is complete madness. To follow the advice of an analyst working for a bank that can’t even manage its own balance sheet and who is intentionally or accidentally divorced from reality, is madness squared.

There are very few financial journalists that we have any time for. One of the rare exceptions is Jason Zweig, a Wall Street Journal columnist and author. Asked at a journalism conference how he defined his job, Jason gave the following response:

My job is to write the exact same thing between 50 and 100 times a year in such a way that neither my editors nor my readers will ever think I am repeating myself.. The temptation to pander is almost irresistible. And while people need good advice, what they want is advice that sounds good. [Emphasis ours.]

Jason Zweig has clearly spent a lot of time considering what is in the best interests of his readers.

Instead of pandering to investors’ own worst tendencies, I try to push back. My role is also to remind them constantly that knowing what not to do is much more important than what to do. Approximately 99% of the time, the single most important thing investors should do is absolutely nothing.

So when it comes to the mainstream financial media, it’s less a question of knowing who to follow, than knowing that it’s best not to follow pretty much everyone.

We increasingly find that the financial commentators most worthy of our attention are bloggers who also happen to be fund managers or professional advisers. In the words of Nassim Taleb, they have skin in the game. This is not to denigrate all financial journalists, but when it comes to skin in the game, most of them have none. Those bloggers who do bring value to their readers also tend to work for small, entrepreneurial boutiques. Larger, more established firms simply have too much internal bureaucracy and compliance to allow their staff to post freely on platforms like Twitter or Substack.

Of the bloggers we follow and unreservedly recommend, some of the best would include, in no particular order Morgan Housel, Meb Faber, Howard Marks (not strictly a blogger but a highly respected fund manager and writer), David Merkel, Cullen Roche and Jesse Felder. Note that all of these commentators are based in the US. This is not to discriminate against British bloggers, but with some highly honourable exceptions (take a bow, for example, Steven Wilkinson), we just don’t have either the quality or the quantity to make it a fair fight.

So in the spirit of Jason Zweig’s advice to do little or nothing whenever possible, and on the presumption that most news, let alone market commentary, is fundamentally irrelevant to any sensible investment process, what should we be looking for ? We should be looking for hard evidence that our investment thesis might be wrong. Otherwise, we should be looking for gifted managers (either of high quality companies, or of specific funds) who have proven themselves to be adept at allocating capital.

Any investment adviser will tell you, quite correctly, that the single most important decision you can make relates to the asset allocation breakdown of your portfolio.

Deciding whether or not to buy Amazon or Tesla stock (or deciding whether to short them, for that matter) is far less important than deciding how much of your portfolio to allocate to listed equities in the first place.

Which is why listening to the economist John Hearn (@jbhearn on Twitter) is so refreshing. Because his answers are clear, honest and unequivocal. When we recently asked John his prediction for financial markets, his answer was straightforward: interest rates are going up, so financial asset prices are likely to fall.

Since John has been unerringly correct, this will inevitably impact most investors, because most investors – especially pension schemes – have the lion’s share of their assets invested in listed equity and government and corporate debt. And, frankly, not much else. (If interest rates continue to rise, property prices are unlikely to do well either.)

Warnings from history

Time, then, for some old favourites.

The charts below, courtesy of Frontier Capital Management, show the sort of damage that investors conceivably face when stock and bond markets conclusively turn.

During the stagflation of the 1970s, investors in UK government bonds, or Gilts, incurred a drawdown (peak to trough loss) of over 35%. A Gilt investor in 1973 had to wait until 1985 before he was at break-even again.

The scale of the losses for stock market investors was more severe than that.

Investors in the FTSE All-Share suffered a drawdown of over 70%. As with Gilt investors, they had to wait for over a decade before they were making any money in real terms.

We’ve saved the best (i.e. worst) for last. An investor simply with money on deposit a) incurred a drawdown of over 45%, and b) had to wait for 23 years simply to see a positive real return.

Could history repeat itself ? It already seems to be doing precisely that.

Which is why we suggest that electing to use cheap ETFs (exchange traded funds) or index-trackers at this particular moment in time carries an extraordinary degree of risk. Investors doing so are being penny wise but pound foolish. Just because a fund is cheap to own does not guarantee superior returns in the future. Especially if investors are buying those funds with the possibility of further downside to come. Those investors are also unable to benefit from any real discernment – market trackers or market ETFs by definition give you exposure to the entire market, warts and all. Since our investment philosophy is to try and generate meaningful positive returns whilst simultaneously avoiding significant negative returns, there are unlikely to be many scenarios in which whole of market trackers or ETFs – in equity markets, at any rate – ever feature within our investible universe.

Because we don’t believe in market timing, we will always be more or less fully invested. Just not exclusively in stocks. In addition to maintaining a portfolio of value-inclined equities or equity funds, our clients are also invested in absolute return funds and precious metal-related investments. (No bitcoin yet though, and possibly never. We note that John Hearn doesn’t see much value in cryptocurrencies either.)

The history of the last two centuries shows that the Anglo-Saxon stock markets (i.e. those of the US and the UK) have been among the winners, with annualised real returns for shareholders of between 6 % and 7%. But those are average figures, and they fail to take into account the scary volatility that comes with equity market investing. They also fail to reflect those periods when shareholders simply lost out. Investors in the US market in 1929, for example, had to wait until 1954 before they had earned their money back. It is perfectly plausible that investors in the US market today may ultimately have to wait years if not decades to enjoy a positive real return. And the Anglo-Saxon markets were stand-out performers. Other markets and other investors in those markets were not so lucky. Some markets closed – in the midst of war or revolution – and never reopened. So the best financial commentators are those who continually reinforce the message of sticking with your investment philosophy when times get tough.

Being There

By some accounts Peter Sellers was the perfect choice to play Chance, the gardener in Hal Ashby’s 1979 film. To many onlookers, Sellers the individual was something of a cipher, an actor who claimed to have no real identity outside the roles that he played on screen. As regards traditional (broad stock and bond) markets in 2022, we have a real choice. We simply do not have to be there.

From the moment we rise in the morning until the moment we retire to bed, we are all assailed by information, news and data. Thirty years ago, in a pre-Internet age, the best investors were those with the best information funnels. Information was comparatively rare and hard to come by, and correspondingly valuable. Today, media choice is almost infinite. Everybody has an opinion, and a social media platform to share it on. Today, the best investors will be those with the best information filters. Choose your sources sparingly.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks and specialist managed funds.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price