“When did the future switch from being a promise to being a threat ?”

- Chuck Palahniuk, ‘Invisible Monsters’.

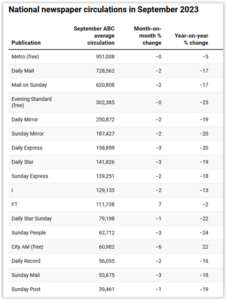

There’s an (inadvertently) hilarious sequence in the BBC’s 2019 drama ‘Mother Father Son’ in which supporters of Prime Minister Jahan (Danny Sapani) are seen angrily striding into a conference brandishing copies of the newspaper owned by Max Finch (Richard Gere) – primarily so they can tear up those same newspapers after it’s revealed that Finch’s media empire is backing another candidate. The idea that large groups of people these days even read print newspapers, let alone care about what’s in them, is simply quaint. The latest ABC data for newspaper readerships makes for pretty grim reading:

Source: ABC

The only way the BBC could have topped this for unwitting irony would have been if it had shown establishing shots of large numbers of people switching on the BBC News – as opposed to switching it off. Has a national broadcaster ever fallen out of favour with its core audience more comprehensively ?

Three sectors in particular are struggling for sheer survival amidst surging digital headwinds: traditional media including newspapers and broadcast TV, High Street retailers, and textile manufacturers (wherever labour is a core component, industrial players tend to shop around for the lowest cost providers, and their capital is highly mobile). Perhaps US Inc. will also come to regret having offshored so much of its manufacturing to China. And when it comes to stock and sector selection, after an effortless decade of outperformance by growth, investor ‘style bias’ is about to matter hugely again.

And of course all of this was foreseeable, pretty much from the birth of the worldwide web itself. Although this correspondent first started using a web browser in 1996 when working for Merrill Lynch, the world-changing potential of the Internet didn’t really sink in until we came across something called ‘The Cluetrain Manifesto’ in late 1999.

‘The Cluetrain Manifesto’ is a modern-day reworking of Martin Luther’s 95 Theses – the propositions and complaints allegedly nailed to the door of Wittenberg Cathedral that sparked the Reformation. Among the Cluetrain propositions:

- Markets are conversations.

- Markets consist of human beings, not demographic sectors.

- The Internet is enabling conversations among human beings that were simply not possible in the era of mass media.

- Hyperlinks subvert hierarchy.

- In both internetworked markets and among intranetworked employees, people are speaking to each other in a powerful new way.

- These networked conversations are enabling powerful new forms of social organization and knowledge exchange to emerge.

- As a result, markets are getting smarter, more informed, more organized.

- Participation in a networked market changes people fundamentally.

- What’s happening to markets is also happening among employees. A metaphysical construct called “The Company” is the only thing standing between the two.

- Companies can now communicate with their markets directly. If they blow it, it could be their last chance.

- Brand loyalty is the corporate version of going steady, but the breakup is inevitable — and coming fast. Because they are networked, smart markets are able to renegotiate relationships with blinding speed.

- Networked markets can change suppliers overnight. Networked knowledge workers can change employers over lunch. Your own “downsizing initiatives” taught us to ask the question: “Loyalty? What’s that?”

- Today, the org chart is hyperlinked, not hierarchical. Respect for hands-on knowledge wins over respect for abstract authority.

- We want you to take 50 million of us as seriously as you take one reporter from ‘The Wall Street Journal.’

- To traditional corporations, networked conversations may appear confused, may sound confusing. But we are organizing faster than they are. We have better tools, more new ideas, no rules to slow us down.

- We are waking up and linking to each other. We are watching. But we are not waiting.

The founders of Cluetrain – Messrs Levine, Locke, Searls and Weinberger – were among the first to “get” how the Internet really would change business as usual.

Impressed by what we read online, we went off and bought the book. Impressed by that, we jacked in our job at Merrill Lynch and entered the digital economy instead. Our career path changed, in a way that we have no regrets about whatever. Indirectly, it led us to where we are today, as partner in our own company, and to financial freedom we would probably never have achieved as just another employee of a Wall Street firm.

Admittedly, from the vantage point of 2023, some of Cluetrain’s philosophy comes across as uncontrollably free-spirited, not to say hippyish (‘The Wall Street Journal’ called it “the pretentious, strident and absolutely brilliant creation of four marketing gurus who have renounced marketing-as-usual”), but Cluetrain always struck us as a new economy battle cry years ahead of its time.

We are living through the end of business-as-usual; the Internet really does change everything. But these guys were saying it over 20 years ago, when profits or even revenues were beyond most web businesses altogether.

As for us, back in 1999, as both an employee and a stockholder of Merrill Lynch, this correspondent had begun to notice the ground shifting beneath his feet. We had not ignored the fact that the full-service investment bank Merrill Lynch – with its army of 13,000 domestic brokers – had just seen its market capitalisation eclipsed by that of online discount brokerage Charles Schwab.

In any event, we didn’t need to be told the message of ‘Cluetrain’ twice. By April 2000 we had left Merrill Lynch and set up our own business.

Others at the firm reacted differently; that is to say, with denial. John “Launny” Steffens, the vice-chairman of Merrill Lynch, warned in September 1998 that

“The do-it-yourself model of investing, centred on Internet trading, should be regarded as a serious threat to Americans’ financial lives.”

But then he would, wouldn’t he ?

Meanwhile, the web and networked markets went on to dismantle or reinvent traditional businesses across the economic landscape. The music industry was an early scalp. Napster may not have won, but Big Music largely lost, and had to change.

Who would have thought in 1999 that a pure technology company – Apple – would end up being the dominant seller of music in the early years of the 21st Century ?

First music, than traditional publishing. Any business whose end product was at the mercy of digitisation was vulnerable to the digital economy. Newspapers buckled under the threat from blogs, aggregators and Google; booksellers and then all kinds of other retailers got crushed by the Leviathan that is Amazon.

Finance is now set grimly against the gale.

There’s a quotation that’s attributed to Bill Gates of Microsoft back in 1994:

“Banking is necessary, but banks are not.”

Just pause to consider that.

And then, around the turn of the millennium, Josef Ackermann, the CEO of Deutsche Bank, one of the largest banks in Europe but now a basket case, commented that what he feared most was not his traditional competitors, but rather the rise of “near-banks and non-banks”.

It took a little time, but those fears are already coming to pass. Suffice to say, the authors of the Cluetrain Manifesto got there first. They wrote of a new economic paradigm, in which gigantic businesses scanned the horizon in search of competitors who looked like they did.

There was just one problem.

Those businesses were utterly unaware of the legions of ant-like start-ups who were swarming at their feet, looking nothing like them, and content to compete for a tiny fraction of the giants’ business. Although each of them individually might not amount to much by way of competition, some of them might become huge, and collectively they would quite possibly sweep the old line players away.

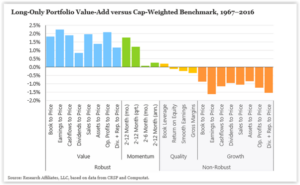

Speaking of style bias, the US fund management firm Research Affiliates crunched the numbers on the entire US stock market for the 50 years from 1967 to 2016 by investment style and the results are shown below.

We can debate the specific characteristics of ‘value’, ‘momentum’, ‘quality’ and ‘growth’ stocks, but in essence they would look something like this:

- Value stocks will typically trade on low valuation multiples (like price / earnings and price / book)

- Momentum stocks will typically be trending strongly higher in price, irrespective of which sector they belong to

- Quality stocks will have robust and well recognised businesses and brands with global reach, with a history of strong and uninterrupted dividends

- Growth stocks will be displaying strong growth in revenues (if not necessarily profits or dividends) and will often be in the technology sector.

The intriguing thing about the Research Affiliates data is that it pointed to some surprising conclusions, namely that on average, only ‘value’ and ‘momentum’ generated superior returns relative to the market over the longer term; ‘quality’ and ‘growth’ actually tended to destroy value relative to the market as a whole.

We stress that these style labels are not beneficiaries of an exact science. It may also be the case that the history of the last decade or so – and the extraordinary outperformance of ‘growth’ over that period, especially relative to ‘value’ – might simply be a huge albeit persistent anomaly.

Or perhaps things really are different now. As somebody once said: value investors invest on the basis that nothing will change; whereas growth investors invest on the basis that everything will change. The reality surely lies somewhere between these two extremes. But as inflation looks increasingly engrained and interest rates and bond yields have already surged from their 5,000 year lows, we’re not about to abandon value now. Nor our commitment to precious metals and other real assets, for increasingly obvious, not to say existential, reasons.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

“When did the future switch from being a promise to being a threat ?”

There’s an (inadvertently) hilarious sequence in the BBC’s 2019 drama ‘Mother Father Son’ in which supporters of Prime Minister Jahan (Danny Sapani) are seen angrily striding into a conference brandishing copies of the newspaper owned by Max Finch (Richard Gere) – primarily so they can tear up those same newspapers after it’s revealed that Finch’s media empire is backing another candidate. The idea that large groups of people these days even read print newspapers, let alone care about what’s in them, is simply quaint. The latest ABC data for newspaper readerships makes for pretty grim reading:

Source: ABC

The only way the BBC could have topped this for unwitting irony would have been if it had shown establishing shots of large numbers of people switching on the BBC News – as opposed to switching it off. Has a national broadcaster ever fallen out of favour with its core audience more comprehensively ?

Three sectors in particular are struggling for sheer survival amidst surging digital headwinds: traditional media including newspapers and broadcast TV, High Street retailers, and textile manufacturers (wherever labour is a core component, industrial players tend to shop around for the lowest cost providers, and their capital is highly mobile). Perhaps US Inc. will also come to regret having offshored so much of its manufacturing to China. And when it comes to stock and sector selection, after an effortless decade of outperformance by growth, investor ‘style bias’ is about to matter hugely again.

And of course all of this was foreseeable, pretty much from the birth of the worldwide web itself. Although this correspondent first started using a web browser in 1996 when working for Merrill Lynch, the world-changing potential of the Internet didn’t really sink in until we came across something called ‘The Cluetrain Manifesto’ in late 1999.

‘The Cluetrain Manifesto’ is a modern-day reworking of Martin Luther’s 95 Theses – the propositions and complaints allegedly nailed to the door of Wittenberg Cathedral that sparked the Reformation. Among the Cluetrain propositions:

The founders of Cluetrain – Messrs Levine, Locke, Searls and Weinberger – were among the first to “get” how the Internet really would change business as usual.

Impressed by what we read online, we went off and bought the book. Impressed by that, we jacked in our job at Merrill Lynch and entered the digital economy instead. Our career path changed, in a way that we have no regrets about whatever. Indirectly, it led us to where we are today, as partner in our own company, and to financial freedom we would probably never have achieved as just another employee of a Wall Street firm.

Admittedly, from the vantage point of 2023, some of Cluetrain’s philosophy comes across as uncontrollably free-spirited, not to say hippyish (‘The Wall Street Journal’ called it “the pretentious, strident and absolutely brilliant creation of four marketing gurus who have renounced marketing-as-usual”), but Cluetrain always struck us as a new economy battle cry years ahead of its time.

We are living through the end of business-as-usual; the Internet really does change everything. But these guys were saying it over 20 years ago, when profits or even revenues were beyond most web businesses altogether.

As for us, back in 1999, as both an employee and a stockholder of Merrill Lynch, this correspondent had begun to notice the ground shifting beneath his feet. We had not ignored the fact that the full-service investment bank Merrill Lynch – with its army of 13,000 domestic brokers – had just seen its market capitalisation eclipsed by that of online discount brokerage Charles Schwab.

In any event, we didn’t need to be told the message of ‘Cluetrain’ twice. By April 2000 we had left Merrill Lynch and set up our own business.

Others at the firm reacted differently; that is to say, with denial. John “Launny” Steffens, the vice-chairman of Merrill Lynch, warned in September 1998 that

“The do-it-yourself model of investing, centred on Internet trading, should be regarded as a serious threat to Americans’ financial lives.”

But then he would, wouldn’t he ?

Meanwhile, the web and networked markets went on to dismantle or reinvent traditional businesses across the economic landscape. The music industry was an early scalp. Napster may not have won, but Big Music largely lost, and had to change.

Who would have thought in 1999 that a pure technology company – Apple – would end up being the dominant seller of music in the early years of the 21st Century ?

First music, than traditional publishing. Any business whose end product was at the mercy of digitisation was vulnerable to the digital economy. Newspapers buckled under the threat from blogs, aggregators and Google; booksellers and then all kinds of other retailers got crushed by the Leviathan that is Amazon.

Finance is now set grimly against the gale.

There’s a quotation that’s attributed to Bill Gates of Microsoft back in 1994:

“Banking is necessary, but banks are not.”

Just pause to consider that.

And then, around the turn of the millennium, Josef Ackermann, the CEO of Deutsche Bank, one of the largest banks in Europe but now a basket case, commented that what he feared most was not his traditional competitors, but rather the rise of “near-banks and non-banks”.

It took a little time, but those fears are already coming to pass. Suffice to say, the authors of the Cluetrain Manifesto got there first. They wrote of a new economic paradigm, in which gigantic businesses scanned the horizon in search of competitors who looked like they did.

There was just one problem.

Those businesses were utterly unaware of the legions of ant-like start-ups who were swarming at their feet, looking nothing like them, and content to compete for a tiny fraction of the giants’ business. Although each of them individually might not amount to much by way of competition, some of them might become huge, and collectively they would quite possibly sweep the old line players away.

Speaking of style bias, the US fund management firm Research Affiliates crunched the numbers on the entire US stock market for the 50 years from 1967 to 2016 by investment style and the results are shown below.

We can debate the specific characteristics of ‘value’, ‘momentum’, ‘quality’ and ‘growth’ stocks, but in essence they would look something like this:

The intriguing thing about the Research Affiliates data is that it pointed to some surprising conclusions, namely that on average, only ‘value’ and ‘momentum’ generated superior returns relative to the market over the longer term; ‘quality’ and ‘growth’ actually tended to destroy value relative to the market as a whole.

We stress that these style labels are not beneficiaries of an exact science. It may also be the case that the history of the last decade or so – and the extraordinary outperformance of ‘growth’ over that period, especially relative to ‘value’ – might simply be a huge albeit persistent anomaly.

Or perhaps things really are different now. As somebody once said: value investors invest on the basis that nothing will change; whereas growth investors invest on the basis that everything will change. The reality surely lies somewhere between these two extremes. But as inflation looks increasingly engrained and interest rates and bond yields have already surged from their 5,000 year lows, we’re not about to abandon value now. Nor our commitment to precious metals and other real assets, for increasingly obvious, not to say existential, reasons.

………….

As you may know, we also manage bespoke investment portfolios for private clients internationally. We would be delighted to help you too. Because of the current heightened market volatility we are offering a completely free financial review, with no strings attached, to see if our value-oriented approach might benefit your portfolio -with no obligation at all:

Get your Free

financial review

Tim Price is co-manager of the VT Price Value Portfolio and author of ‘Investing through the Looking Glass: a rational guide to irrational financial markets’. You can access a full archive of these weekly investment commentaries here. You can listen to our regular ‘State of the Markets’ podcasts, with Paul Rodriguez of ThinkTrading.com, here. Email us: info@pricevaluepartners.com.

Price Value Partners manage investment portfolios for private clients. We also manage the VT Price Value Portfolio, an unconstrained global fund investing in Benjamin Graham-style value stocks.

Take a closer look

Take a look at the data of our investments and see what makes us different.

LOOK CLOSERSubscribe

Sign up for the latest news on investments and market insights.

KEEP IN TOUCHContact us

In order to find out more about PVP please get in touch with our team.

CONTACT USTim Price